(NAR) Recently released government data for 2011 from the Home Mortgage Disclosure Act (HMDA) shows just how tight mortgage credit has been.

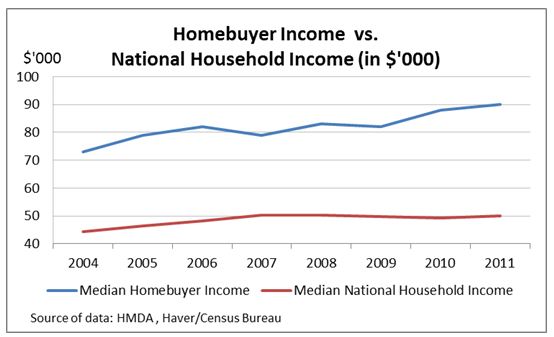

(NAR) Recently released government data for 2011 from the Home Mortgage Disclosure Act (HMDA) shows just how tight mortgage credit has been. Incomes of prospective purchasers have increased since 2004, but the loan to income ratio has declined. The median household income for a homebuyer using conventional financing rose from $79,000 in 2007 to $ 90,000 by 2011, while the national median household income has remained flat since 2007 at about $50,000, This indicates that either 1) more loan applicants with higher incomes were applying and those with lower incomes were self-selecting themselves out of the process, and/or 2) that banks income standards had become more stringent.

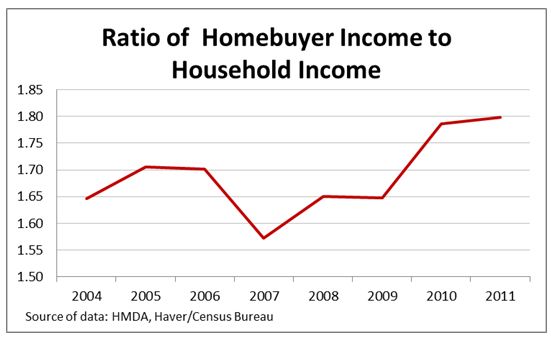

Looking at the ratio of the median home buyer household income of those with conventional loans to the median national household, this increased from 1.65 x to 1.8 x from 2007 to 2011.

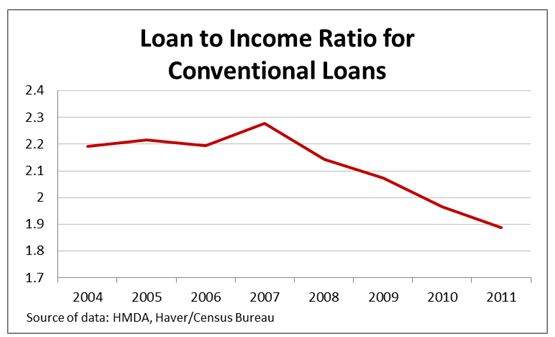

Yet even as median home buyer income rose, credit financing became even tighter with the loan to income ratio for conventional loans declining from about 2.3 in 2007 to 1.9 in 2011.

If financial institutions returned to normal underwriting requirements, NAR estimates that an additional 10 to 15 percent residential homes would be sold, resulting in the creation of approximately 300,000 new jobs in the economy. In the meantime, a number of REALTORS® have cited local and regional banks as well as credit unions as good places to look for a mortgage.