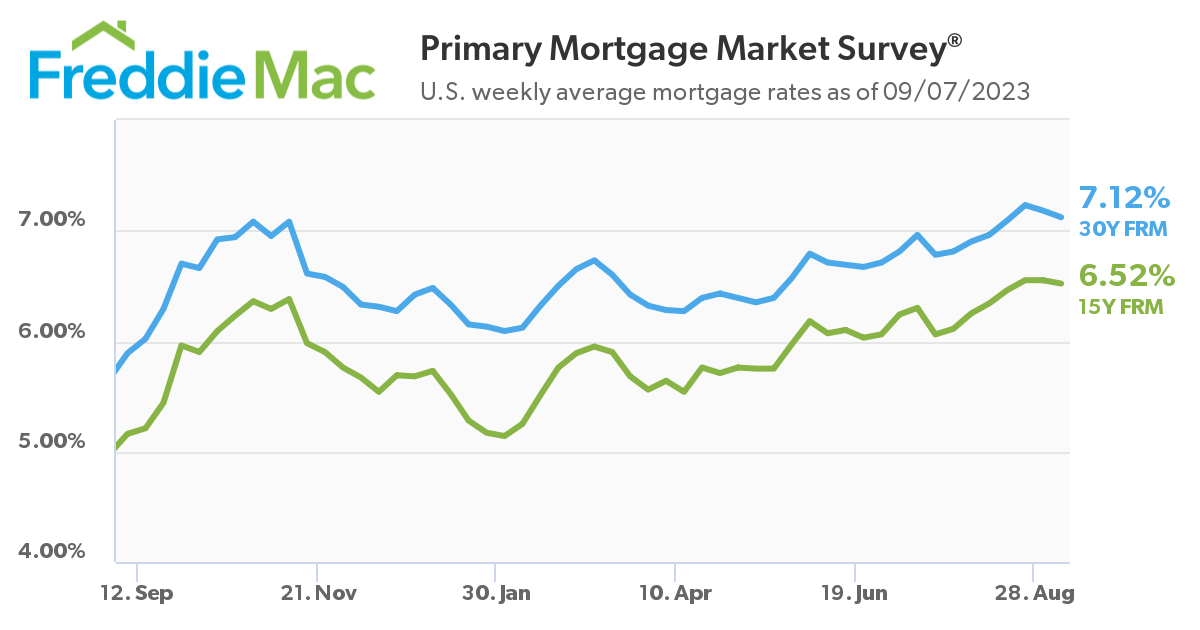

The 30-year fixed-rate mortgage stuck at above 7%

The breakneck surge in mortgage rates eased for the second straight week, but rates remained significantly higher than they've been in decades, Freddie Mac reported Thursday.

The 30-year fixed-rate mortgage fell six basis points from last week to 7.12% as of Sept. 7, according to data from Freddie Mac's latest Primary Mortgage Market Survey. The 15-year loan averaged 6.52%, down just three basis points from a week ago.

"For the fourth consecutive week, the 30-year fixed-rate mortgage hovered above 7%," said Sam Khater, chief economist for Freddie Mac. "The economy remains buoyant, which is encouraging for consumers. Though inflation has decelerated, firmer economic data have put upward pressure on mortgage rates, which are straining potential homebuyers in the face of affordability challenges."

Fed chair Jerome Powell said they will continue raising rates as long as necessary to push inflation down to its 2% target.

"Although inflation has moved down from its peak — a welcome development — it remains too high," Powell said in a speech. "We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective."

Stay updated with the freshest mortgage news.s Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.