Closing rates also remained high in March origination report shows

(5).jpg)

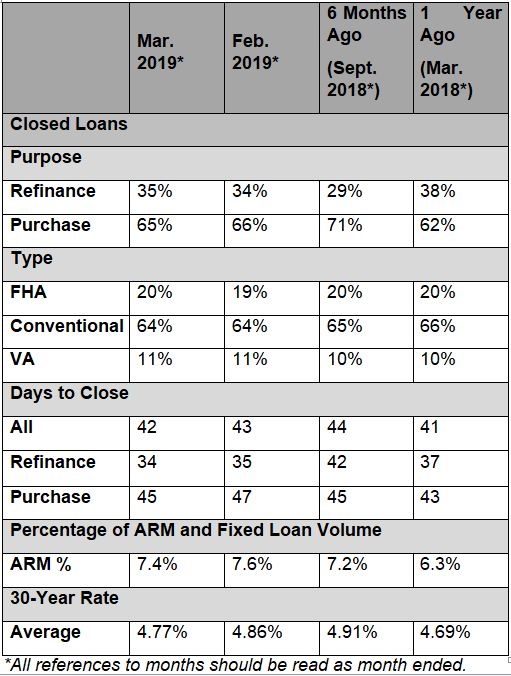

The 30-year note dropped to 4.77% in March, down from 4.86% in the previous month and marking the third consecutive monthly decline.

Ellie Mae’s Origination Insight Report shows that the share of all loans that were refinances edged higher, 35% vs. 34% a month earlier.

As we enter the busy spring home buying season, we are seeing activity tick back up across the board with the 30-year note rate decline,” said Jonathan Corr, President and CEO of Ellie Mae. “We will continue to watch closing rates as they have stayed at or above 75% through the first quarter of 2019, a possible indication of buyers’ conviction.”

The report also reveals that the percentage of FHA refinances increased to 23% in March (up from 20% in February) and the percentage of Adjustable Rate Mortgages decreased to 7.4%, down from 7.6% in February.

Time to close all loans was 42 days in March, down from 43 in February and 45 in January; with the time to close a purchase loan down to 45 days from 47 in February and 49 in January.

The average FICO score for all loans was 726, LTV was 79, and debt-to-income ratio was 25/38.