Datasets point to wider trend in housing markets and commercial real estate

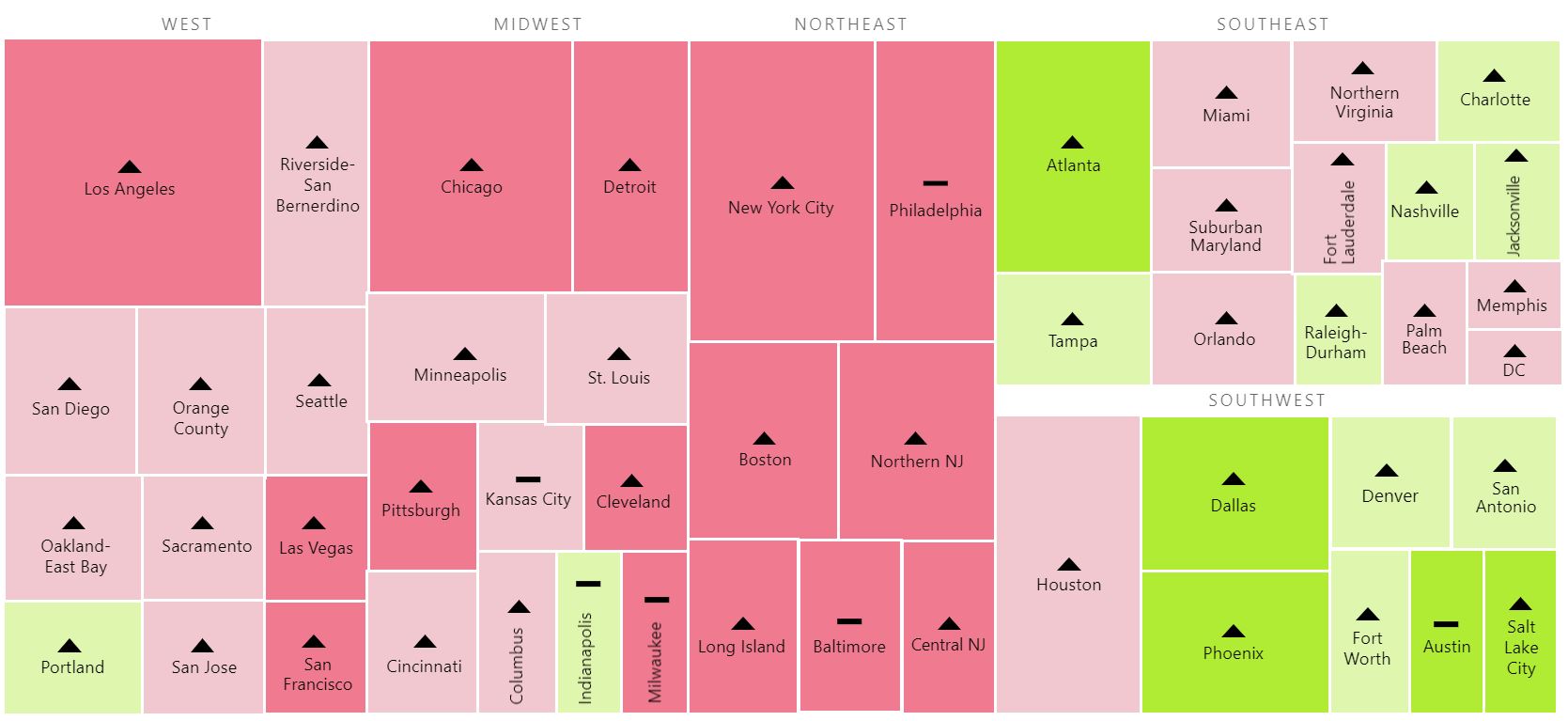

SitusAMC recently released a pair of key reports that, taken together, display just how the regional economic and real estate market landscape has shifted in America since the pandemic.

Its quarterly economic measures heatmap shows a nation in recovery, but with far greater regional strength in the Southwest, Southeast and Mountain West. Their Top Five and Bottom Five Metros for Q4 of 2020 show a similar trend and where we can find outliers. Heavily suburban metro areas in warmer locales make up most of the top five, with the only exception being number four, Cambridge-Newton-Farmingham, MA, which is uniquely poised to benefit from the growth of the life sciences sector. Riverside-San Bernadino-Ontario CA, Phoenix, Denver and Atlanta make up the first, second, third and fifth spots respectively. The bottom five is a laundry-list of mega cities. San Francisco tops that list, followed by Houston, Miami, Chicago and Washington DC. Taken together, both sets of data point to a deeply uneven recovery so far.

Peter Muoio (pictured), senior director and head of SitusAMC Insights, explained why we have seen so much strength in some markets and weakness in others. While many in the media have pointed to COVID-19 as the source of struggle in larger cities and colder states, he pointed to trends that go back further and may continue to shape our national residential and commercial real estate markets well into the future.

“The shortest answer is the old term ‘demographics is destiny,’” Muoio said when asked why recoveries have been so unequal nationwide. “There’s been a ton of press about people leaving the Northeast and Coastal California to go to Texas and Florida because of COVID. Actually, this has been happening for years and years. COVID caused a little pop in this phenomenon, but fundamentally these markets have stronger population growth which drives economic growth.”

Read more: The national rental market has recovered from COVID-19 - with a catch

While broad demographic trends underline regional growth, many of the harder hit cities are struggling due to specific sectors. New York, for example, remains in difficult straits because its restaurants, theaters, and world-spanning cultural reach is inaccessible to tourists right now. With limited travel, even cities like Miami are taking a hit. Muoio also noted that many of the nation’s largest cities are struggling somewhat because many of the jobs that drive their economies can be done remotely. Where factory and retail jobs might require physical proximity, many office workers have proven to be perfectly productive since the pandemic began. That means cities with big service industry economic engines might be a bit longer in coming back.

SitusAMC derives its heatmap from measures of employment in each metro area, comparing recent changes in household unemployment by sector with older data. It also looks at economic momentum in metro areas and how likely people living in those areas are to spend based on personal income data.

While the heat map and the top-five bottom-five list shows that many cities are still struggling, Muoio firmly believes they will come back. Even if the underlying churn of young jobseekers never returns to the same levels that shaped cities for much of the past decade, market adjustment by landlords and new opportunities for entrepreneurs and aspirational city dwellers should make up any vacuum left by the pandemic. Muoio also noted that cities are already beginning to bounce back in a zero-immigration environment. When immigrants can start coming in, many of these cities will function as ‘landing pads,’ buttressing their housing markets.

Read more: These towns will pay you up to $20,000 to move there

As mortgage professionals work to make sense of these models and lists, Muoio believes they should look at the underlying trends driving these differences in performance between regions. He said they should see past COVID, to the demand trends underneath.

“When the census data comes out later this year for 2021, it’s going to look great for Dallas, Palm Beach, Tampa, Atlanta and cities like that,” Muoio said. “I do think that will simmer down, but the underlying forces of good weather, cheaper homes, quality of life will come into play.

“I do think that many other people will want to come back to urban centers, for the bars, restaurants and museums that got a bit spoiled as a result of COVID. I think the ‘death of the city’ people have been predicting won’t pan out, but I think that the Southeast, Southwest and the Mountain West will be the stronger growth markets.”