Discover four of the most common types of mortgages available in the US. This guide will also help you educate clients on loan options, rates, and more

Property ownership is one of the biggest commitments your clients will face. Choosing the right mortgage can either make or break their experience for years. For most people, the process can feel overwhelming at first. This is especially true when they’re trying to figure out what different mortgages offer and where each one falls short. As a mortgage broker (or an aspiring one), you should be aware of how important it is for your clients to understand their options.

When they learn the basics early on, they might feel more prepared and make better choices. In this article, Mortgage Professional America will discuss the most common types of mortgages available in the US market. We'll share valuable insights so you can use this guide to support your discussions with new and existing clients.

How do mortgages work?

A mortgage is a type of loan that people use to buy or maintain a house or other types of real estate. An eligible borrower will enter into an agreement to repay the mortgage lender over a loan term. This is usually in the form of monthly payments that go toward the principal and the interest.

To secure the mortgage, the property will serve as collateral for the mortgage lender. If you want to find the right mortgage for your clients, you must understand which property loans they qualify for. Here are some factors that can influence which mortgages will be available to them:

-

Down payment: Banks, credit unions, and other mortgage lenders use the size of your clients’ down payment to determine the interest rate that they’ll offer

-

Monthly mortgage payment: Mortgage providers will review your clients’ assets and income to find out how much the latter can repay. As such, advise your clients to take these into account when settling on a budget for their monthly mortgage payment:

- utility costs

- principal amount

- interest and taxes

- mortgage insurance

- any homeowner’s fees

-

Credit score: The interest rate on your clients’ mortgage will largely depend on their credit score.

Four main types of mortgages

There are many types of mortgage options available for different kinds of clients. The types of property loans available can vary by location and government programs, but there are generally four main mortgage types. Here are the four types of mortgages we will be looking at:

- conventional loan

- jumbo loan

- fixed-rate mortgage

- adjustable-rate mortgage

To help your clients decide which one might be the best for their situation, here is a closer look at each:

1. Conventional loan

Conventional loans are the most common type of mortgage in the US. They’re offered by almost every mortgage lender. While this home loan isn’t backed by the government, it’s still a great option if your clients have documented employment history and a stable income.

If your clients’ credit score is under 620, they might not be able to qualify for a conventional loan. Banks and mortgage lenders will also review their debt-to-income ratio (DTI). They might not qualify for this mortgage type if more than 36 percent of their monthly income is tied up in debt payments.

As a rule, mortgage providers will require potential borrowers to make a 20 percent down payment. Your clients might pay less if they have a solid income and favorable credit history. For a conventional mortgage, one can make a down payment for as little as 3 percent.

2. Jumbo loan

Conventional loans fall into two categories: conforming and non-conforming. A conforming loan meets the loan limits set by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac. These conforming loan limits help keep the housing market stable.

A non-conforming type of loan, also known as a jumbo loan, goes beyond those limits. The specific amount that defines a jumbo loan depends on the housing market in a particular area. In high-cost regions, the loan limit will be higher than in more affordable locations.

A jumbo loan is designed for clients buying more expensive properties. This type of mortgage is best suited for those with consistent income and the ability to manage large monthly payments.

Because of the size of these loans, mortgage lenders apply stricter standards. Most require a credit score of at least 700. Some can also ask for proof of six to 12 months of cash reserves.

As for the down payment, advise your clients to expect that mortgage lenders may ask them to put down at least 10 percent to 20 percent. Others might even ask for a 25 percent down payment to get the lowest interest rate that they advertise.

3. Fixed-rate mortgage

A fixed-rate mortgage gives your clients the same interest rate and loan payment amount throughout the entire mortgage term. Although changes in property taxes or insurance may affect the total monthly bill, the mortgage payment itself stays steady. This makes it easier for clients to manage their budget and set long-term plans.

This type of mortgage will work well for those who plan to stay in their home for many years. If your clients want to buy property to use it as their permanent residence, this option will provide them stability and predictability.

However, if current interest rates are high, locking in a fixed rate may lead to higher overall costs. Property buyers who choose this type of mortgage during a high-rate period might end up paying more in interest over time. Because of this, you must guide your clients in learning about the trade-off between payment stability and potential savings.

4. Adjustable-rate mortgage

An adjustable-rate mortgage (ARM) is a type of mortgage where the interest rate can change based on market conditions. If a borrower takes out an ARM, they begin with a fixed interest rate for a set period. This introductory period often lasts five, seven, or 10 years. During this time, the rate is usually lower.

Once the fixed period ends, the interest rate adjusts at regular intervals. The mortgage lender uses a specific market index to determine how the rate should change. If market rates increase, the interest rate on the loan also increases. If market rates fall, the rate goes down as well.

ARMs include a rate cap, which limits how much the interest rate can change. This cap will help protect your clients from rapid rate increases. However, the same cap may also restrict how much the rate can decrease over time.

If your clients are interested in applying for an ARM, they must know how the rate cap works. This will help them prepare for any changes in future payments.

For a quick but informative look at other types of mortgages available in the country, watch this:

If you want to become a top mortgage professional like those listed in our special reports, learning about various mortgage types is a must.

What type of mortgage has the lowest interest rate?

Among the four mortgage types listed above, an ARM usually has the lowest interest rate during the introductory period. It also begins with a low interest rate that is fixed. After that, the rate adjusts periodically based on market conditions—usually once per year.

Mortgage lenders offer this lower initial rate because they’re passing the future rate risk to the borrower. While fixed-rate mortgages offer stability, they often have higher initial rates than ARMs.

If your clients want the lowest starting interest rate and expect to move or refinance before the adjustment period kicks in, an ARM can offer early savings. However, for those planning to stay in their home long-term, a fixed-rate mortgage may be the safer option despite a slightly higher initial rate.

On the other hand, conventional loans refer to the overall loan structure and can be fixed or adjustable. Their interest rates will depend on the terms. Finally, jumbo loans carry higher interest rates than conforming loans due to their size and the increased risk to lenders.

Other types of mortgages

Aside from the common types of mortgages, there are other options that your clients can choose from. When shopping around for home loans on their behalf, you might also encounter these less popular mortgage types:

- construction loans

- interest-only mortgages

- piggyback loans

- balloon mortgages

Let’s take a closer look at each:

1. Construction loans

If your clients want to build a home instead of buying one, a construction loan might be the right solution. For instance, they might go for a standalone construction loan that only covers the building phase. Then they can take out a separate mortgage once the home is built.

Others prefer a construction-to-permanent loan, which rolls the construction costs and mortgage into one with a single closing process. During construction, they will only pay interest on the money used so far. Once the home is finished, the loan automatically turns into a regular mortgage, with monthly payments covering both principal and interest.

2. Interest-only mortgages

With an interest-only mortgage, your clients will pay only the interest for an initial period. This is usually between seven and 10 years at the beginning of a 30-year home loan term. After that, monthly payments will start to cover both interest and principal.

This can be attractive to high-income clients who can afford the costlier monthly payments once they begin. Eligible borrowers who plan to refinance or sell before the principal payments begin might also take advantage of this mortgage type.

However, remind your clients that an interest-only mortgage doesn’t help build equity early on. Their payments can also increase drastically after the interest-only phase ends.

3. Piggyback loans

A piggyback loan involves two separate loans taken out at the same time. Using the 80-10-10 set-up, this covers 80 percent of the home price, while the second accounts for 10 percent. The borrower will contribute the remaining 10 percent as a down payment. With this type of loan, your clients will avoid paying for private mortgage insurance (PMI), which is usually required when the down payment is under 20%.

While this strategy can reduce upfront costs, piggyback loans come with two sets of closing fees. That’s why it's important to evaluate whether this approach will benefit your clients’ finances in the long run.

4. Balloon mortgages

Balloon mortgages are short-term types of mortgages that start with either small monthly payments or no payments at all. After several (usually five to seven) years, your clients must make a large lump-sum payment to cover the remaining balance.

This mortgage type might suit clients who plan to sell or refinance before the balloon payment is due. However, it carries potential risk if they can’t follow suit. So, be sure that your clients have a clear grasp of the repayment terms and have a planned exit strategy before committing.

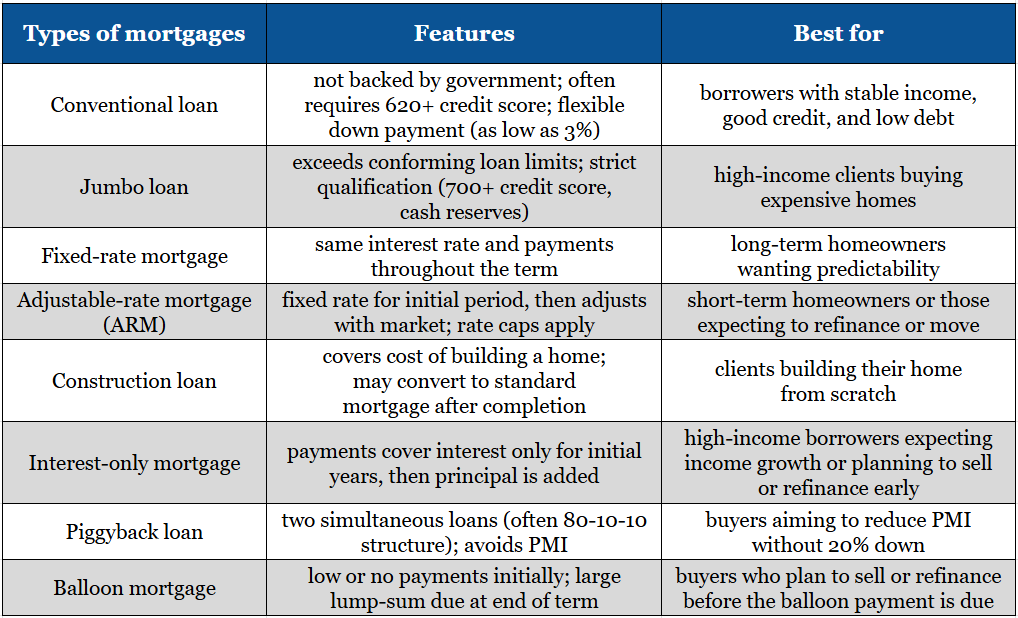

To summarize the eight types of mortgages listed in this guide, check out this comparative table:

What is the best type of mortgage?

The best type of mortgage is the one that fits your clients’ circumstances such as their:

- financial situation

- long-term and short-term goals

- comfort with payment changes over time

- tolerance for risk

For those who want steady monthly payments and plan to stay in their home for many years, a fixed-rate mortgage can be their best option. The interest rate stays the same for the full loan term, which helps with budgeting.

If your clients expect to move or refinance within a few years, an ARM is often the better choice. This type of mortgage starts with a lower fixed rate for a set period, then adjusts based on market rates. In turn, ARMs can lead to savings in the early years.

For those who aim to buy more expensive property, a jumbo loan might be needed. This mortgage type goes beyond the usual limits and often requires higher credit scores and larger down payments.

Some of your clients might also be curious about government-backed loans, especially if they have low credit scores. For example, they might ask about qualifying for a Federal Housing Administration (FHA) loan or a US Department of Veterans Affairs (VA) loan.

Helping borrowers choose the right type of mortgage

As a mortgage broker, your goal is to help clients choose the right home loan based on their needs and financial goals. Whether they are first-time home buyers or landlords who want to expand their portfolio, your guidance can have a huge impact on their journey.

If you’re knowledgeable about many types of mortgages, you'll be able to recommend the best option for them. Remember, every property loan has pros and cons. Just be sure to match your clients’ profile with the most suitable one.

Have you helped clients secure one of these types of mortgages recently? Share your experience or tips in the comments below.