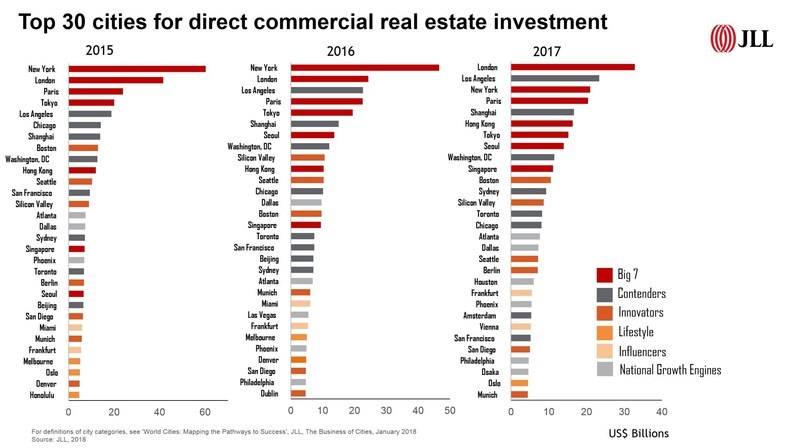

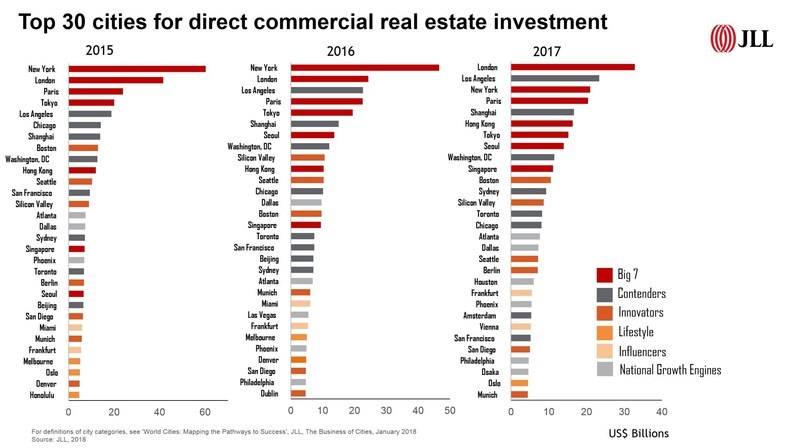

The effects of Brexit seem not to have weakened interest in commercial real estate in the UK with London topping the league tables for investment

The effects of Brexit seem not to have weakened interest in commercial real estate in the UK with London topping the league tables for investment.

The rankings from global real estate firm JLL shows that investment in London’s CRE market was up 35% in 2017 compared to 2016, to U$33 billion, knocking New York into third place from the top spot last year.

Los Angeles saw a rise though into second place with $23 billion invested, up from its third-place ranking in 2016.

Overall investment in commercial real estate globally beat 2016 with a total of $700 billion last year.

The growth is not forecast to last though with JLL predicting a 5-10% fall in overall CRE investment in 2018 as the challenges of finding available assets to purchase, combined with continuing investor discipline, are likely to constrain growth in volumes.

The Big 7 dominate

This year, as last, the CRE investment market will be dominated by 7 cities: London, New York, Tokyo, Paris, Singapore, Hong Kong and Seoul.

But the power shift from New York to London, and the rise of contenders including Los Angeles, Sydney and Shanghai, should keep things interesting.

The rankings from global real estate firm JLL shows that investment in London’s CRE market was up 35% in 2017 compared to 2016, to U$33 billion, knocking New York into third place from the top spot last year.

Los Angeles saw a rise though into second place with $23 billion invested, up from its third-place ranking in 2016.

Overall investment in commercial real estate globally beat 2016 with a total of $700 billion last year.

The growth is not forecast to last though with JLL predicting a 5-10% fall in overall CRE investment in 2018 as the challenges of finding available assets to purchase, combined with continuing investor discipline, are likely to constrain growth in volumes.

The Big 7 dominate

This year, as last, the CRE investment market will be dominated by 7 cities: London, New York, Tokyo, Paris, Singapore, Hong Kong and Seoul.

But the power shift from New York to London, and the rise of contenders including Los Angeles, Sydney and Shanghai, should keep things interesting.