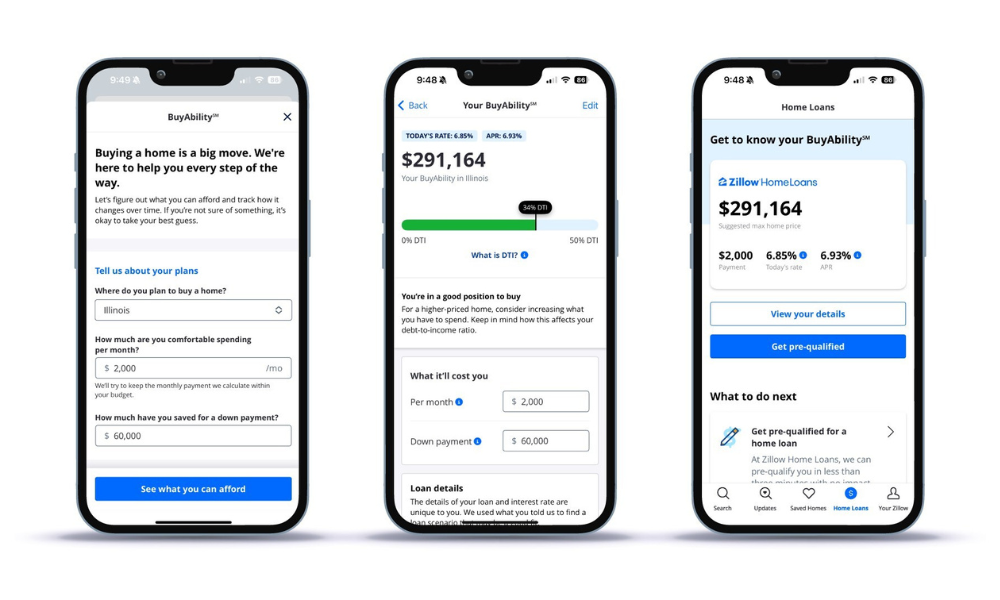

New tool shows affordable price range tailored to each user's financial situation

Zillow Home Loans has launched BuyAbility, a new tool designed to help buyers understand what they can afford in today’s housing market.

Exclusive to Zillow, the personalized tool provides a real-time estimate of the maximum home price and monthly payment that fits within a buyer’s budget based on their financial situation.

BuyAbility factors in the buyer’s income, credit score, down payment amount and current mortgage rates to calculate an affordable home price range and likelihood of qualifying for a loan. It is powered by real-time rates from Zillow Home Loans.

“What many people don’t realize is that your mortgage rate is highly dependent on your credit score,” Orphe Divounguy, senior economist at Zillow Home Loans, said in a media release. “The better your credit score, the lower the rate you’ll qualify for, potentially saving you hundreds of dollars a month.”

To use BuyAbility, homebuyers simply enter a few details about their finances, such as income, credit score and desired monthly payment. The tool then instantly provides a personalized home price and payment estimate along with the likelihood of mortgage approval at that level.

The affordability calculation will update regularly as mortgage rates and the buyer’s credit score changes. For example, a small rate increase from 6% to 7% could reduce a median-income household’s affordable home price from $420,000 to $380,000.

“BuyAbility is personalized to a buyer’s credit score, income and down payment, and updated regularly to reflect current mortgage rates, giving home shoppers a true understanding of their buying power,” Divounguy said. “BuyAbility is a great starting point for buyers who may be hesitant to look under the hood of their finances or share personal details with a loan officer.”

Read next: How mortgage brokers can remain busy in a quieter market

Later this year, Zillow plans to integrate BuyAbility deeper into its home search experience. Buyers can shop for listings based on their calculated affordable price range rather than a general price filter. Home listing pages will also display the estimated monthly payment based on the buyer’s personalized BuyAbility data.

The tool is available within the Home Loans tab on Zillow’s mobile app and website.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.