What are conforming loan limits in the US? Would you like to know how it can be applied to your mortgage? Find out everything about conforming loan limits here

- How are conforming loan limits determined?

- How much are the conforming loan limits in major states?

- Conforming loans vs jumbo loans

- How conforming loan limits affect first-time home buyers

- Disadvantages of conforming loan limits

- Conforming loan limits forecast: what to expect in the future

- Conforming loan limits can be leveraged by transferees

Updated: Dec 3, 2024

Conforming loan limits for 2025: $806,500

Conforming loan limits for one-unit properties in the United States have increased by $39,950 (or 5.2%) in November this year. This is a historically high jump in year-over-year loan limits. But what does this mean for home buyers in general? How will it affect current homeowners’ mortgages, if any?

In this article, Mortgage Professional America will cover what you need to know about conforming loan limits in the country. We will talk about what an increase in these limits could mean to home buyers and go over other options if they fail to qualify.

To our usual pool of readers who are mortgage professionals, this is another one of our client education pieces. If you have leads and existing clients who want to learn about conforming loan limits, be sure to share this with them!

How are conforming loan limits determined?

The amount you can borrow with a conforming loan, commonly referred to as a regular mortgage, is adjusted every year by the Federal Housing Finance Agency (FHFA). Across most of the United States, the borrowing limit for a single-unit home is $806,500 for 2025.

The conforming loan limits for pricier parts of the country are close to a million dollars, sometimes even more. Some of these expensive areas include:

- California

- Colorado

- District of Columbia

- Florida

- Hawaii

If you want to know other places where the US conforming limits are expensive, you can ask your mortgage broker. Don't have one yet? Check out our Best in Mortgage page to see the top mortgage professionals in the country.

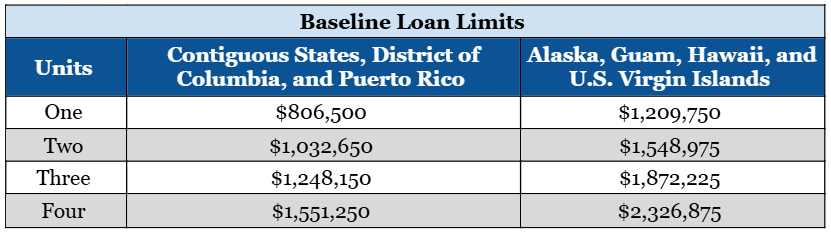

While the figures above represent the borrowing limits for single-unit homes, you can borrow more money for two-unit, three-unit, and four-unit homes.

Want to know more about conforming loan limits? Watch this clip:

How much are the conforming loan limits in major states?

Fannie Mae’s conforming loan limits have increased in most regions in the US. Here is a comparative table of the baseline or general conforming loan limits from Fannie Mae:

Source: fanniemae.com

Source: fanniemae.com

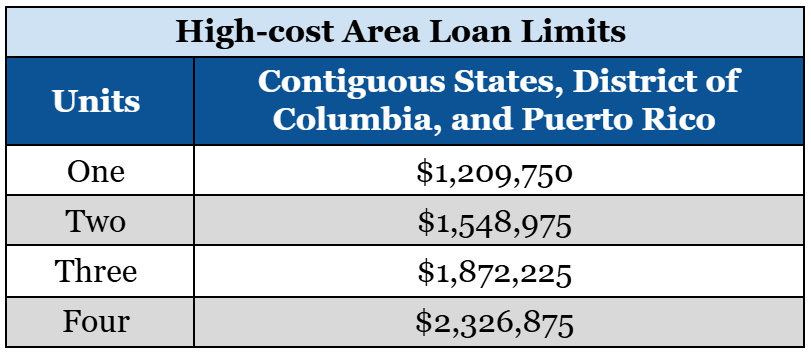

In any identified high-cost areas, the median home value is more than the baseline conforming loan limit. The precise conforming loan limit can be as high as 150% of the baseline conforming loan limit, depending on the median home value in the area.

To track the differences in housing affordability and estimate mortgage defaults region by region, Fannie Mae has identified high-cost areas where loan limits have increased. This is to accommodate the expensive cost of real estate. Here is another comparative table showing Fannie Mae’s conforming loan limits for high-cost areas:

Note: The states of Alaska, Hawaii, Guam, Puerto Rico, and the US Virgin Islands do not have any high-cost areas

Check out Fannie Mae’s full report on conforming loan limits.

Conforming loans vs jumbo loans

A jumbo loan might be a good option if you want to borrow more than what the FHFA has set for each year’s conforming loan limits. In essence, jumbo loans are mortgages for anyone requiring a larger loan than the FHFA allows. Compared to conforming loans, jumbo loans have higher interest rates and stricter requirements.

Aside from these two, there are other types of home loans that you can apply for in the US.

For commercial banks and mortgage lenders, jumbo loans carry a higher risk. As a result, companies make qualifying more difficult to lessen the likelihood that a borrower will default on any payments.

For information on lenders in the US, check out our list of top mortgage companies.

How to apply for jumbo loans

While mortgage providers have their own requirements for conforming loans, you will likely need the following to qualify for a jumbo loan:

- larger down payment

- higher credit score

- lower debt-to-income ratio

Let us help you further understand each requirement below:

Larger down payment

Since jumbo loans mean a large amount which you can borrow, your prepared deposit must also be larger as compared to the required amount when applying for conforming loans. A 20% or higher down payment might be necessary.

Higher credit score

As for the credit score, jumbo loan applications require at least 700. However, if your credit score is not as good, you can still apply for other home loans. Read this to find out how to get a mortgage with a low credit score.

Also, are you curious to discover what your credit score actually means? Watch this video:

Your credit score to buy a house can greatly affect your homeownership journey. Mortgage lenders can use this as a barometer to know if you are high risk as a borrower or not.

Lower debt-to-income ratio

Finally, jumbo loans require a debt-to-income ratio of 43% or lower. The better your debt-to-income ratio, down payment, and credit score, the more likely you are to get approval for a jumbo loan.

Other alternatives to conforming loans

If your debt profile and credit score are both too weak for a conforming loan or a jumbo loan, you could apply for an FHA mortgage. This is ideal for anyone who has a debt-to-income ratio under 45% and a credit score less than 580.

If you are a military member, or you are purchasing a home in a rural region, you might want to go for a VA loan.

How conforming loan limits affect first-time home buyers

Conforming loan limits are important for first-time home buyers in the US. This is because conforming loan limits decide the most money that aspiring homeowners can borrow—this can also be through government-backed loans.

When conforming loan limits go up, it helps buyers afford more expensive homes, especially in areas where property prices are high. This can positively affect first-time buyers, who, more often than not, find it hard to save enough for a deposit and mortgage repayments.

Higher conforming loan limits

In places where home prices are rising quickly, higher conforming loan limits allow first-time buyers to get loans for homes that fit their needs. Without these limits, they might have to turn to more expensive home loans that are harder to secure.

All in all, conforming loan limits are a key factor in helping first-time home buyers enter the housing market and find homes they can afford.

If you are trying to secure a mortgage for the first time, you might want to apply for first-time home buyer programs that are available in the US.

Disadvantages of conforming loan limits

Conforming loan limits can have several disadvantages. For instance, these limits can make it hard for property buyers in expensive areas to get affordable mortgage deals. Home prices in these locations often exceed the conforming loan limits, burdening would-be homeowners.

This is especially difficult for first-time home buyers who might need larger loans to compete with experienced real estate investors.

Strict eligibility criteria

Another drawback is that, while conforming loans usually have lower interest rates, they often come with strict eligibility criteria. This can make it harder for mortgage applicants with less-than-perfect credit scores or lower incomes to qualify for a loan. Tighter conditions can also limit their chance of buying a home.

Also, conforming loan limits might not increase quickly enough to match skyrocketing home prices. This can create a gap between what buyers can borrow and the actual cost of homes, making affordability issues worse.

Fewer options

Focusing on conforming loan limits can lead to fewer options for affordable housing. If home buyers are limited to certain price ranges, it may discourage the development of housing that better meets the needs of the community.

While conforming loan limits aim to provide stability and accessibility in the US housing market, they can create challenges for home buyers. This is especially true for those with less favorable financial situations in costlier regions.

To combat these challenges set by conforming loan limits, you might want to go for nonconforming loans instead. Watch this clip on conforming loans versus nonconforming loans:

Read this article for policy updates from Fannie Mae and Freddie Mac, government-sponsored enterprises that support the conforming loan market.

Conforming loan limits forecast: what to expect in the future

Here are some future trends that you might watch out for regarding conforming loan limits:

Potential increase in limits

As property prices continue to climb in several housing markets, it is likely that conforming loan limits will also increase to accommodate demand. If inflation remains high or if the US economy shows strong growth, the FHFA might adjust these limits to reflect such changes.

Impact of interest rates

Rising interest rates could dampen housing demand. In turn, it can stabilize or even lower real estate prices. This can also have an impact on FHFA’s future adjustments to conforming loan limits.

Conforming loan limits can be leveraged by transferees

Because conforming loans offer lower down payment options and competitive mortgage interest rates, transferees will have a higher chance of buying a home. As a transferee, you will be able to expand your search into a higher-end housing market with more options. This means less stress, thanks to more available spending power and less due at the closing table.

Transferees who otherwise would have been priced out of the market will likely be able to expand their search criteria, potentially securing a new property in the new year.

Do you have experience in dealing with conforming loan limits in the US while trying to secure a mortgage? Tell us about it in the comments section below.