J.D. Power says effective digital guidance, proactive outreach, and a simple thank you are more important than ever

The coronavirus pandemic has put mortgage servicers to the test, with record-low rates, skyrocketing unemployment, and rising delinquencies creating a surge in customer inquiries.

However, mortgage customers were left to their own devices as servicers struggled to provide effective digital guidance and proactive communication, according to a new report from J.D. Power.

J.D. Power said that the inadequate response to customers' woes during the COVID-19 crisis dragged down overall customer satisfaction scores.

"The COVID-19 pandemic has really amplified the gaps in customer satisfaction, digital experience and call-center experience that have been a challenge for mortgage servicers for some time," said Jim Houston, director of consumer lending intelligence at J.D. Power. "At a time when the need for streamlined, effective digital guidance and proactive outreach and counsel is more important than ever, mortgage customers aren't finding the answers they need online, pushing them onto long customer service queues in call centers and leaving them to hunt for answers on how best to address their challenges."

Unresolved issues

The study showed that more than 62% of customers visit their lender's website as the first line of information, but only 28% said online is the most effective channel by which to resolve an issue. Among those who couldn't fix their problem on the lender's website, 45% said the issue was settled only after picking up the phone to speak with a representative.

However, nearly 19% of customers said they had a hard time contacting a live agent via the telephone. This negative experience caused a 261-point cut (on a 1,000-point scale) in satisfaction for those consumers looking to use this traditional channel.

Given that customers mostly rely on websites for common activities, J.D. Power suggested that lenders ensure their websites and traditional channels are effective in helping customers work out issues.

Waiting by the phone

Customer fears fueled a surge in calls, the report showed. Roughly 44% of at-risk customers called their servicer in the past 12 months compared to 25% of low-risk customers. At-risk customers are on the phone more – calling an average of 3.15 times vs. 2.54 times for low-risk customers.

However, reaching out proactively to customers will likely bump up satisfaction scores. Customers who received three or four proactive communications per year from their mortgage lender posted the highest levels of overall satisfaction, which is represented by an average score of 810. Yet, only 8% of customers said they experienced this level of communication.

Around 40%, on the other hand, said they received no proactive communication from their lender, while 29% reported getting 11 or more proactive outreaches. J.D. Power noted that too few or too many communications cause satisfaction score to drop.

So far, the best thing to say when reaching out to a customer is a simple "thank you." The study found that expressing gratitude has the "single greatest effect" on customer satisfaction, increasing scores by 86 points. But despite the impact of this gesture, only 22% of lenders thank their customers.

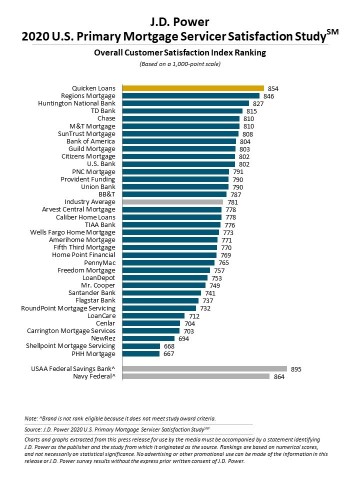

Overall Customer Satisfaction Index ranking

Quicken Loans remained at the top for the seventh straight year, with a score of 854. Regions Mortgage followed at 856 and Huntington National Bank ranked third at 827.