Buyers will be forced to stay on the sidelines by a severe lack of supply

Tight inventory and economic concerns will create a challenge for the US housing market in 2020 according to a new report.

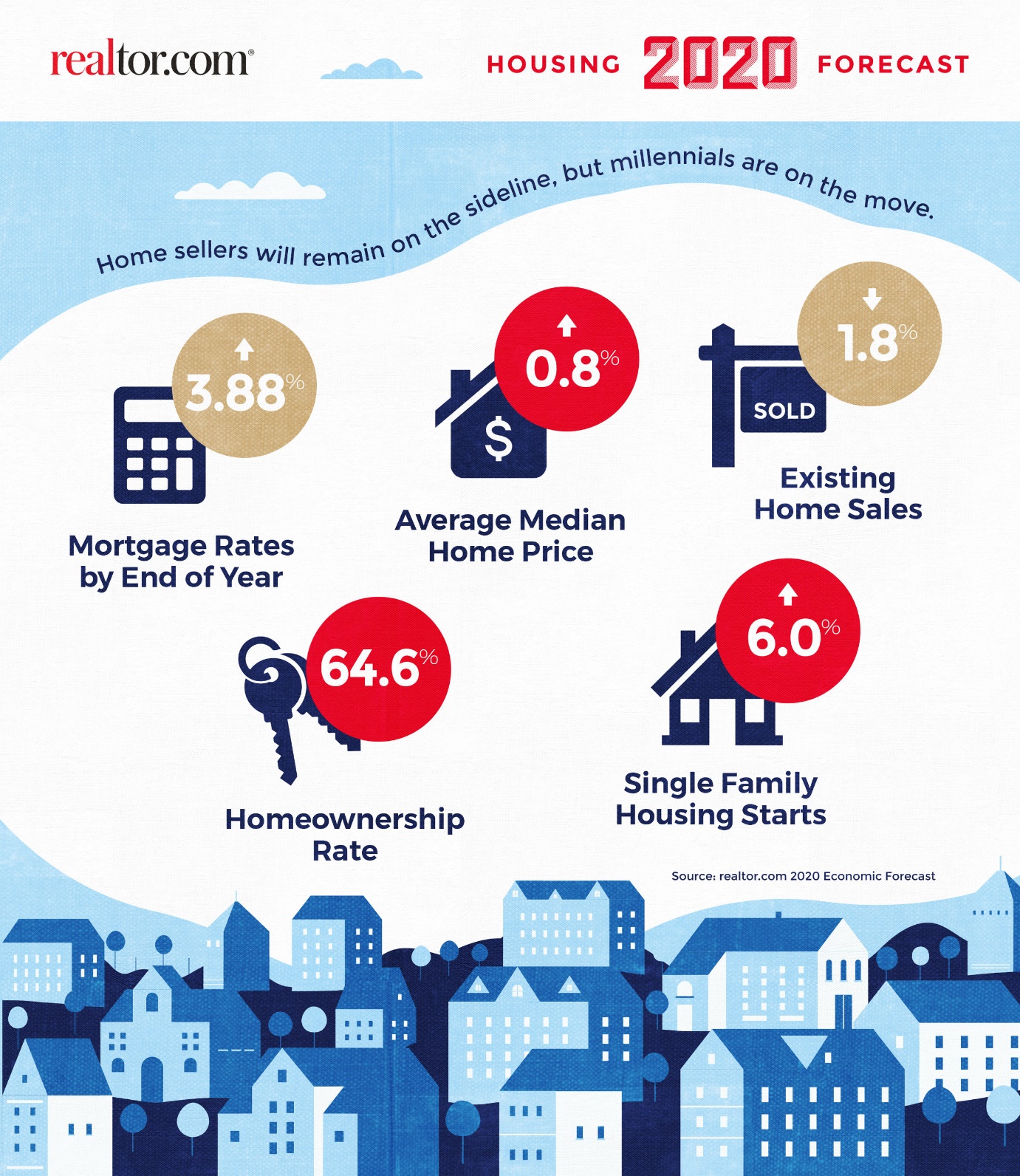

Buyers will have limited choices – potentially a record low supply - and will be tightening their spending amid signs of a softening economy (although recession is unlikely), leading to a decline in existing home sales of 1.8% to 5.23 million.

Realtor.com’s 2020 Economic Forecast shows that affordability will remain challenging for first-time buyers even as construction increases, moderating home prices, and relatively low interest rates (average 3.85%) provide some relief.

Sellers will face flattening prices with a national increase of just 0.8% and 25% of the largest 100 metros will see price declines. These include Chicago, Dallas, Las Vegas, Miami and San Francisco.

By generation, millennials – with the oldest members approaching 40 and the biggest cohort turning 30 in 2020 – will surpass 50% of all home purchase mortgages; but baby boomers will continue to hold onto their homes; and Gen X is more likely to upsize, freeing up some entry level inventory.

"Housing remains a solid foundation for the U.S. economy going into 2020," said George Ratiu, senior economist at realtor.com®. "Although economic output is expected to soften – influenced by clouds of uncertainty in the global outlook, business investment and trade – real estate fundamentals remain entangled in a lattice of continuing demand, tight supply and disciplined financial underwriting. Accordingly, 2020 will prove to be the most challenging year for buyers, not because of what they can afford, but rather what they can find."

Secondary markets

The affordability challenges for first-time buyers will be a boost for some secondary markets.

Arizona, Nevada and Texas will benefit as alternatives to California and home seekers from expensive Northeast markets will find relief in the Carolinas, Georgia and Florida.

Midwest markets will become more attractive, as buyers will find the affordable housing and solid, diversified economies of Ohio, Indiana and Kansas compelling.