Quicken Loans says spread remains extremely narrow

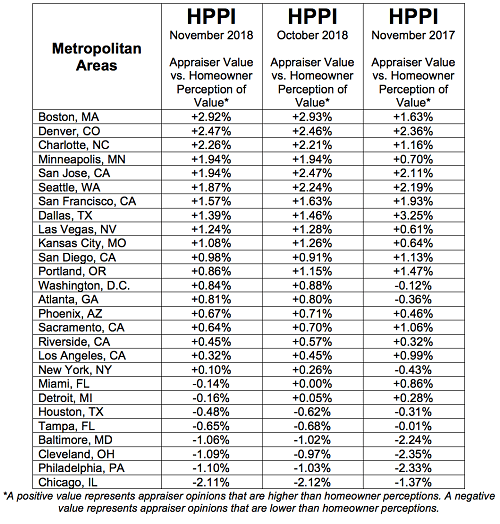

The spread between the value homeowners put on their properties when applying for a refinance mortgage and the value assessed by professional appraisers widened slightly last month.

The Quicken Loans Home Price Perception Index reveals that nationwide, appraised values were an average of 0.36% lower than what homeowners expected. Even with the increase, the spread remains extremely narrow.

“Homeowner perception staying at a steady level is a sign of a sturdy housing market,” said Bill Banfield, Quicken Loans Executive Vice President of Capital Markets. “Some homeowners may not be as aware of home value changes as the professionals who study the real estate market every day, so any large, sudden, spikes or drops in home values, are often reflected by a swift widening gap in the HPPI.”

Home values gain

Meanwhile, the Quicken Loans Home Value Index, tracking home value trends based solely on appraisal data from home purchases and mortgage refinances, reveals that values rose by about half of a percent in all four regions measured by the HVI, while they all posted annual growth from 4-6%.

“With interest rates higher than they were at this time last year, and signs pointing to this trend continuing, it’s good to see appraisal values keeping moderate annual growth – avoiding possible affordability problems,” said Banfield. “While homeowners like to celebrate increasing equity, these restrained gains, keeping closer pace with inflation and wage growth, is much healthier for the economy.”