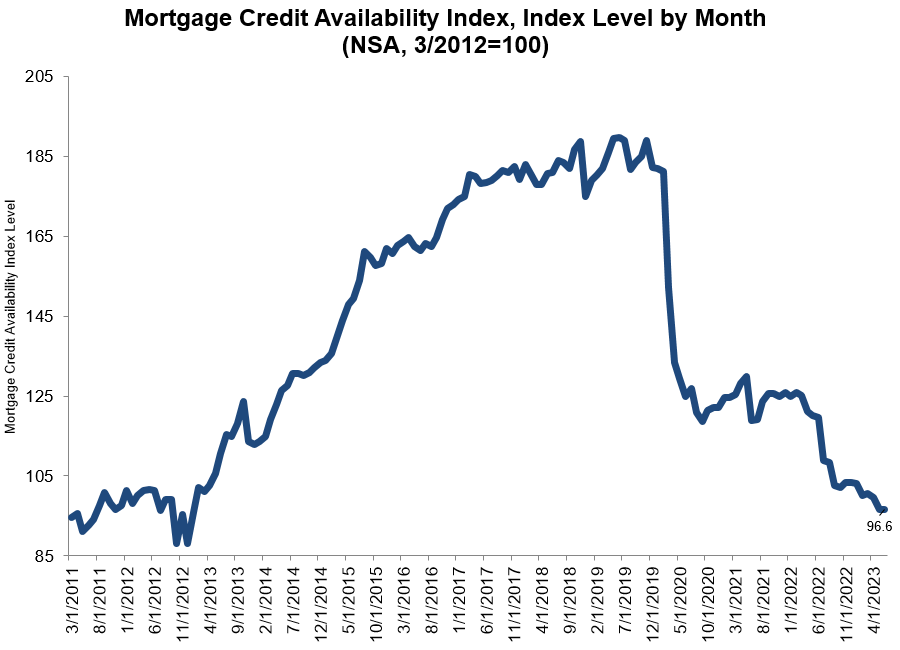

Credit supply still hovers near 10-year low

Mortgage lending standards remained tight in June, with credit supply staying close to the lowest level in a decade, according to the Mortgage Bankers Association's Mortgage Credit Availability Index (MCAI) report.

The index, which measures mortgage credit availability, was essentially unmoved at 96.6 in June – only up by one basis point from the previous month. MBA deputy chief economist Joel Kan explained that the June reading signals tighter lending standards as the industry continues to operate at reduced capacity.

"Lenders are streamlining their operations by offering fewer loan programs, with some exiting certain channels," Kan said in a news release. "Data from our weekly applications survey indicated that June mortgage applications were more than 30% lower than a year ago and at the slowest pace since December 2022."

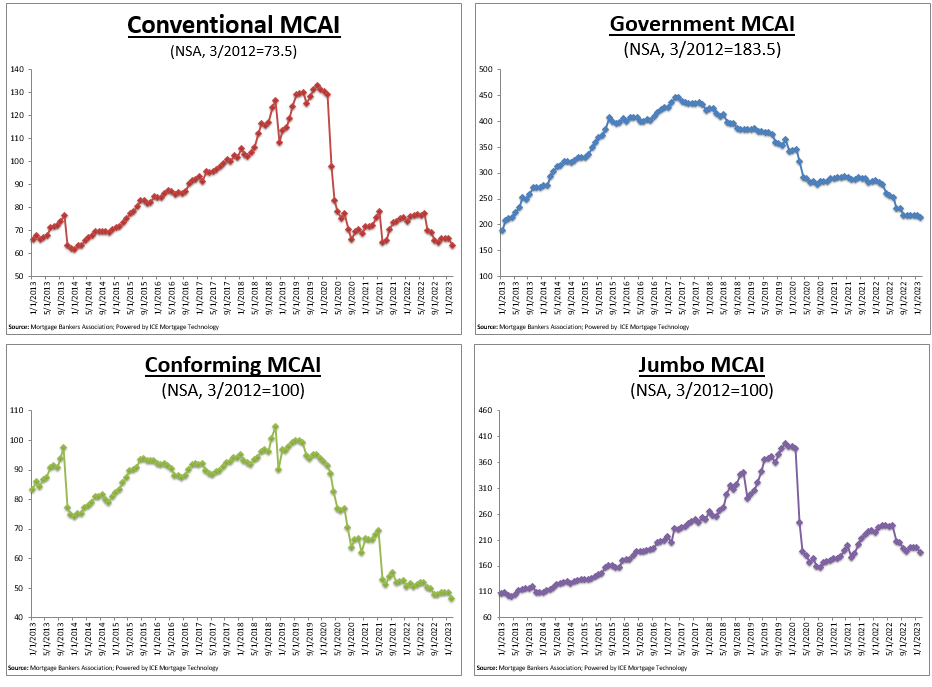

Both the Conventional and Government MCAIs were unchanged. Of the component indices of the Conventional index, the Jumbo MCAI inched down by 0.2%, and the Conforming MCAI rose by 0.2%.

"The Jumbo Index declined slightly by 0.2% – the second straight monthly decrease – as liquidity conditions have been tightening for jumbo lending," Kan said.

According to mortgage applications data from MBA, the average contract interest rate for jumbo loans jumped to a new record high of 7.04% as of July 7.

Want to keep up with the latest mortgage news? Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.