Credit is becoming more easily available and one industry professional believes he knows why

Access to credit is becoming easier for Americans and that’s because lenders are becoming better at underwriting, according to one industry player.

“It’s a good thing that more Americans are able to access credit,” David Hill, a loan originator with Independent Mortgage, told Mortgage Professional America. “Lenders are doing a better job; before they weren’t doing the proper due diligence and now they are.”

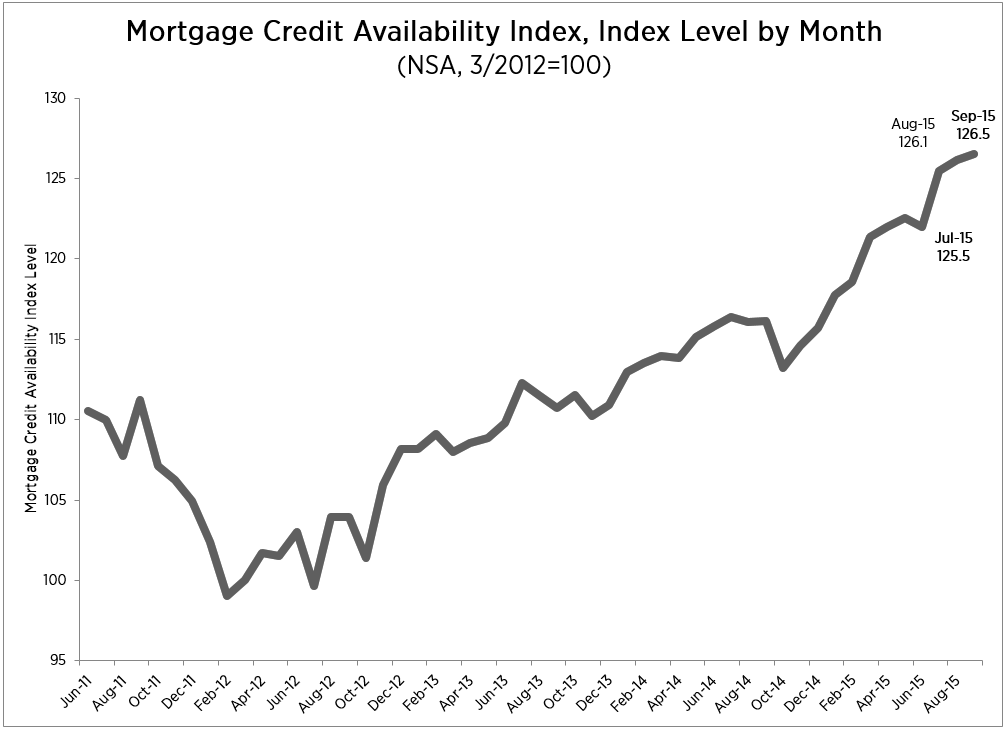

The Mortgage Bankers Association released its credit report for September, which indicates an increase of 0.3% to 126.5 on its Mortgage Credit Availability Index (MCAI).

An increase in the index indicates loosening credit, according to the MBA.

"Credit availability increased slightly in September due to some expansion of conventional affordable offerings," said Mike Fratantoni, MBA's chief economist, in a release. "In particular, this month there was an increase in the offerings of Freddie Mac's affordable lending programs."

And according to Hill, that available credit is being utilized by more creditworthy clients.

“People who deserve to get a mortgage these days are getting one and those who don’t, aren’t,” he said.

Hill is noticing an uptick in business as a result. In particular, among one important client type.

“A lot of first-time buyers who waited on the sidelines to see where the economy was going are now coming out of the woodwork to buy,” he said.

See below for a breakdown of the credit index over the past few years.