Jobless claims for this week rose to 312,000. Meanwhile, MBS prices crept up 2 basis points from yesterday's close. All this and more in today's rate snapshot

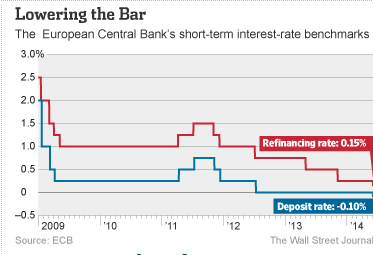

As expected, the ECB cut its base lending rate to a record low 0.15% and lowered its deposit rate to minus 0.1% from zero, also as expected. Draghi said the ECB will introduce new, “targeted” offerings of liquidity to banks to encourage them to lend money to the real economy. Officials will also start work on purchases of asset-backed securities, he said. The ECB will extend its current offerings of unlimited cash to banks and will suspend the sterilization of its bond purchases at the start of the euro crisis in a bid to boost liquidity in money markets, Draghi said. The ECB is now the first central bank to charge a fee on deposits at the bank. In order to support bank lending to households and non-financial corporations, excluding loans to households for house purchase, the ECB will be conducting a series of targeted longer-term refinancing operations (TLTROs). From March 2015 to June 2016, all counterparties will be able to borrow, quarterly, up to three times the amount of their net lending to the euro area non-financial private sector, excluding loans to households for house purchase, over a specific period in excess of a specified benchmark. Net lending will be measured in terms of new loans minus redemptions. Loan sales, securitizations and write-downs do not affect the net lending measure. The interest rate on the TLTROs will be fixed over the life of each operation, at the rate on the Euro system’s main refinancing operations (MROs) prevailing at the time of take-up, plus a fixed spread of 10 basis points. Starting 24 months after each TLTRO, counterparties will have the option to make repayments. A number of provisions will aim to ensure that the funds support the real economy. Those counterparties that have not fulfilled certain conditions regarding the volume of their net lending to the real economy will be required to pay back borrowings in September 2016. Sounds confusing, the bottom line though is more emphasis on lending to juice the economies in the EU.

Weekly jobless claims were about what was expected, +8K to 312K. The 4 week average declined 2500 to 310,250. No reaction to the report ahead of tomorrow’s May employment report and most focus this morning on the ECB’s actions to stimulate its economy and attempt drive an increase in inflation that at the moment is so low (0.5%) that fears of deflation have ignited great fears at the central bank.

At 9:30 the DJIA opened +36, NASDAQ +10, S&P +3; 10 yr 2.61% +1 bp and 30 yr MBS price +2 bp from yesterday’s close.

Now that the ECB has essentially done what markets had expected, it is on to tomorrow’s employment report. There hasn’t been a lot of reaction to the ECB after the initial volatility at about 8:30; markets had already discounted it over the last week. Tomorrow’s employment report is hard to discount prior to actually seeing the data as generally the report presents surprises. The current ‘consensus’ is NFP jobs up 213K, private jobs +215K and the unemployment rate at 6.4% from 6.3% in April.

The technicals have broken down with the recent selling; the 10 now above its 20 and 40 day averages and the momentum oscillators are now in bearish territory. We will have to wait until tomorrow to decide where rates are headed; a weaker than expected report will help stabilize the markets. Ukraine/Russia is still a factor but unless a country wide civil war breaks out markets are not likely to be directly affected.