Quicken Loans reports wider gap between owner perceptions, valuations

The gap between what homeowners applying for a refinance mortgage believe their home is worth and the assessment of an appraiser, has widened.

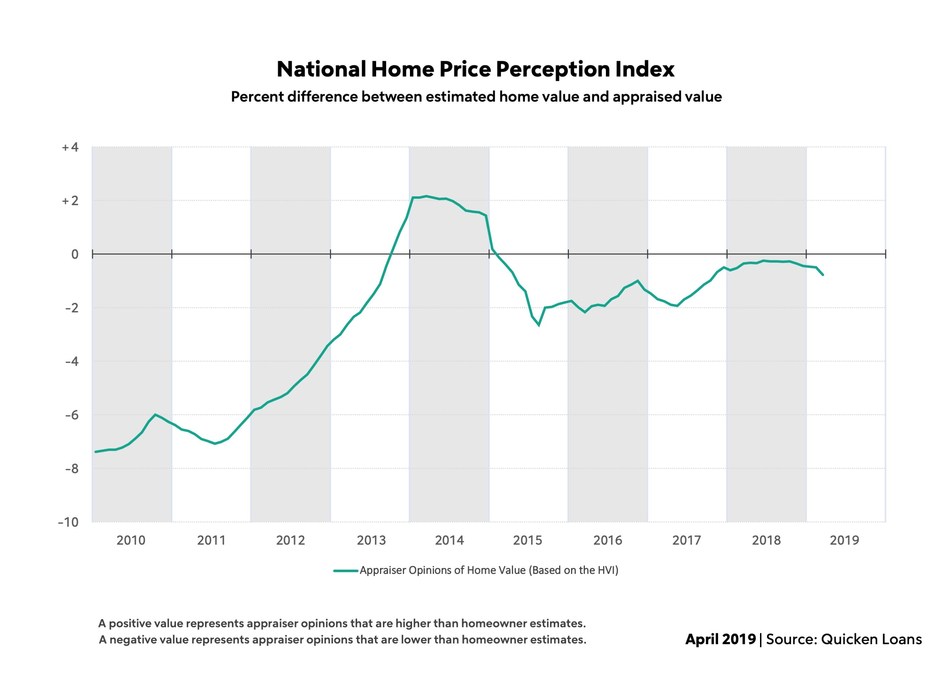

Quicken Loans’ National Home Price Perception Index (HPPI) expanded to 0.78% in March from 0.50% in February.

"This month's fluctuation in the HPPI was driven more by a dip in home values than a change in the owners' viewpoint. Homeowners are often reluctant to believe their house has lowered in value, even at a slight monthly fluctuation," said Bill Banfield, EVP of Capital Markets for Quicken Loans.

In most areas appraisals are within 1% of homeowners’ perceptions but across the areas measured for the HPPI, Chicago is where owners are overestimating the most (1.94% above appraisals) and Boston owners are underestimating the most (2.23% below appraisals).

"Depending on the area, appraised values are either growing at a much more measured pace or have taken a step back from their meteoric rise,” added Banfield. “Homeowners are usually slower to realize change – in either direction – than the appraisers who study the market on a daily basis. This can lead to a slight widening of the perception gap when there is a turn in the market."

Home Value Index

Meanwhile, Quicken Loans’ National Home Value Index (HVI) shows appraisal values dipped 0.20% from February to March. Home values continued to grow annually, rising 3.37% year-over-year.

This is a slowdown from the growth in February, when appraised values rose 5.47% year-over year.

"Some of the rampant buyer demand that we've seen over the last few years has subsided because of the affordability issues many areas are having, driven by a lack of availability," said Banfield. "Would-be buyers have decided to sit on the sidelines to see if more home inventory becomes available at the price-points where they're shopping. The entire housing industry is watching to see what will happen in the coming months – whether owners and builders will provide the home inventory the buyers have been waiting for, amid the recent drop in interest rates."

|

Metropolitan Areas

|

HPPI March 2019

Appraiser Value vs. Homeowner Perception of Value* |

HPPI February 2019

Appraiser Value vs. Homeowner Perception of Value* |

HPPI March 2018

Appraiser Value vs. Homeowner Perception of Value* |

|

Boston, MA |

+2.23% |

+2.51% |

+2.40% |

|

Charlotte, NC |

+2.11% |

+2.10% |

+1.22% |

|

Denver, CO |

+1.58% |

+1.98% |

+2.26% |

|

Minneapolis, MN |

+1.37% |

+1.50% |

+1.53% |

|

San Jose, CA |

+1.27% |

+1.63% |

+2.71% |

|

Seattle, WA |

+1.23% |

+1.48% |

+2.20% |

|

Las Vegas, NV |

+1.16% |

+1.09% |

+0.72% |

|

Dallas, TX |

+0.99% |

+1.02% |

+2.61% |

|

Atlanta, GA |

+0.81% |

+0.93% |

+0.06% |

|

San Francisco, CA |

+0.70% |

+0.73% |

+1.99% |

|

San Diego, CA |

+0.55% |

+0.67% |

+1.41% |

|

Phoenix, AZ |

+0.39% |

+0.52% |

+0.40% |

|

Washington, D.C. |

+0.31% |

+0.57% |

+0.46% |

|

Portland, OR |

+0.30% |

+0.26% |

+1.03% |

|

Sacramento, CA |

+0.28% |

+0.46% |

+0.72% |

|

Kansas City, MO |

+0.24% |

+0.43% |

+1.09% |

|

Los Angeles, CA |

-0.03% |

+0.06% |

+0.91% |

|

New York, NY |

-0.31% |

-0.37% |

+0.42% |

|

Riverside, CA |

-0.32% |

-0.02% |

+0.84% |

|

Houston, TX |

-0.47% |

-0.48% |

-0.92% |

|

Tampa, FL |

-0.59% |

-0.57% |

+0.21% |

|

Miami, FL |

-0.70% |

-0.46% |

+0.66% |

|

Detroit, MI |

-0.88% |

-0.70% |

+0.69% |

|

Baltimore, MD |

-1.08% |

-1.12% |

-1.18% |

|

Philadelphia, PA |

-1.42% |

-1.38% |

-1.62% |

|

Cleveland, OH |

-1.63% |

-1.53% |

-1.44% |

|

Chicago, IL |

-1.94% |

-1.93% |

-1.47% |

*A positive value represents appraiser opinions that are higher than homeowner perceptions. A negative value represents appraiser opinions that are lower than homeowner perceptions.