Upcoming webinar will explain why originators need to be stepping into non-QM with the right partner

The first quarter of 2021 has forced originators to reconsider their business models. Rising rates are pushing refi volume down, with most experts predicting rates to push higher through the balance of 2021. The housing market, at the same time, is heating up. Rates are still low enough to incentivize first-time buyers and the COVID-19 pandemic has pushed a millennial move to the suburbs and ex-urbs that should have taken a decade. As they look to pivot to purchase, one lender is offering a means for originators to rethink their business models.

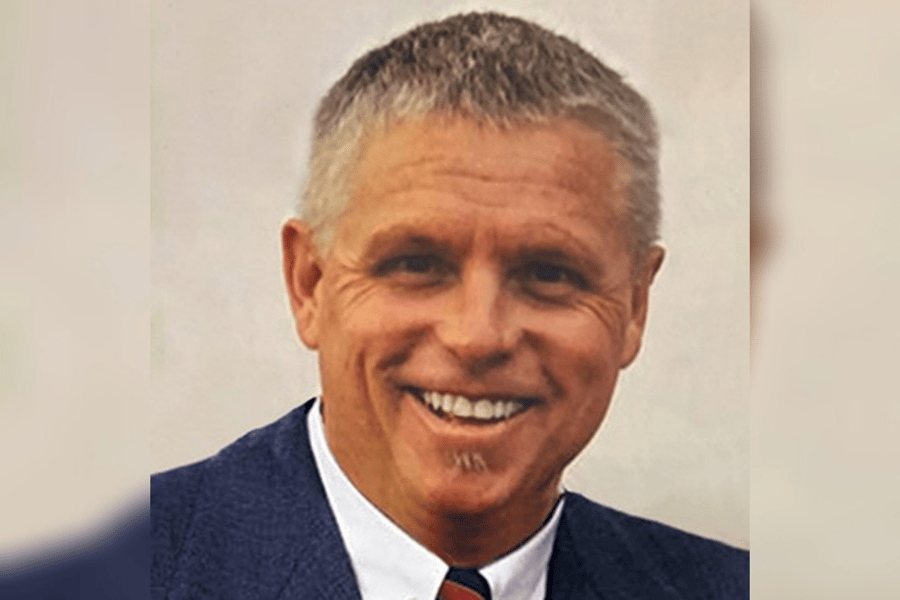

Michael Kirk (pictured), VP of wholesale sales at Acra Lending, explains how his company’s non-QM product set and service package can play a crucial role for originators pivoting into new market conditions. In a preview, Kirk shared with MPA how crucial versatility and flexibility will be in this new environment and how Acra’s unique offerings serve originators looking to become more versatile and play an absolutely crucial role as the market begins to tighten.

“I don’t think it’s a matter of ‘should’ originators be looking at the next market stage,” Kirk said. “It’s a matter of ‘must.’ Agency rates are on the rise in an unstable nation and originators have got to consider their future pipelines and their business platforms moving forward. They need to act now to determine what the growth and the stability of their company’s future look like…Even though they’ve had a record year, rising rates are going to separate originators from their competition. It’s going to take something special to rise above and maintain profitability in this crazy market.”

That ‘something special,’ for Kirk is a diversified set of business plans that allow an originator to go after a wide array of key market segments. Acra’s core portfolio of non-QM products plays a key role in this, offering deeper penetration into local referral networks. The originator who knows non-QM will simply pick up more business from each referral partner they already have. The originator that doesn’t, is leaving money on the table for their competitors to take. In an increasingly zero-sum market, it’s a difference-maker.

Not only does non-QM improve local referral presence, but Kirk also explained that with the right base an originator can turn those products into statewide and nationwide reach. Perhaps more importantly in the immediate term, non-QM’s flexibility will help greatly with a foreign buyer market that’s full of pent-up demand due to the pandemic. When those floodgates open, a savvy originator will be there with the right product.

Read more: Understanding Florida’s foreign buyer ban and its key impacts

The biggest challenge in non-QM, according to Kirk, is more about mindset than the eccentricities of a product. Originators might come in with misconceptions or the expectation that the process is a hassle. If they can get over that and see the opportunity in the channel, Kirk believes they’ll realize the non-QM process is far easier and more straightforward than they had ever expected. The key is to move from a more restrained agency mindset, towards a more creative outlook that reflects the creativity of the non-QM process.

As the non-QM market itself grows more competitive, Kirk explained that Acra’s mindset is key to what sets it apart. As an innovative lender in a vertically integrated ecosystem, they are empowered to experiment but know that the buck isn’t going to be passed on to somebody else. It treats brokers as partners and strives to train them up on these product sets, no matter their level of non-QM expertise. It offers a personalized marketing platform and supports brokers as they begin to sell these non-QM products. When hurdles do arrive, the Acra team is there to help.

While Kirk expects the webinar will show brokers why they need to look at non-QM now or risk being left behind, he hopes it will also show them the sort of supportive culture that exists at Acra, a culture that they bring to work with all their mortgage partners.

“If you don’t step out into the non-QM market, you’ll get left behind,” Kirk said. “That’s where the market is going. And Acra offers great reward with limited risk for that. We want to help our partners grow because that’s our culture. We believe that when all our partners grow, our own growth is a guaranteed default.”

To hear more from Michael Kirk on the ways Acra can help diversify your portfolio, check out the webinar here.