You will have access to favorable mortgage rates with good credit. Here is how a good credit score will benefit you

Mortgage interest rates are constantly rising and falling. And these ever-changing interest rates are due to numerous factors. Many of these factors are out of the individual homeowner’s control, while others can be affected by personal finances. As you start the process of getting a mortgage, it is important to know what your interest rate could look like.

What are good mortgage rates with good credit? And what mortgage rate can you get with a 760 credit score? In this article, we will answer these questions and more.

Here is everything you need to know about mortgage rates with good credit.

What is a good mortgage rate for excellent credit?

First things first. To get a clear idea of what a good mortgage rate is—and what kind of credit you need to get a good rate—it is important to know the current averages in the US.

In June 2023, the average interest rates for the most popular 30-year fixed mortgage hovered around 6.5%. The average monthly mortgage payment for a 30-year fixed mortgage in the US is currently $3,048.

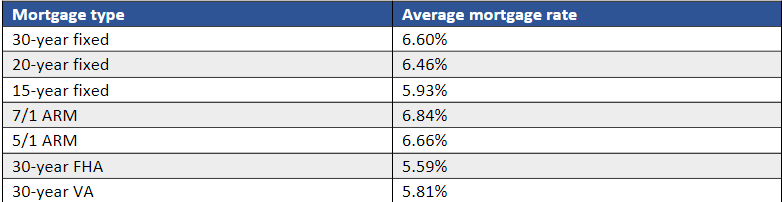

The following chart shows the average mortgage rate based on mortgage type as of the end of June 2023, according to Zillow:

While the average mortgage and refinance rates can give you a picture of where mortgage rates are at currently, they are never a guarantee of the rate that a lender will offer to you. This is because mortgage rates vary depending on the borrower.

Here are some of the key factors that will determine your mortgage rate:

- Credit score

- Home loan type

- Down payment

To get the best mortgage rate for you, your financial situation and your long-term goals, you will want to get quotes from multiple mortgage lenders.

Mortgage rates with good credit: Interest rates by credit score

National mortgage rates are not the only factor that can impact your rate. Your credit score can also have a significant impact on the price it will cost you to borrow. Your credit score is the number calculated based on your borrowing, repayment history, and credit use.

The credit score that you receive—which is between 300 and 850—is essentially a grade point average for how you have used credit in the past. You can check your credit score online for free. The better your credit score is, the less money you will have to pay to borrow the money. Generally speaking, 620 is the minimum credit score you need to purchase a property in the US. Exceptions do exist, however, in the form of government-backed loans, such as FHA loans, for instance.

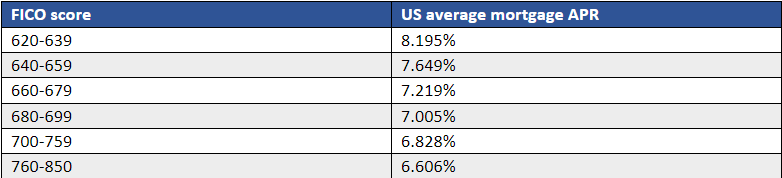

The lower your credit score, the more you have to pay for credit, according to data from credit-scoring company FICO. The following graph outlines how the interest rate on a 30-year, fixed-rate mortgage of $300,000 will change depending on the FICO score:

Only prospective home buyers with a credit score higher than 660 will see interest rates around the national average, according to FICO.

What mortgage rate can I get with a 760 credit score?

While mortgage rates vary by lender, a difference of a few points on your credit score can have a significant impact on your monthly mortgage repayments. For instance, the difference between a 5.5% interest rate and a 6% interest rate on a $200,000 mortgage equals $64 per month. While that does not seem like a lot of money in the short term, it amounts to more than $23,000 over the course of a 30-year mortgage term.

With a credit score of 760-850, you would get a rate of 5.868% on a 30-year fixed mortgage loan of $300,000 (as of February 2023). This equals monthly payments of $1,773, which over the course of the 30-year loan would equal $338,378.

By contrast, if you have a credit score between 620-639, your rate would be 7.457% for the same mortgage. That equals monthly payments of $2,089 and interest over the course of the 30-year loan equaling $451,974.

In short, you get good mortgage rates with good credit.

How to improve credit score to get better mortgage rate

Before you shop around for your mortgage, you should check your credit by pulling your credit reports from the three major credit agencies in the US: Equifax, Experian, and TransUnion. If you address any credit problems you may have early on, you can increase your credit score before applying for a mortgage—and get a better mortgage rate.

If, however, your credit score is low, there are ways you can increase it. Here are some fast ways you can increase your credit score:

- Check report, correct errors

- Pay down credit card(s)

- Pay your bills

- Keep older credit lines open

- Don’t take on new debts

Let’s take a closer look at each of these tips for increasing your credit score:

1. Check report, correct errors

As mentioned, you can request a copy of your credit report through one of the three major credit agencies. If you find missing or inaccurate information, you can file a dispute with the credit reporting agency and the creditor. You will have to identify every item you are disputing and include supporting documentation.

2. Pay down credit card(s)

Paying down your credit card balances is always a good idea. This is especially true when shopping for a mortgage because lenders like to see a credit utilization ratio of 30% or less. Your credit utilization ratio is the amount of debt you owe compared to your available credit. To calculate your debt utilization ratio, you divide the amount of debt into the amount of available credit. For instance, if you have $10,000 in debt and available credit of $20,000, your credit utilization ratio is 50%.

3. Pay your bills

Your payment history makes up 35% of your credit score. Remember: late payments remain on your credit report for seven years. The good news, however, is that their impact on your credit score diminishes over time.

4. Keep older credit lines open

It is important that you do not close older credit lines, even after paying them off. While closing unused accounts may sound like a good idea, it might increase your credit utilization ratio—which can, in turn, cause your credit score to drop.

5. Don’t take on new debts

When applying for a mortgage, the less debt you have, the better off you will be. Because every credit request can lower your credit score, FICO recommends not opening new credit accounts to increase your credit utilization ratio. After your credit has improved, you should rate shop within 30 days, especially since spreading out rate inquiries can damage your credit score.

Mortgage rates with good credit: closing thoughts

Mortgage rates are notoriously ever-changing. While some of the factors that contribute to these fluctuations are beyond most homeowners’ control, you can control your credit score. Since your credit score is a major determining factor to the type of mortgage rate you will get, it is important to keep your score healthy. It is also vital to understand how just a few credit points can impact your mortgage rate.

If you are looking for the most favorable mortgage rates with good credit, you may want to speak with a mortgage professional first. We have a list of the USA’s top performing mortgage professionals, including mortgage loan officers, in our Best in Mortgage section.

Have experience getting good mortgage rates with good credit? Let us know in the comment section below.