Private mortgage insurance report reveals state of the market

A new report calculates that first-time homebuyers earning the national median income have to save for 20 years to afford a 20% down payment on the national median-priced single-family home.

The US Mortgage Insurers (USMI) report found that more than 1 million homebuyers used private mortgage insurance to avoid that long wait by enabling them to qualify for a low down payment mortgage.

The figures are based on a national median income of $61,372 and a national median single-family home price of $262,250.

"Our report underscores the critical role private MI plays in helping millions of first-time and middle-income homebuyers bridge the down payment gap across the United States,” said Lindsey Johnson, President of USMI.

Of the homebuyers who used private mortgage insurance in 2018, 60% were first-time buyers and more than 40% had incomes of less than $75K.

The average loan amount purchased or refinanced with MI was $244,715 and the average FICO score for these borrowers was 741, compared to a 733 score for all home loan borrowers.

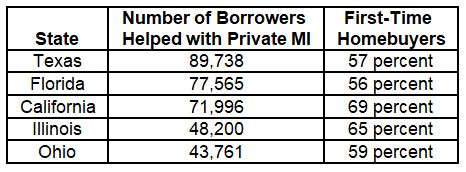

Where MI was most used in 2018

Top five states in which MI was used by borrowers to purchase or refinance homes in 2018:

"In recent years, the private MI industry has become even stronger with more robust underwriting standards, stronger capital requirements, and improved risk management,” added Johnson. “The industry is well-positioned to continue its important work, and we look forward to further helping grow American homeownership."