CoreLogic says home loans are bucking the consumer credit trend

.jpg)

While concerns are increasing around some forms of consumer credit, including auto and student loans, the mortgage sector is showing contrasting resilience.

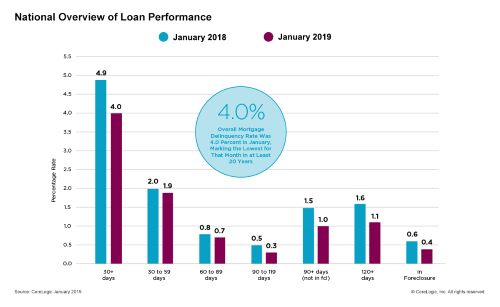

The national mortgage delinquency rate continued to decline in January 2019, according to the newly-released Loan Performance Insights Report from CoreLogic.

In fact, the 0.9% decline in the overall delinquency rate compared to a year earlier meant the 4% of homes with a mortgage in some stage of delinquency was the lowest for the month of January for at least 20 years.

There was also a decline in the foreclosure inventory rate, down 0.2 percentage points year-over-year to 0.4%.

“Income growth, home appreciation and sound underwriting combined have pushed delinquency rates to their lowest level in 20 years,” said Dr. Frank Nothaft, chief economist for CoreLogic. “The low delinquency rates on home mortgages are a contrast to the rising delinquency rates on consumer credit. While home mortgage delinquency rates are at, or are near, their lowest levels in two decades, delinquency rates for auto and student loans are higher now than they were during the early and mid-2000s.”

Delinquencies down for more than a year

The overall delinquency rate has been declining lower on a year-over-year basis every month for more than a year.

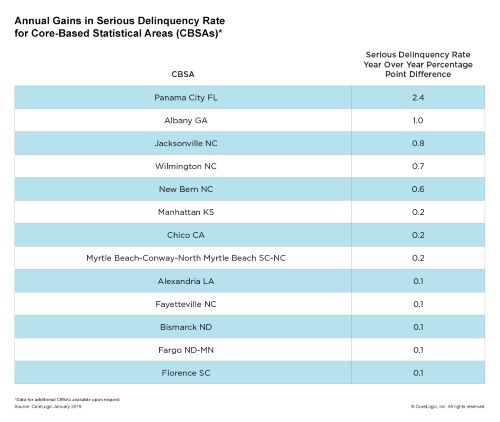

But there were small increases in 13 markets in January.

“As the economic expansion continues to create jobs and low mortgage rates support home buying this spring, delinquency rates are likely to trend lower during the coming year,” said Frank Martell, president and CEO of CoreLogic. “The decline in delinquency rates has occurred in nearly all parts of the nation.”