Coworking is still a small segment of the commercial market, but understanding the growth of coworking spaces can open the door to development potential

Fundamental changes in commercial real estate have shifted focus towards the coworking office space market.

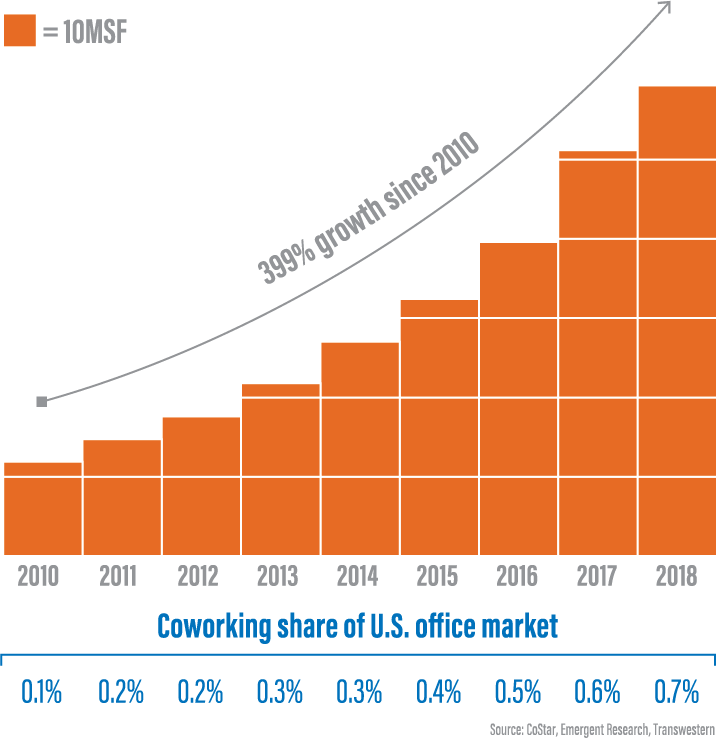

While the growth in this market may be slowing slightly, Emergent Research shows a 399% increase in providers of shared workspace from 2010 to year-end 2018. Based on recent data, George Vogelei, executive vice president of Transwestern, predicts that this sector could occupy another 22.2 million square feet by 2022 and expand its memberships by 1.1 million users - a 99% increase.

“New brands account for about 65% of the new coworking spaces that open each year,” said Vogelei. “Providers and landlords are using a variety of business structures to bring those spaces to the market, giving property owners more options to incorporate coworking into their buildings.”

With its significant growth, there are a large number of providers and operating models in the coworking niche market. As of mid-year 2019, coworking providers occupy less than 1% of the U.S. office market but the growth and popularity of this market have had a significant influence on the potential and opportunity the workplace can offer.

“Office users today expect their leased space to offer features that initially made coworking unique, including flexible terms, compelling amenities, and a variety of settings within the workplace,” said Vogelei. “Ranging in size from sole proprietorships to global enterprises, firms increasingly include coworking options in their real estate searches and are raising the pressure on landlords to offer some of the product type in their portfolios.”

Coworking caters to many niche markets and business as it can cater to workers by industry, aesthetic tastes, gender, and other characteristics. Usually, Vogelei said, specialization is a function of local demand. While some coworking spaces such as coveHQ cater to companies seeking to develop their identity, other industry-specific shared spaces include: Eastern Foundry, which serves government businesses and start-ups; InDo Nashville, which serves the music industry; Clinicube, where medical professionals have access to medical offices space with shared services including reception and billing; or Tradecraft Industries, where construction contractors and firms are provided conference and classroom spaces along with coworking spaces.

There are several hundred coworking providers across the U.S., but only 20 had 10 or more locations at year-end 2017, according to Transwestern. WeWork is by far the largest provider of coworking space, comprising more than half of the top 10’s market share. These major chains offer convenient access to multiple locations, which is an especially attractive attribute for traveling professionals.

The coworking industry is ripe for consolidation, Transwestern notes.

“Landlords may consider size and number of locations as a partial indicator of a coworking providrs credit quality as a tenant,” said Vogelei. “As some markets approach a saturation point, providers themselves are growing more sensitive to the risk of oversupply and are adjusting their exposure through evolving structures that extend beyond standard leases.”

With this type of shift in the office space development market, the landlord’s role evolves.

Transwestern found that only about 17% of coworking providers own their locations which, until recently, meant that they signed long-term leases and sublet their space to individual members or to corporate clients on flexible terms. Providers are now more interested in sharing subleasing risks with landlords. Joint ventures where the landlord assumes some risk by charging the operator below-market rent in exchange for a cut of the coworking profits.

“Providers themselves are growing more sensitive to the risk of oversupply and are adjusting their exposure through evolving structures that extend beyond standard leases,” said Vogelei.

A popular alternative is a 10-year lease where the provider partners with the landlord under a management contract to establish and run a coworking space. “The parties share set up costs, risks and profits,” said Vogelei. “This helps growing providers stretch their capital to more locations while mitigating some of the risk for each party.”

Recent trends in the coworking market include catering and other hospitality features from their own locations as a third-party, amenities-management service to landlords. As a landlord, you can tap into the trend and popularity of coworking spaces. Using portions of your building to offer “the flexibility that is now part of mainstream demand, with large common areas, shared meeting space, and high-density capacity” with “amenities designed to help users recruit and retain labor, can enable landlords to compete directly with coworking providers,” Vogelei said.

The fastest way to start offering coworking spaces is to weigh the benefit of profit sharing with an established operator. This will “allow both parties to remain focused on their own core competencies, increasing the owners profit potential while mitigating tenant-default risk,” said Vogelei.