Yes, condo investment in Toronto is a good idea. Just make sure you do your research first

Updated January 15, 2024

Condo prices in the Greater Toronto Area are continuing to rise.

That is a part of what makes condo investment in Toronto such a good idea, especially now. But before you dive in, there are some things you should know first.

In this article, we will look at why condo investment in Toronto is a good idea. We will also look at the best time to buy a condo in Toronto and offer tips on how to climb onto the property ladder.

Here is everything you need to know about condo investment in Toronto.

Are condos still a good investment in Toronto?

Short answer: yes. Condos are still a good investment in Toronto. In fact, the condo market is where the biggest gains are when it comes to the Toronto real estate investment.

Since 2017, the average price of a condo in Toronto has gone up 32% or 6% per year. That means that if you bought a condo in 2017 for $550,000, for example, you would have made more than $180,000 ($36,000/year) just by living there.

Equity gains in Toronto’s condo market

The high equity gains when buying a condo in Toronto are one of the key reasons it is among the top spots in Canada to invest in real estate. And if you add a robust condo investment strategy on top of that, you will likely make better returns faster.

Why are Toronto condo investments a good idea?

Toronto has an international profile that is catching up to major US cities like New York City and San Fransisco. The difference is that Toronto’s property values remain well below those markets.

If you live in Toronto, you may think the condo prices or real estate listings are absurdly high. However, they still have a way to go to compete with other major North American markets.

Now is the ideal time to invest in Toronto condo property. With rental demand stable, investors can expect steady returns for years to come. Condo investment in Toronto is also an excellent way to diversify your portfolio and create a steady income stream that will help you build wealth in the future.

Let’s look at an example to illustrate why investing in a condo in Toronto now is an especially good idea.

Let’s say you and a friend both have $100,000 to invest. Your friend decides to invest in a $500,000 condo while you decide to wait for a year, hoping the Toronto condo market will drop. Instead, the condo market continues to rise, say 10%. This earns your friend $50,000 while your $100,000 is now only worth $90,000.

Think of it this way: by this time next year, either condo prices will be higher than they are right now, or interest rates will be higher.

How much do condos appreciate per year in Toronto?

Every year sees another increase in condo prices in Toronto. Historically, the average condo appreciation rate has been between 4% and 5% each year. Significant gains have been made by buyers who have tapped into that potential.

If you analyze the data, you will see that certain neighbourhoods record better performances than others. To play it safe, it is a good idea to invest in a condo in a neighbourhood that people want to live in and has room for the value of the condo to grow. Areas that are not likely to perform well are neighbourhoods without TTC services, shopping districts, schools, businesses, cafes, and restaurants. Remember: a condo in a desirable neighbourhood is likely to appreciate more per year.

Are condo prices dropping in Toronto?

Yes, condo prices are dropping in Toronto, according to an October 2023 report released by the Toronto Regional Real Estate Board (TRREB). These comparatively lower prices mean that now may be a good time to purchase a condo in the Greater Toronto Area.

The report found that while condo sales had increased year-over-year, the rise was “far outstripped” by an increase in the number of units listed. In Q3 of 2023, 4,415 condo sales were processed, according to the TRREB data. That number represents an increase of 6.2% compared to Q3 in 2022.

During that same period, new condo listings increased 28.8%, the TRREB said. The increase in supply translates to lower prices. That is welcome news for buyers who want to break into the market, said the TRREB.

The average selling price for a condo in the GTA in Q3 of 2022 was $720,628. In Q3 of 2023, on the other hand, the average price for a condo was $716,145. In Toronto proper, the average condo price was $736,566. That figure is down from $750,087 the year prior.

“The condominium apartment market is an important entry point into home ownership for first-time buyers,” TRREB President Paul Baron said in October. “A better-supplied market has led to more choice for these buyers, resulting in more negotiation power and lower selling prices on average.”

When to buy a condo in Toronto?

The time to buy a condo in Toronto is in the winter. The peak seasons for real estate listings are spring and fall. These are times when most sellers wait to list their property to take advantage of the price increase that typically comes with it.

This essentially means that you have more choice as a buyer. However, you should also know that there are likely to be more buyers competing, which gives sellers the advantage. This is why the best time of year to purchase a condo will likely be in the winter, i.e., when there is less competition.

But the time of year should not be your only consideration. There are other factors you should think about when buying a condo in Toronto.

Condo investment in Toronto: key considerations

In this section, let’s look at six expert tips to help you purchase a condo in Toronto in 2024.

- Ensure your finances are in order

- Buy a condo sooner than later

- Build a good team

- Research Toronto neighbourhoods

- Study the condo developer

Now, let’s break down each of these tips to ensure your condo investment in Toronto runs smoothly.

1. Ensure your finances are in order

The first step is to ensure your finances are in order. This will help you better understand what you can afford.

Consider, as well, that continuing price growth paired with rising interest rates mean carrying costs will be higher than they were just a few months ago. This means that even if you have only been shopping for a short while, you will likely need to recalculate your budget.

If you are in the early stages of buying a condo, you can get the proper paperwork and your downpayment together. You can start by getting pre-approved by a lender. This will show you how much mortgage you can pay back each month, as well as what your interest rate will be. At this stage, the lender will ask for the following:

- an employment letter stating your status, employment start date, position, and salary

- your credit check

- a T4 from the previous tax year verifying your income

- a notice of assessment confirming your income taxes were paid

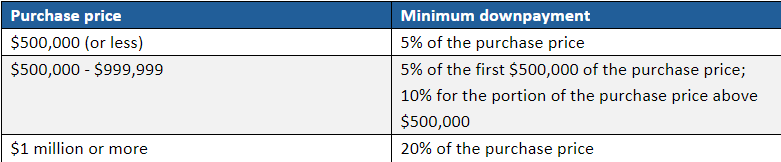

After you get pre-approval, you can get your downpayment together. Use this chart as a guideline:

2. Buy a condo sooner than later

Timing is one of the biggest things to remember when buying a condo in Toronto. The sooner you can buy, the further you can make your money go. In other words, the money you have now is worth more than it will be in the future. Toronto’s real estate market is experiencing incredible price growth.

It may be better to buy now rather than wait around for the right deal. Prices will continue to climb. Get into the Toronto condo market sooner than later so you can capitalize on equity gains properties.

3. Build a good team

Build a team of real estate professionals to help you through your condo-buying process. Real estate agents can access data that is not otherwise publicly available. By working with one of them, you too can leverage that data, helping you make the most informed decision possible.

In Toronto’s real estate market, never underestimate the power of a good real estate agent.

4. Research Toronto neighbourhoods

Location is among the most important factors you must consider when buying a condo in Toronto. Condo prices differ depending on which neighbourhood you look at, whether it be Chinatown, Little Italy, Greektown, or Little India.

This is, again, why you want to work with a good real estate agent. They will help you understand the social and economic outlook of each neighbourhood. The data they have access to will also help you discern good deals from over-priced units.

To help you in your research, visit each neighbourhood you are interested in buying in.

5. Study the condo developer

Research is a key component to buying a condo in Toronto. Not only should you have your finances in order and research the neighbourhood, but you should also study the condo developer.

You can start by looking at whether the condo has a high turnover rate. If it does, you can find out why. This goes for maintenance issues as well. If there are maintenance issues, again, find out why. Your real estate agent will likely be your best source of information on this.

After all, you do not want to buy a costly condo that is vacant due to poor management.

Condo investment in Toronto: research is key

When shopping for a condo in Toronto, you will want to research the condo market (and outlook), get your finances in order, and determine what you can afford. This will also help you decide which neighbourhood(s) to look in and what the future may look like.

Now is a good time for condo investment in Toronto. Doing your due diligence will help you climb onto the property ladder in one of Canada’s toughest real estate markets.

If you want help navigating your condo investment in Toronto, take the time to look at the mortgage professionals we highlight in our Best of Mortgage section. Here you will find the top performing mortgage professionals, including mortgage brokers, across Canada.

Did you find this information on condo investment in Toronto useful? Does it impact how you will shop for condos? Are there any other factors you would consider? Let us know in the comment section below.