CoreLogic’s HPI shows acceleration in May with June expected to follow

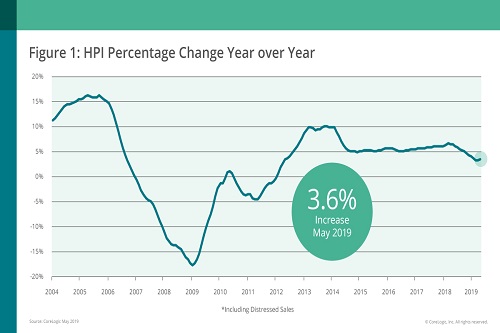

There has been a 14 month trend of slowing growth for US house prices on a year-over-year basis; but that changed in May.

The latest CoreLogic Home Price Index gained 3.6% year-over-year in May and a month-over-month increase of 0.9%. And the firm’s HPI Forecast suggests growth in price rises will continue.

“Interest rates on fixed-rate mortgages fell by nearly one percentage point between November 2018 and this May,” said Dr. Frank Nothaft, chief economist at CoreLogic. “This has been a shot-in-the-arm for home sales. Sales gained momentum in May and annual home-price growth accelerated for the first time since March 2018.”

Although the month-over-month rise for June is expected to be 0.8%, slightly down from the previous month, it will mark a new all-time high for single-family home prices.

And over the year to May 2018, CoreLogic is forecasting a 5.6% gain for home prices.

However, Dr Northaft says there are good and bad points about the recent and forecast acceleration of home price growth and says the supply issues must be addressed.

“Higher prices and a lack of affordable homes are two of the most challenging issues in housing today, and every buyer, seller and industry participant is being impacted,” he said. “The long-term solution lies in expanding supply, which will require aggressive and effective collaboration between policy makers, state and local government entities and home builders.”

Largest metro markets

According to the CoreLogic Market Condition Indicators (MCI), an analysis of housing values in the country’s 100 largest metropolitan areas based on housing stock, 38% of metropolitan areas have an overvalued housing market as of May 2019. As of May 2019, 24% of the top 100 metropolitan areas were undervalued, and 38% were at value.

For the top 50 markets, 42% were overvalued, 16% were undervalued and 42% were at value.