A mixed signal for the housing market?

Mortgage rates remained stable thanks to a strong economy and solid job and income growth that set the stage for a more robust housing market, according to Freddie Mac.

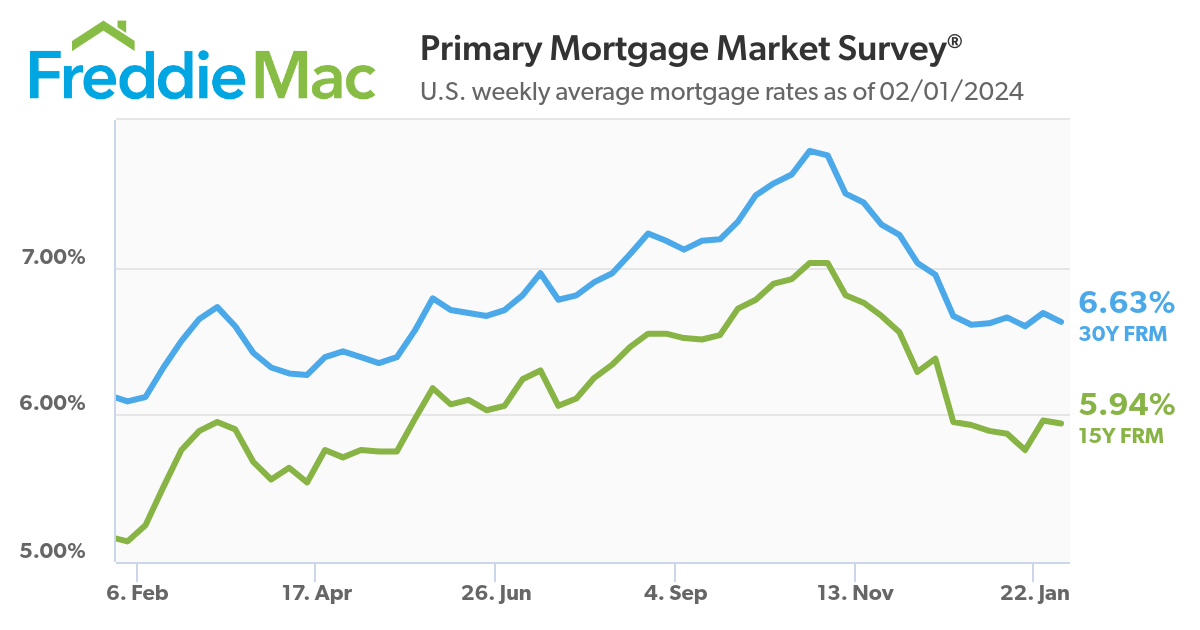

This week, the 30-year fixed-rate mortgage dropped six basis points to 6.63%, and the 15-year FRM dipped two basis points to 5.94%.

While affordability continues to stymie homebuying activity, Freddie Mac chief economist Sam Khater noted, “Mortgage rates have been stable for nearly two months, but with continued deceleration in inflation, we expect rates to decline further.”

“The economy continues to outperform due to solid job and income growth, while household formation is increasing at rates above pre-pandemic levels,” Kan said in Freddie’s report. “These favorable factors should provide strong fundamental support to the market in the months ahead.”

The Federal Reserve’s recent decision to maintain interest rates, as announced at its first 2024 meeting, has been met with mixed reactions from industry experts.

NerdWallet mortgage expert Holden Lewis commented: “Mortgage rates didn’t change much this week as markets awaited the results of the Federal Reserve’s monetary policy meeting. Investors expect the Fed to cut short-term rates this year. But the timing of those rate cuts is uncertain, and the uncertainty kept rates relatively stable.”

Marty Green, principal at mortgage law firm Polunsky Beitel Green, interprets this as a cautious move by the Fed to achieve a soft landing. However, he warned that consumers may soon require interest rate relief to sustain economic growth.

“As expected, the Federal Reserve maintained the holding pattern for the federal discount rate that has been in place since the Fed last raised rates in July of 2023,” Green told MPA. “Like a pilot landing a plane in fog, the Federal Reserve is being very patient and deliberate before taking additional action to reduce interest rates. As long as the economy remains relatively strong and inflation continues to moderate, as it has in recent months, the Fed can circle the runway for another meeting cycle or two before trying to navigate the soft landing it has hoped for. But the American consumer, who has been bolstering the economy so far, may very well be running on fumes at this point, and some interest rate relief in the coming months will likely be necessary for the economy to maintain a healthy growth pace.”

Read more: Fed rate decision – what were the key takeaways?

Rich Traub, a commercial real estate partner at Smith, Gambrell & Russell, views the Fed’s stance as double-edged, providing neither significant promise of rate cuts nor immediate stimulation for the real estate market.

“The action by the Federal Reserve is a mixed bag for everyone in the United States,” Traub said. “On one hand, people should be comforted that rates were held steady and there is at least a recognition of potential rate cuts later in the year. But the messaging on rate cuts was less than enthusiastic or promising. If the cuts do occur, they will occur over a longer period of time and are less dramatic than what was hoped for at the end of 2023. All in all, for the real estate market, I don’t think today’s pronouncements move the market one way or the other. I still see the market involved in a waiting game and one that may take longer to play out than what is needed to jumpstart the marketplace.”

The experts agreed that the future of the real estate market remains uncertain, waiting on decisive actions to catalyze movement.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.