The next cohort of typical-age buyers will find supply, prices challenging

(1).jpg)

If you thought the current low-inventory, rising-prices scenario is challenging for first-time homebuyers, just wait until the next decade.

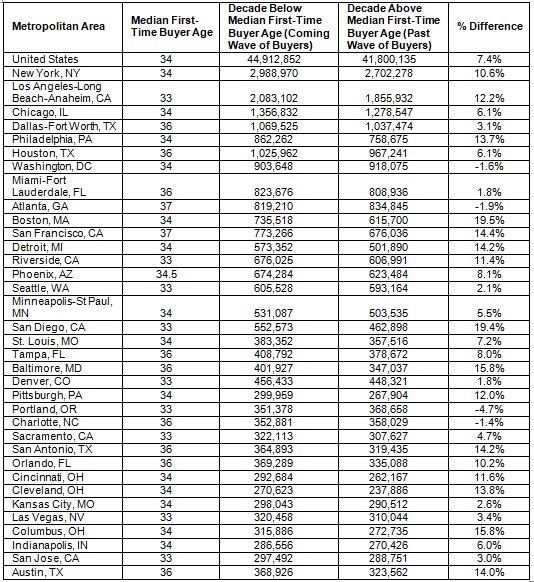

That’s because there are 45 million Americans who will reach the typical age for buying a first home (34 years), 3.1 million more than in the previous 10 years.

An analysis from Zillow reveals that this cohort of buyers will heap added pressure on the starter-homes market – already among the tightest – and this will in turn add pressure on rentals.

Prices for starter homes have gained 57.3% in value over the past five years, a median increase of $47,600, while for-sale inventory in this price range has fallen by 23.2%.

Over the same time period, the most expensive third of homes gained 26% in value and homes in the middle third appreciated 36.8%.

"The potential first-time buyer bulge, without inventory to meet it, suggests that the typical age of first-time buyers will continue to be pushed further and further out,” said Skylar Olsen, director of economic research at Zillow. “The rate of single-family construction is still behind the pace we experienced in the 1990s, and without an increase in truly new supply, would-be first-time buyers will instead persist in the rental market."

These markets could suffer the most

The analysis shows that some of tightest markets are also those that will see the strongest new demand.

San Diego and Boston for example, are both expected to see a rise in potential first-time buyers of almost 20% compared to the previous wave