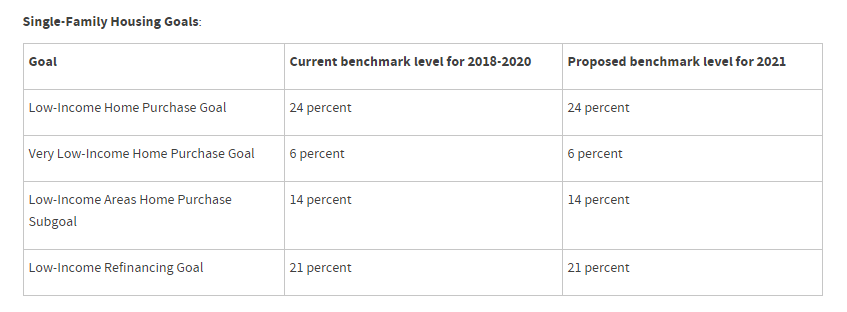

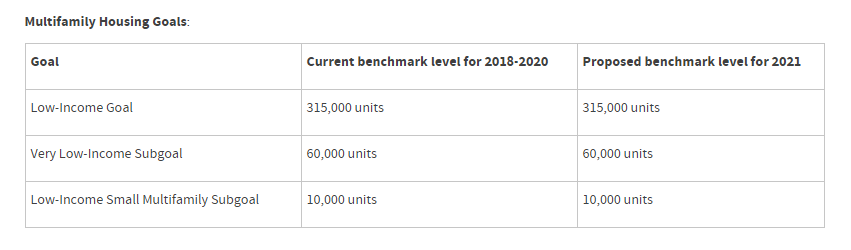

To meet their targets, the enterprises must purchase 315,000 multifamily units and reach the 24% single-family purchase benchmark

The Federal Housing Finance Agency (FHFA) has released its proposed 2021 housing goals for Fannie Mae’s and Freddie Mac’s single-family and multifamily sectors.

FHFA proposed to set the benchmarks for 2021 the same as the 2018-2020 levels. The agency explained that, due to coronavirus-related economic uncertainty, the suggested rule only extends for the calendar year 2021. Once finalized, the baseline levels would extend the benchmarks set to expire on Dec. 31.

To meet a single-family housing goal or subgoal, Fannie and Freddie must either exceed the percentage of mortgage purchases benchmarked in advanced by FHFA or the market level for that year.

FHFA determines the market levels retrospectively each year based on the actual goal-qualifying share of the overall market as measured by FHFA based on the Home Mortgage Disclosure Act (HMDA) data for that year.

Meanwhile, to achieve a multifamily housing goal or subgoal, an enterprise must purchase mortgages on multifamily properties (properties with five or more units) with rental units affordable to families in each category, as well as a subgoal for properties with five to 50 units. Like the single-family housing goals, FHFA measures multifamily goal performance against benchmark levels set by FHFA.

The agency invites interested parties to submit comments on this proposed rule within 60 days of publication in the Federal Register. Comments should be submitted to the Federal Housing Finance Agency, Division of Housing Mission and Goals, 400 7th Street, S.W., Washington, DC 20219 or through its website, FHFA.gov.