Not quite yet, says government – in fact, faster growth

Earlier this week, global ratings agency Standard & Poors sent ripples through the property market when it released its report that claimed that some housing markets were overvalued by up to 50 %.

Fast forward a few days, and the UK Government’s official forecaster, the Office for Budget Responsibility has said, in effect, keep calm, and carry on.

And the carrying on, in this case, could be the housing boom.

The OBR has just released figures that predict a 7.4% UK house price increase this year – more than double the 3.2% it expected in its October report.

If true, its ‘average’ house that was valued at £275,000 in the last month of 2021 will be worth a whisker under £300,000 by the end of this year.

That, however, was one of the only pieces of good news in the report – other predictions include:

- Real disposable incomes will slip by 2.2% during the year

- The Bank rate will hit nearly 2% by the end of 2023

- Home values will grow by a paltry 1% in 2023 before accelerating slightly to 1.5% in 2024 and 2% in 2025.

How fast has property growth been?

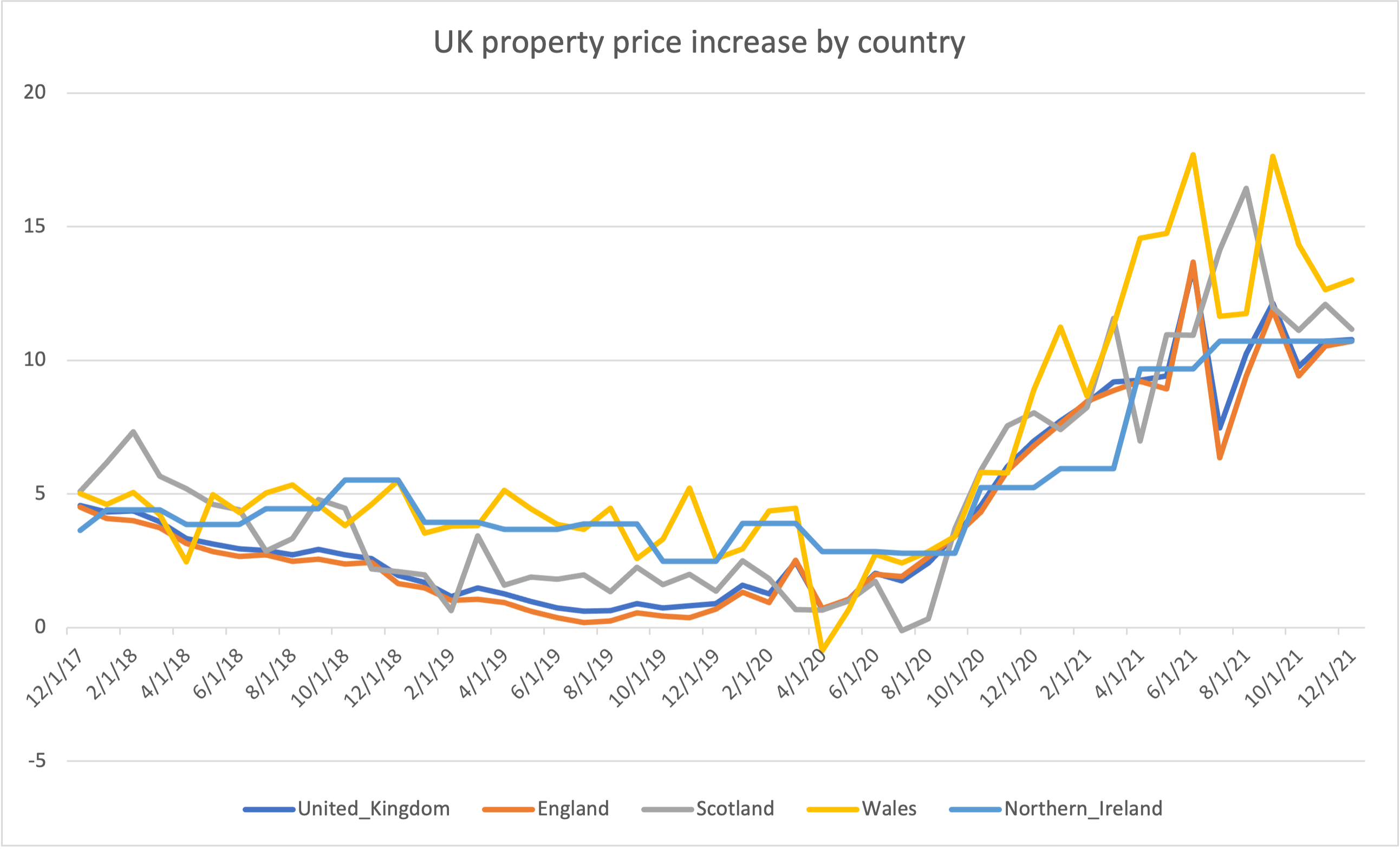

According to Government figures, Wales has been the star performer over recent months, with England trailing below the national average.

And how long can the party continue? It’s uncertain but with the headwinds of high inflation, external uncertainties like Ukraine, and looming interest rate rises, there are plenty of pressures to cool down the heat in the market.