Redfin report reveals growing wealth divide in homeownership

Buying a home is getting harder for younger generations, with more than a third of Gen Z and millennials turning to family for help.

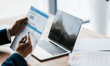

A new Redfin report revealed that over 36% of young homebuyers expect cash gifts from family for a down payment. This trend has doubled in recent years, with only 18% of millennials receiving similar aid in 2019.

Family support isn’t just limited to down payment gifts. Redfin’s survey revealed that 16% of young buyers will use inheritance for their down payment, while 13% intend to live with family to save money for down payments.

“Nepo-homebuyers have a growing advantage over first-generation homebuyers,” said Redfin chief economist Daryl Fairweather. “Because housing costs have soared so much, many young adults with family money get help from mom and dad even when they have jobs and earn a perfectly respectable income.”

While family assistance is on the rise, earning income remains the primary source for young buyers. Saving from paychecks (60%) and working second jobs (39%) are the most common means of funding down payments.

The affordability challenge

Why are young people turning to family? Fairweather blamed soaring home prices, which have jumped nearly 40% since the pandemic. There are also fewer homes available, making it harder to save enough.

“In many ways, Gen Zers and millennials face a more difficult financial landscape than their parents did at the same age: Their wages are lower than their parents’ wages were, they have more student loan debt, and inflation has pushed up the cost of nearly everything, including housing,” Redfin said in the report. “The fact that so many young Americans rely on help from family to afford a down payment is emblematic of the fact that housing is simply too expensive.”

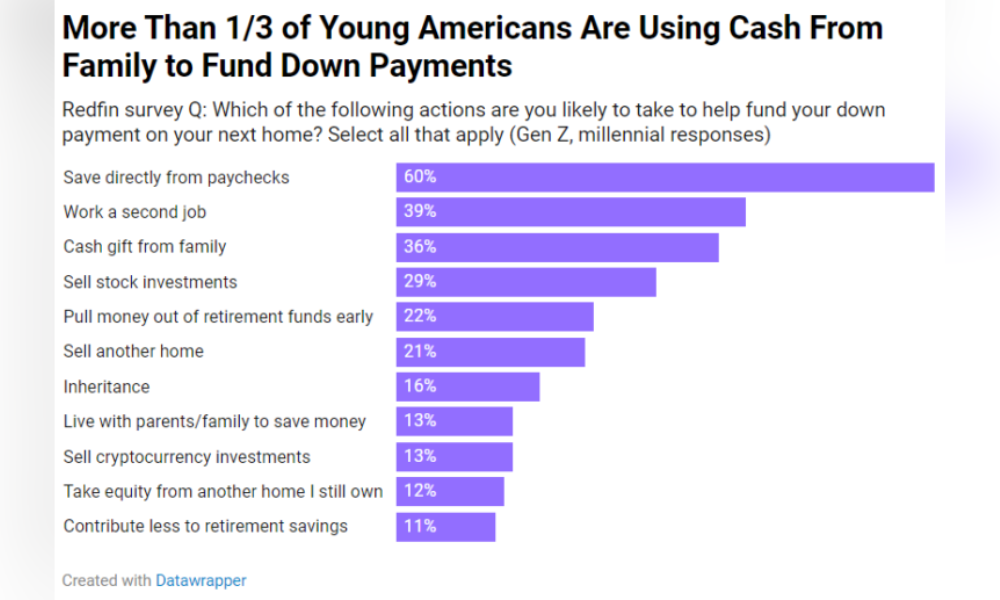

Among those unlikely to purchase a home soon, 43% cite high housing costs as the biggest barrier, followed by the inability to save for a down payment (34%), struggle to afford mortgage payments (29%), and elevated mortgage rates (29%).

Roughly 16% pointed to a lack of family financial support as an obstacle to homeownership, while 12% said they need to tackle student loan debt before considering a home purchase.

The long-term impact

Fairweather warned this trend contributes to a growing wealth gap. Young buyers with family help have a huge advantage over those without it.

“The bigger problem is that young Americans who don’t have family money are often shut out of homeownership,” he said. “Many of them earn a perfectly good income, too, but they can’t afford a home because they’re at a generational disadvantage; they don’t have a pot of family money to dip into.

Read more: How can the mortgage industry become more representative?

“This contributes to wealth inequality and often prevents young people from gaining economic ground on their peers from more privileged backgrounds. The American Dream is just as much about class mobility as it is the home with a white-picket fence, and the housing affordability crisis has made both elements of the dream harder to attain.”

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.