The reasons borrowers are in forbearance are changing

The Mortgage Bankers Association has recorded a five-basis-point drop in mortgage forbearances, revealing changing trends and reasons.

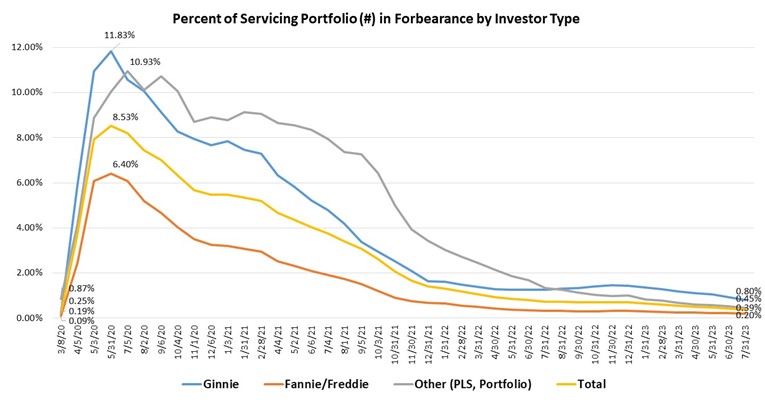

The share of home loans in forbearance tumbled to 0.39% of servicers’ portfolio volume, representing 195,000 homeowners in forbearance plans. The reasons why these borrowers are still in forbearance vary, according to MBA.

Of the total number, 69.3% of borrowers remained in forbearance plans in July because of the pandemic, 6.5% were in forbearance because of a natural disaster, while the remaining 24.2% cited other reasons such as temporary hardship caused by job loss, death, divorce, disability, etc.

MBA’s report showed that the share of Ginnie Mae loans in forbearance fell from 0.93% in June to 0.80% in July. The percentage of Fannie Mae and Freddie Mac loans in forbearance inched down one basis point month over month to 0.20%, and the share of portfolio and private-label securities (PLS) loans in forbearance decreased seven basis points to 0.45%.

“The prevalence of forbearance plans has dramatically dropped since 2020, and the reasons that borrowers are in forbearance are changing,” said Marina Walsh, MBA’s vice president of industry analysis. “About two-thirds of borrowers are still in forbearance because of the effects of COVID-19, but a growing share of borrowers are in forbearance for other reasons that cause temporary hardship such as financial distress or natural disasters.”

While Fannie Mae and Freddie Mac have ended certain COVID-19 forbearance plans and workouts, the government-sponsored enterprises offer mortgage assistance and disaster relief options, especially for homeowners and renters affected by the ongoing wildfires in Hawaii.

“Given the recent natural disasters impacting California, Washington, and Hawaii, forbearance is one way for mortgage servicers to mitigate the potential impacts on homeowners,” Walsh said.

Want to keep up with the latest mortgage news? Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.