February figures show lending standards loosened in February

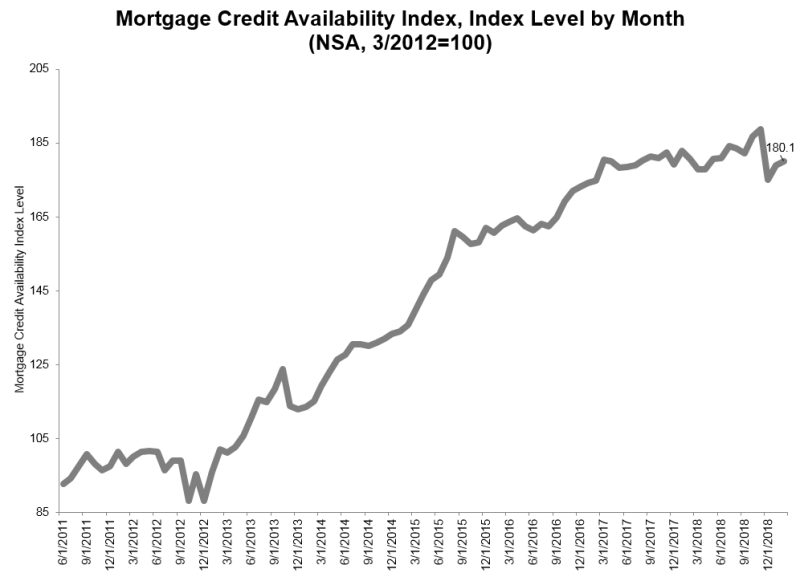

There was an increase in mortgage credit availability in February according to the Mortgage Bankers Association.

Its Mortgage Credit Availability Index gained 0.6% to 180.1 with the Conventional Index up 1.1% (Jumbo up 2.2%, Conforming down 0.2%); and the Government Index was up 0.1%.

"Credit availability increased in February as a result of new jumbo offerings brought to the market, both for agency jumbo and non-agency jumbo programs," said Mike Fratantoni, MBA Senior Vice President and Chief Economist. "We also saw some expansion in credit for borrowers with lower credit scores and higher LTVs, although credit availability for government programs remains tighter following the scaling back of VA refinance programs."

Source: Mortgage Bankers Association; Powered by Ellie Mae's AllRegs® Market Clarity®

The index was benchmarked to 100 in March 2012 and is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). It analyzes data from Ellie Mae's AllRegs® Market Clarity® business information tool.