Following the Great Recession, a little-used financing tool for low-value homes has seen a big resurgence

After the financial meltdown of 2008 and the accompanying collapse of subprime lending, financing for low-credit borrowers – especially those with little or no down payment – dried up. FHA-backed loans spiked to fill the void, jumping from 3.3% of all purchase originations in Q4 of 2006 to 27.2% in Q4 of 2008.

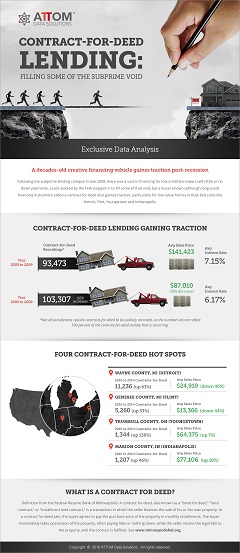

But another financing instrument also saw a sharp uptick in use, according to ATTOM Data Solutions. That’s the contract for deed – a transaction in which the seller finances his or her own property. In a contract-for-deed transaction, the buyer agrees to pay the seller the full purchase price in monthly installments. The buyer takes possession of the property, while the seller retains the title until the contract is fulfilled.

According to ATTOM, contract-for-deed sales have seen a surge since the financial crisis, especially for low-value homes in Rust Belt cities like Detroit and Indianapolis.

In the five years following the end of the Great Recession (2010-2014) more than 103,000 contract-for-deed sales were recorded nationwide, according to ATTOM. That’s a 10% increase over the previous five years. However, the prices for contract-for-deed sales fell precipitously. The average nationwide sale price for a contract-for-deed sale between 2005 and 2009 was $141,423. Between 2010 and 2014, it was $87,010, a 38% decrease.