LendingTree study exposes gaps in Black Americans' housing access

Black Americans own a disproportionately small share of homes relative to their population size, positioning them as one of the most economically disadvantaged groups in the United States, according to analysis by LendingTree.

Digging into data from the Census Bureau, the study found a striking imbalance in homeownership rates.

Despite Black individuals making up an average of nearly 15% of the population across the 50 largest metros, they own just over 10.2% of the homes. This is in sharp contrast to White individuals, who, while making up around 57.8% of these populations, own 69% of the homes.

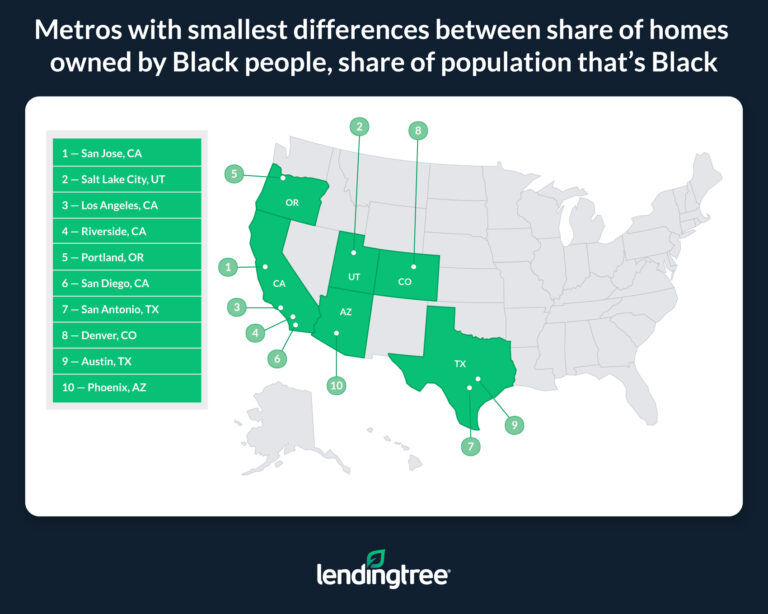

In cities with relatively small Black populations like San Jose, Calif., Salt Lake City, and Los Angeles, the gap between the percentage of Black residents and Black homeowners is smaller. However, this doesn’t necessarily mean it’s easier for Black individuals to buy homes there.

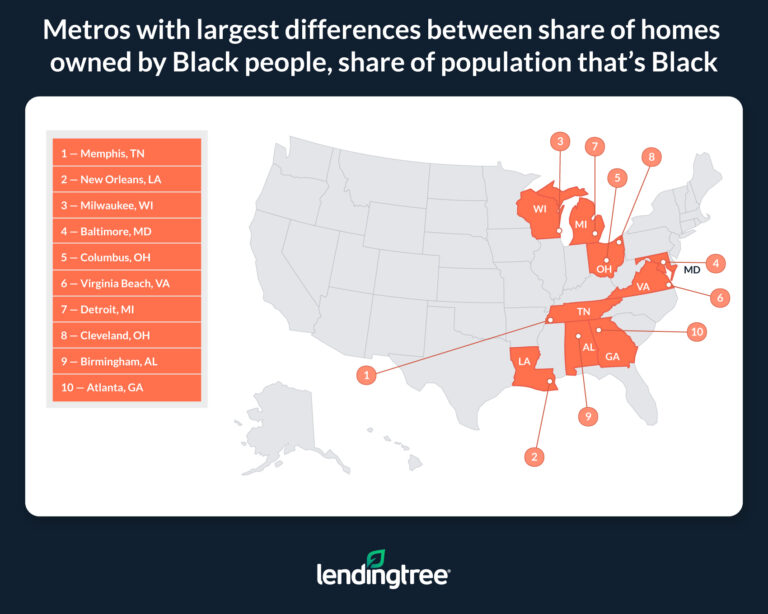

Memphis, Tennessee, stands out for the wrong reasons, having the largest disparity, with Black people making up 47.33% of the population but owning only 35.97% of the homes. New Orleans and Milwaukee also face significant homeownership gaps, highlighting a nationwide issue of racial inequality in housing.

LendingTree senior economist Jacob Channel points to systemic barriers as a major hurdle.

“Buying a house can be a challenging experience for many, regardless of their racial or ethnic identity,” Channel said in an email to MPA. “Nonetheless, the data is clear that in the face of systematic issues, such as having fewer opportunities to access credit and less generational wealth, Black Americans are especially likely to struggle when it comes to home buying.”

The reasons behind these disparities are complex and multifaceted. Black households, for example, earn significantly less than their White counterparts, with a nearly $29,000 difference in median income. Other contributing factors include lower overall household wealth, higher likelihood of being unbanked and facing more rejections on mortgage applications.

The lingering effects of historical housing discrimination practices, like redlining, still impact Black homeownership rates today.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.