Increase in seniors' mortgage debt offset by gain in home value

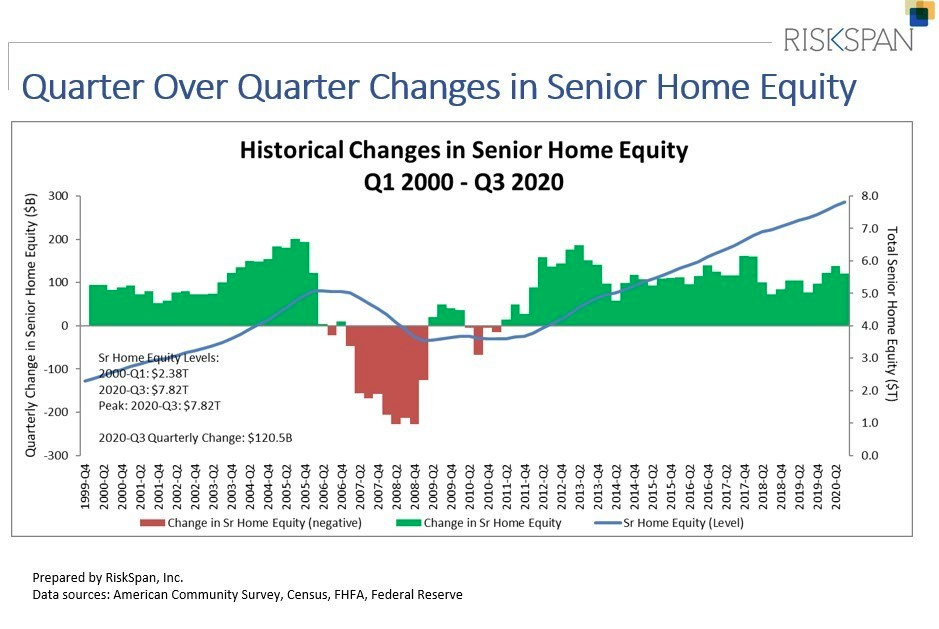

The housing wealth of homeowners aged 62 and older hit a record high of $7.82 trillion in the third quarter of 2020, the National Reverse Mortgage Lenders Association (NRMLA) reported Thursday.

The association said seniors saw a $121 billion (1.6%) quarter-over-quarter gain in their housing wealth, as the value of seniors’ homes climbed by an estimated $149 billion (1.3%). The increase in home values was offset by a 1.6% or $28 billion rise in their mortgage debt.

The NRMLA/RiskSpan Reverse Mortgage Market Index was up in Q3 to 280.99, another all-time high since the index was first published in 2000.

“The reverse mortgage marketplace has greatly expanded over the past year to include more private-label products that offer consumers more options and greater flexibility compared to the FHA-insured Home Equity Conversion Mortgage,” said NRMLA President Steve Irwin. “While the HECM still accounts for over 90% of the market, we expect private-label reverse mortgage distribution channels to expand over time.”