First-look at mortgage data shows a rare increase for the month

Typically, mortgage delinquencies in February and March decline as tax refunds help keep struggling homeowners afloat.

But it appears that last month bucked that trend to deliver the first February delinquency rise in 12 years according to a first-look at mortgage data from Black Knight Inc.

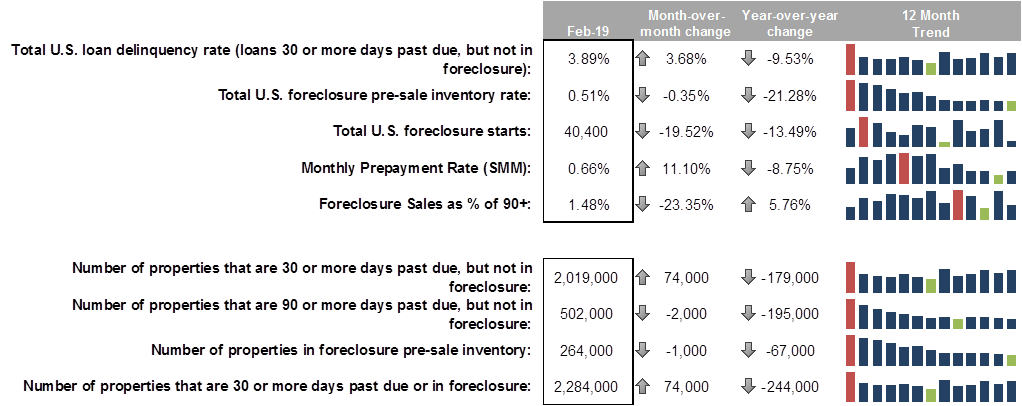

The 3.7% month-over-month increase, while unusual, does not detract from the fact that year-over-year figures show a 9.5% decline in delinquencies. The 74,000 additional homes took the total number of homes that were 30+ days past due but not in foreclosure to 2,019,000.

The data shows better news for foreclosure starts, down 19.5% from January to 40,400 – that’s close to September 2018’s 15-year low. The total US pre-sale foreclosure inventory rate edged lower by 0.35% to 0.51% (264,000 homes).

Prepayment speeds rose

Prepayment speeds rose by 11% from January’s 18-year low, suggesting an increase in refinance activity driven by the recent decline in 30-year interest rates.

Image source: Black Knight Inc.

Mississippi, Louisiana, Alabama, West Virginia, and Arkansas lead the states for highest rates by non-current percentage while Delaware replaces West Virginia in the top 5 for 90+ days delinquent percentage.