Top areas for single-family rental returns

The niche market of single-family rentals offers lucrative opportunities for investors. In order to get the most out of your investment, it’s key to know which markets you’ll be successful in and which ones you should avoid.

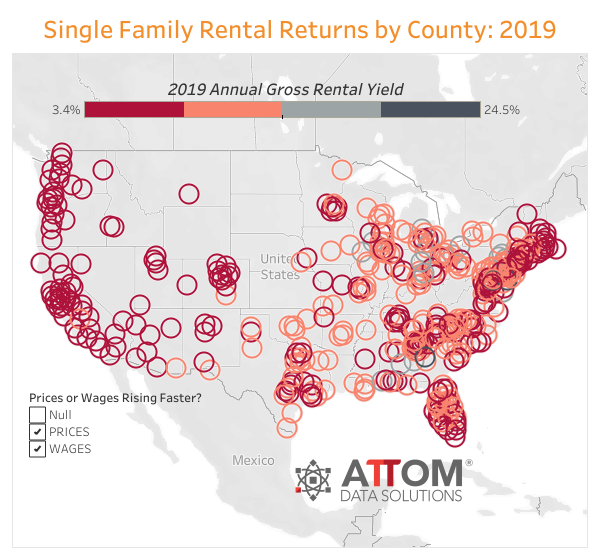

By analyzing 432 markets, a recent blog post by Sharestates uses ATTOM Data Solutions’ analysis tools to rank nationwide single-family rental markets for 2019. A particularly important finding concluded that the average annual gross rental yield is 8.8%, increasing an encouraging one-tenth of a percent since last year. In over half the counties analyzed, rental returns have increased.

Rent increases that outpace wage increases could indicate areas that Sharestates recommends staying away from; rising rents cause an increase in the desire for the transition to homeownership. If wages increase, renters might seek home ownership options as well.

Western Mid-Atlantic and eastern Midwest regions are seeing success with single-family rentals – possibly due to higher property values and lower wages, which can decrease access to lower income earners. Western states have seen the lowest single-family gross rental returns, specifically in the state of California.

Highest single-family rental returns in 2019:

- Bibb County, Ga.: 9%

- Baltimore City, Md.: 5%

- Cumberland, N.J.: 2%

- Winnebago, Ill.: 1%

- Wayne County, Mich.: 1%

With 1 million residents and similar demographics to Wayne County, Mich., the following counties saw modest gains in returns over last year:

- Cuyahoga County, Ohio: 12% annual gross rental yields

- Allegheny County, Pa.: 10.9%

- Cook County, Ill.: 9.7%

- Philadelphia County, Pa.: 9.4%

Lowest single-family rental returns in 2019:

- San Francisco, Calif.: 7%

- San Mateo County, Calif.: 4%

- Kings County, N.Y.: 3%

- Santa Clara, Calif.: 2%

- Marin County, Calif.: 0%

With 1 million residents and similar demographics to Santa Clara County in California, the following counties show similar low potential for annual gross rental yields:

- Orange County, Calif.: 5% potential

- Alameda County, Calif.: 4.9%

- Queens County, N.Y.: 4.8%

- Fairfax County, Va. (where Washington, D.C. is located): 4.7%

Credit: ATTOM Data Solutions