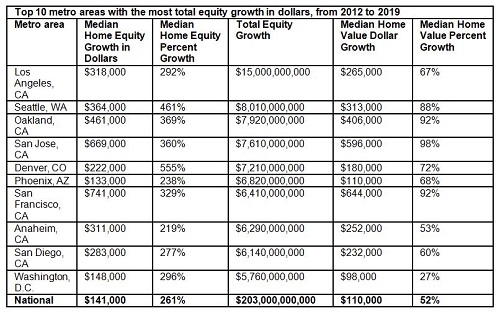

Home values have surged 261% according to Redfin

Those who bought a home in 2012 have earned a median $141,000 in equity in the years since.

The 261% increase discovered in an analysis by Redfin means that 2012’s cohort of buyers have increased by a collective $203 billion thanks to their decision to buy when prices were in their post-recession trough.

With an average $54,000 in equity at purchase and $110,000 increase since, a typical buyer would now have $195,000 in equity. This is based on a median-priced home increasing from $210,000 in 2012 to an estimated $320,000 this month.

"The opportunity to build wealth through home equity when prices hit their low point was available only to a fortunate subset of Americans who had enough cash for a down payment," said Redfin chief economist Daryl Fairweather. "And now many people who weren't able to buy into homeownership during that window of time find themselves on the other side of the housing market coin: Many areas are just plain unaffordable for people who don't have equity built up to trade in for a new home.”

Next time won’t be as lucky

He added that those who are waiting in the wings, hoping to buy a home when the next recession hits, probably won't be as lucky as buyers were in 2012.

“Even if home prices do come down slightly, the housing market won't be impacted nearly as much as it was during the Great Recession and home equity gains won't be nearly as big," he said.