Mr Cooper survey finds out what matters for owners’ next home purchase

More than three quarters of existing homeowners say they feel more confident with their second purchase.

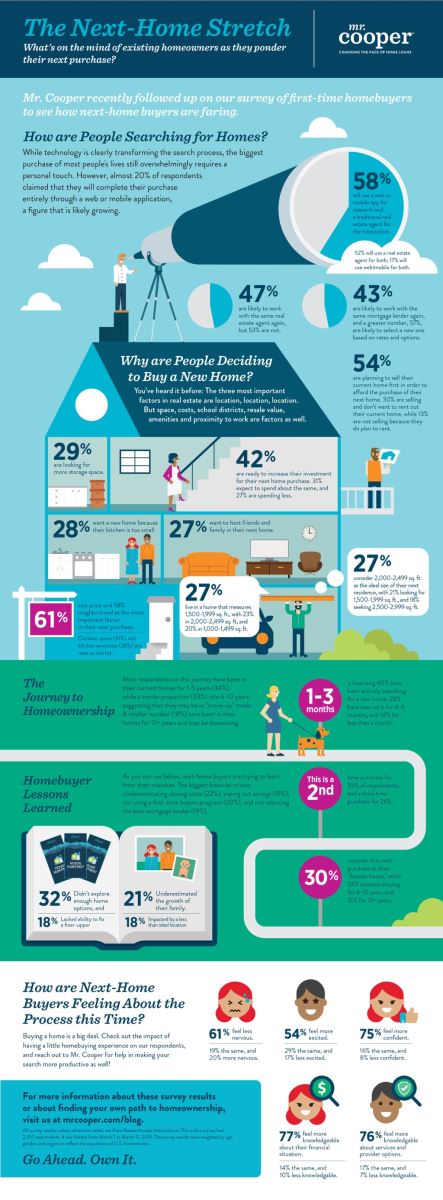

In a survey conducted in March for Mr Cooper, Researchscape International found that 22% of first-time buyers underestimated closing costs, 20% didn’t use a homebuyer program, and 19% completely wiped out their savings.

Second-time around, 43% said they trust their mortgage lender enough to use them again.

Most next-home buyers (82%) spent up to 6 months searching for a home and 27% are planning to spend less this time. Price is the main factor in home search for 61%, followed by neighborhood (58%) and outdoor space (41%). Only 27% consider school systems a top-10 priority in their next purchase decision.

Many (51%) next-home buyers are also looking for a long-term home, possibly their ‘forever home’.

First-time buyer mistakes

Along with underestimating closing costs, existing owners said these were their biggest mistakes when buying their first home:

- 32% simply didn’t look hard enough;

- 21% underestimated how fast their family would grow;

- 18% didn’t weigh the impact of being in a less-than-ideal location, or they bought a fixer-upper and were unable to complete the repairs timely enough.

Learn some tips on how to help them buy their first home easily, with help programs to access. Read more in this article.