No state posted an annual gain in its overall or serious delinquency rate in April

There was a further boost in mortgage loan performance in April with delinquencies falling to the lowest rate for any month in more than 20 years.

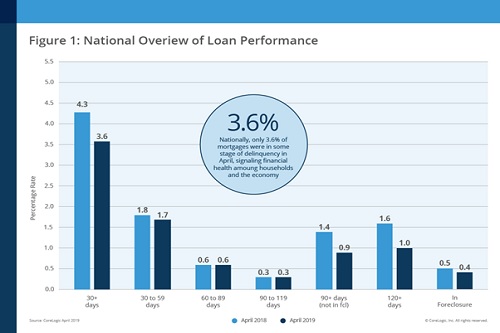

CoreLogic’s Loan Performance Insights Reports shows that nationally 3.6% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in April 2019.

That was a 0.7 percentage point decline in the overall delinquency rate compared with April 2018, when it was 4.3%.

And the foreclosure inventory rate was 0.4%, down 0.1 percentage points from April 2018, the lowest rate (along with the prior 5 months) for any month since at least January 1999.

“Thanks to a 50-year low in unemployment, rising home prices and responsible underwriting, the US overall delinquency rate is the lowest in more than 20 years,” said Dr. Frank Nothaft, chief economist at CoreLogic.

The serious delinquency rate (90+ days past due or in foreclosure) in April (1.3%) was the lowest for any month in nearly 14 years and down 6 percentage points from April 2018.

The share of mortgages that transitioned from current to 30 days past due was 0.7% in April 2019, down from 0.8% in April 2018.

Disaster impact

Although the national delinquency rate was lower, individual markets did not all fare so well.

Ten metropolitan areas logged an increase in the serious delinquency rate with the highest gains continuing to plague the hurricane-ravaged parts of the Southeast (in Florida, Georgia and North Carolina), and in Northern California where the Camp Fire devastated communities in 2018.

“The US has experienced 16 consecutive months of falling overall delinquency rates, but it has not been a steady decline across all areas of the country,” said Frank Martell, president and CEO of CoreLogic. “Recent flooding in the Midwest could elevate delinquency rates in hard-hit areas, similar to what we see after a hurricane.”