Planning to buy a house? Read on to discover the most expensive postcodes in the UK

Updated: 23 April 2024

If you want to reside in a place where history meets luxury, the most expensive postcodes in the UK provide nothing short of that. It has some of the most wonderful cities where dream homes are waiting to be purchased. From modern, urbanised regions to historic boroughs, the country has a wide array of choices for every aspiring homeowner.

Apart from choosing the best location, prospective buyers must also be updated about the average prices of the properties that they go for. One of the first things that you must know when looking for the ideal living space is the postcodes of the area.

What are the most expensive postcodes in the UK?

London’s W1J in Mayfair, Piccadilly tops the list of the most expensive postcodes in the UK. Properties in the area had an average selling price of £7.9m in 2023. It is followed by W1K in Grosvenor Square being sold at an average of £7.57m, and W1B in Regent Street at £7.23m.

All three are in the City of Westminster, and the borough is crowned as the priciest one in the capital.

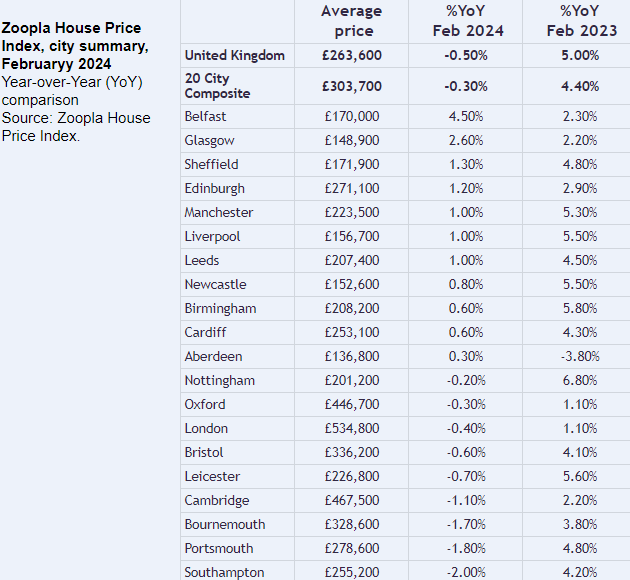

It should not come as a surprise that London is the most expensive place to live in the UK. Properties are sold at an average of £534,800 according to the February 2024 House Price Index by Zoopla.

20 City Composite in the United Kingdom – Zoopla House Price Index, city summary for February 2024

Top 10 most expensive cities in the UK aside from London

Following London as one of UK’s most expensive cities is Cambridge, best known as the home of one of the world’s most prestigious universities. The city also boasts a vibrant cultural scene and advanced tech sector, which drives demand and pushes property values higher.

Here’s the rest of the most expensive cities aside from London:

|

City |

Average selling price |

|

Cambridge |

£467,500 |

|

Oxford |

£446,700 |

|

Bristol |

£336,200 |

|

Bournemouth |

£328,600 |

|

Portsmouth |

£278,600 |

|

Edinburgh |

£271,100 |

|

Southampton |

£255,200 |

|

Cardiff |

£253,100 |

|

Leicester |

£226,800 |

|

Manchester |

£223,500 |

Luxurious postcodes outside of London

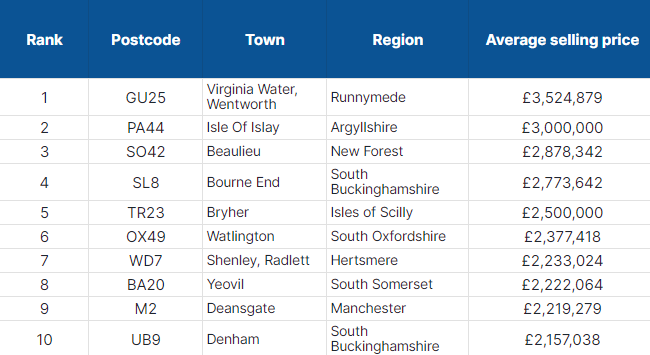

Outside the capital, there are still a great deal of postcodes that will suit the expensive tastes of soon-to-be property owners. The Sellers Report 2024 of real estate agent comparison website, GetAgent, listed UK’s costliest postcodes in and out of London:

Top 10 Most Expensive Postcodes in the UK - GetAgent Sellers Report 2024

1. GU25 Virginia Water, Wentworth, Runnymede

This postcode has also been named as the most expensive one in GetAgent’s 2022 report. With over £3.5m as its average selling price, the area may also be the best choice for real estate buyers as it boasts a territory covered with woodland and enclosed by the Surrey Hills. Being a commuter village, travel to and from London is also easy.

2. PA44 Isle of Islay, Argyllshire

Placing second is PA44 with an average selling price of £3m. The Isle of Islay (or simply Islay), also widely known as 'The Queen of the Hebrides', is the southernmost island of the Inner Hebrides of Scotland. It’s around 40 kilometres north of the Northern Irish coast and lies in Argyll southwest of Jura.

This location offers breathtaking views with its rugged coastline as well as plentiful wildlife. Islay also has access to a supply of high-quality water, an important component in making whisky. Islay is known for its 8 distilleries that produce single malt whiskies.

3. SO42 Beaulieu, New Forest

The average selling price of properties in SO42 Beaulieu, New Forest is around £2.8m. In the past, the village of Beaulieu was given the name of ‘Bellus Locus Regis’ by King John. It means 'the beautiful place of the King.' True to its roots, Beaulieu remained timelessly picturesque as it was awarded the fifth most beautiful village in the UK and Ireland by Condé Nast Traveler.

A brick house and trees reflected on a lake in Beaulieu, New Forest

4. SL8 Bourne End, South Buckinghamshire

Placing fourth on the list is SL8 Bourne End, South Buckinghamshire, with an average selling price of £2.7m. It’s about 8 kilometres southeast of High Wycombe and 3 kilometres east of Marlow. Bourne End is the ideal residence for a lot of commuters – the village has a railroad station on the Maidenhead to Marlow Branch Line. This means easy access to and from the capital.

5. TR23 Bryher, Isles of Scilly

This postcode can be found on one of the smallest inhabited islands of the Isles of Scilly. With an average selling price of £2.5m, Bryher is a popular destination for house-hunters and tourists alike due to its historical landmarks and its rich plant and animal wildlife. In addition, the island is famed for being featured in several films and television programs.

The other postcodes that made it to the Top 10 are:

- OX49 Watlington, South Oxfordshire

- WD7 Shenley, Radlett, Hertsmere

- BA20 Yeovil, South Somerset

- M2 Deansgate, Manchester

- UB9 Denham, South Buckinghamshire

The most desirable postcode in the UK

With several postcodes named above and many others to choose from, real estate buyers may be in a state of confusion as to where the best postcode is in the UK. You may have already read a ton of articles and reports stating that this area or that location is the most desirable; and yet, the answer lies not in any of those you’ve seen (we won’t even be providing an exact postcode, sorry).

The home of your dreams can only be defined by one person and that is you. There’s no need to worry, however, as we’ll provide some very useful advice on choosing where your ideal house should be. Read on to find out.

1. North or South: Where to?

When searching for a house or property, location is king. This is the defining point as it will help you think about other factors such as your budget, how far your chosen postcode is from your work, school, or business, the area’s design and landscaping, etc.

Aside from being aware of the average selling prices of the properties and where they are situated, knowing which cities and boroughs have the highest living expenses is also beneficial. This is true not only when choosing a home or buying a property but also when selecting a place to rent. The cost of living for the cities in the north and those in the south has a vast difference. Understanding this will help you decide on the most suitable postcode for your dream home.

2. Set the terms: Long or short

Having a long-term plan is often better when choosing to buy property. This ensures stability and peace of mind.

You might want to ask yourself if the house that you’re about to purchase is going to be the place where you will grow as a person or even retire. If you have a spouse or a partner, planning to adopt or have children might be something to think about. Co-living with relatives and family may also come into play. Living solo is another factor to consider.

Short-term planning may be another course of action especially for first-time buyers. This can also be the case if you choose to be a property renter.

3. Compromise is key

Some factors are much more important than others. There could be some adjustments that you might have to make. Your ultimate dwelling place does not necessarily have to be without flaws. Let’s face it: there is no perfect location or perfect property. It is all about sticking to what you want and making small compromises for trivial matters.

4. Financing

The next step will be dealing with finances. This is arguably the most stressful part of your journey as an aspiring homeowner. Set your budget early on; this should make it easier to weed out the postcodes that are beyond your price range.

Most house-hunters will choose bank financing when buying a property. Keep an eye on mortgage rates from the UK's top 10 providers in our interest rates database. This is updated weekly, so you know that you’re getting accurate figures.

5. Get a real estate agent

Lastly, it is advisable to get a real estate agent. Without a doubt, their expertise and knowledge will be beneficial in your journey as a future property owner.

Benefits of having a real estate agent:

- They can narrow down the list of postcodes for you. Through years of experience, these professionals have gained in-depth knowledge of the local real estate market: something you can rely on.

- They can negotiate and transact on your behalf. Real estate agents act as intermediaries between homebuyers and sellers. Plus, their primary objective is to advocate for your interests. This makes compromise an option and not the goal.

- They can help protect you from potential legal and financial issues. Real estate agents are more adept in handling the contracts, documents, and every paperwork involved.

- Most, if not all, real estate agents have a wide network of partners in the industry. In turn, this advantage can assist in making the transactions faster, smoother, and more efficient.

If you’re looking for a property agent, visit our Best in Mortgage section. It features the best brokers, mortgage leaders, and mortgage companies across the UK, the US, Australia, Canada, and New Zealand. They’re top-notch mortgage professionals who can help with property searches - whether it's for the most expensive postcodes in the UK or something friendlier on the pocket.

Do you think that the most expensive postcodes set the standard for property buyers in the UK? Let us know in the comments.