But government credit tightened

Mortgage credit availability was mixed in April but the overall rate was the same as in March.

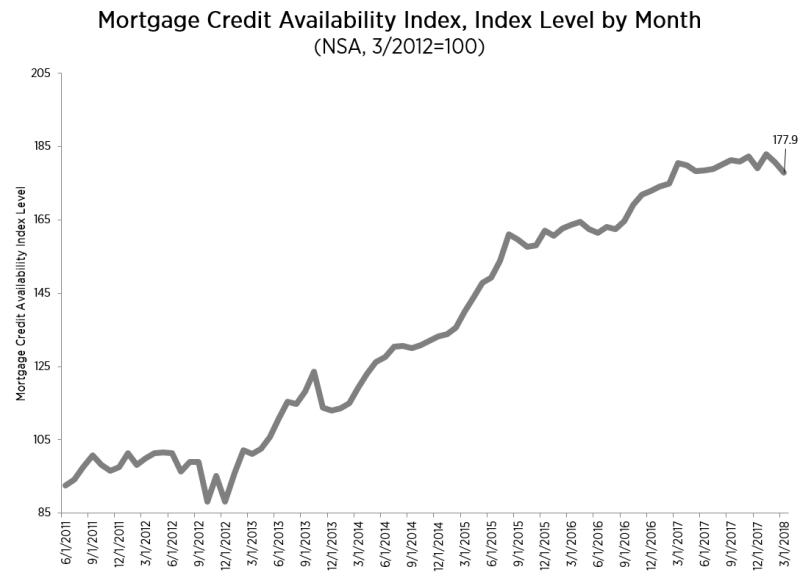

The Mortgage Bankers Association says that its Mortgage Credit Availability Index stayed at 177.9 but that its components told different stories.

The Conventional MCAI increased 1.9%, indicating that lending standards loosened for these loans; while the Government MCAI fell 1.4% indicating a tightening of lending standards.

"Government credit tightened slightly as investors continued to pull back on streamline refinance products, while conventional credit availability increased, driven mainly by an expansion in jumbo credit,” said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting.

Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 4.4% while the Conforming MCAI fell by 0.9%.

The jumbo market remains competitive for lenders according to data from our Weekly Application Survey, as the spread between conforming 30 year fixed rate loans and jumbo 30 year fixed rate loans widened to 12 basis points over March and April, the widest this spread has been since early 2016," explained Kan.