Even with the changes to the way Australians work, and reduced retail confidence, the commercial property market fared better than many expected in 2020

The performance of the commercial property market in the past year has been “somewhat of a surprise”, according to lenders in this sector, who were expecting a difficult year thanks to COVID-19. While the market did soften, it was nowhere near as much of a fall as many expected.

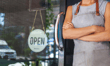

In July 2020, the value of new loans for the purchase of commercial property dropped by 25% from the previous year. But by the end of last year the value was the highest it had been since June 2019, and 2021 has started with strong figures too.

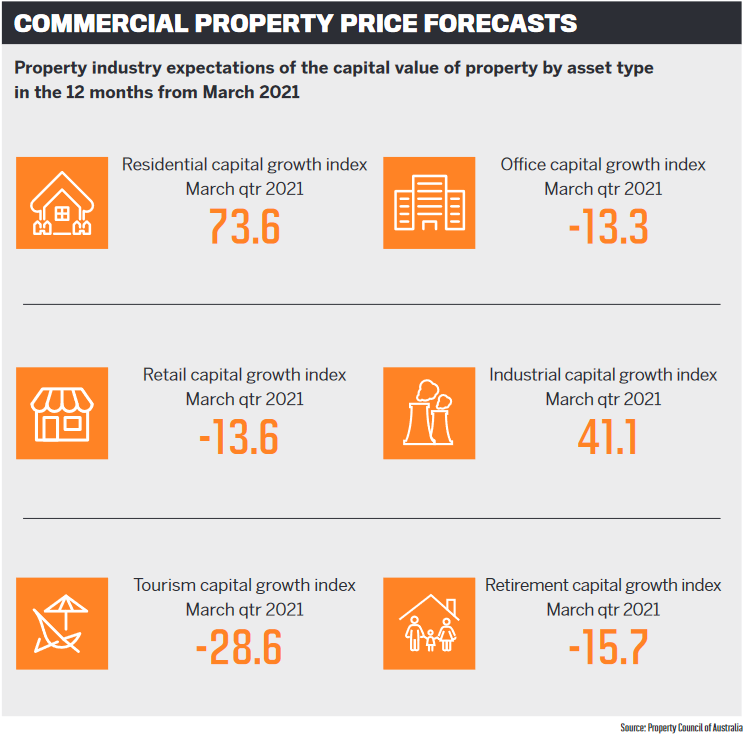

Different industries have been affected in different ways, of course. La Trobe Financial’s chief lending officer, Cory Bannister, explains that the sector hardest hit was discretionary retail, particularly hospitality and tourism-related businesses. On the other hand, demand for logistics and industrial property surged globally on the back of strong demand from investors.

Even in the office market, Bannister says landlords have reported stronger-than-expected results.

“Like many businesses, commercial office landlords have had to adjust their business models, shifting from large-scale tenants on long-term leases to providing flexible space to encourage more tenants to sign shorter contracts,” he says.

“This shift is seeing many operators who were once unable to take a city lease take advantage of the opportunity to adopt a CBD address.”

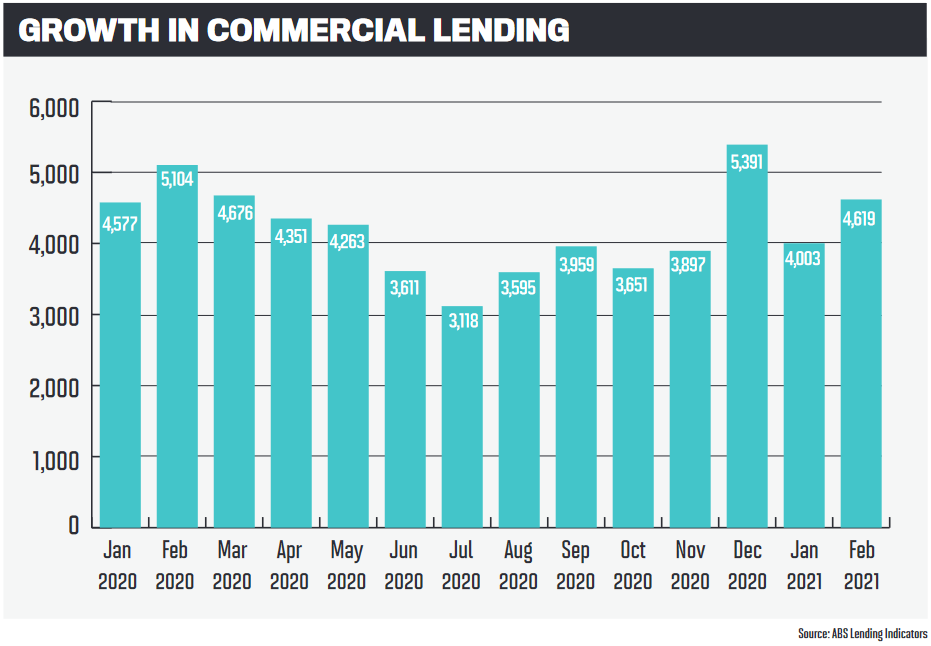

It will not come as a surprise to learn, though, that office occupancies across Australia are at an all-time low. Before the pandemic, the average level of occupancy in all capital cities was around 90%, according to the Property Council of Australia. The occupancy rates of Sydney CBD offices dropped to a low of around 30% in August 2020, and in Melbourne it was down to a low of 7% in October.

At the same time, vacancy rates have edged higher as demand for office space declines and new office space continues to come on to the market.

Thinktank’s general manager – partner-ships and distribution, Peter Vala, predicts the sector will see a higher level of persisting vacancies than pre-COVID.

“Retail premises are still holding up well in moderate-to-good locations; however, higher vacancies and slower sales turnover will persist for some time in the weaker areas and more specialised property,” he says.

“It’s clear the inner city is still suffering to some extent from remote working, with consistently fewer people in the CBD, as opposed to well-located strata offices in suburban areas which are performing along the same lines as retail.”

Opportunities for business owners and brokers

Despite the resilience of the commercial property market in 2020, Liberty is cautious about being too optimistic about the future. Group sales manager John Mohnacheff says it is clear things will not “bounce back to a pre-COVID world”. Particularly as snap lockdowns continue across the country to combat any virus outbreaks, he says businesses need to remain cautious and ensure they have contingency plans in place.

This doesn’t mean that market conditions will be more or less favourable, but things will be different, with many new opportunities for smart business owners to make their mark.

“Already, we have seen a strong shift in consumer behavioural patterns, with more Australians turning to online shopping than ever before,” he explains.

“While this has led to some businesses choosing to reduce the number of physical shopfronts, it has simultaneously increased the demand for warehouse space and ship-ping facilities.

“While this has led to some businesses choosing to reduce the number of physical shopfronts, it has simultaneously increased the demand for warehouse space and ship-ping facilities.

“Our way of work has evolved faster than we could have anticipated, and we are still very much in a state of flux. While some employers seek larger spaces to better accommodate social distancing requirements, others have decided to downsize to help reduce costs.”

As businesses recover from the direct impacts of COVID-19, lenders are seeing them “taking advantage” of low interest rates to purchase commercial property.

Malcolm Withers, head of commercial at Pepper Money, says this is one of the biggest trends the non-bank has seen.

With this demand for commercial property and positive outlook for retail growth, there are opportunities for mortgage brokers to step in. Withers says there is a gap in the market where “customers are begging to tell their story”.

“Diversification allows brokers to become that person who listens to their story and becomes their business relationship manager,” he says, adding that this leads to stronger ties and a longer-term relationship with the client.

“Commercial real estate is an easy product to integrate into the suite of current products offered, especially when you consider that everything you have requested from the client to do their home loan is all you will need in most cases to get them a commercial property loan if they need it.”

Brokers can provide businesses with alternative solutions

One of the areas where La Trobe Financial has traditionally seen an opportunity for brokers to help borrowers is in self-managed super fund lending. Bannister says many brokers will have self-employed customers who can take advantage of the benefits of purchasing their business premises via SMSF – and he sees no reason for this to change.

“Over the past 12 months we experienced steady demand for SMSF loans secured against commercial property, typically from SMEs looking to purchase the premises they operate their business from, in many cases reducing their monthly cash flow requirement as a result as they shifted from renters to property owners,” he says.

“For brokers looking to get into this space, we find accountants and financial planners are the best source of referrals. Not only can they establish a steady and sustainable supply of regular, quality clients, but brokers can also take comfort in knowing that the clients have been qualified, and deemed appropriate, to undertake borrowings under an SMSF structure.”

The non-bank is keeping the commercial process easy for new entrants by mirroring its residential loans. If a broker can write a residential loan, they can write a commercial loan, and with its team of senior commercial underwriters and national BDM support staff, La Trobe Financial is providing the necessary assistance and training.

“The forms, documents and lodgement methods are the same, with the only difference being the format of the valuation, which is typically longer for commercial property and uses different methodology to arrive at the valuation figure, so we really do make it easy for brokers to use us,” Bannister says.

Thinktank’s Vala also sees SMSF loans as an opportunity for brokers. He believes they are ideal for clients with longer-term wealth goals and ideal for brokers as the loan terms tend to be much longer. While SMSF lending is much more technical, when it comes to commercial loans for standard offices, industrial, retail, professional suites, child-care facilities or student accommodation, Vala says raising finance of up to $2m is very similar to arranging a home loan for a self-employed client.

“When it comes to larger and more complicated deals, however, we generally recommend that brokers who are new to commercial either defer or partner with an experienced broker as they can be very time-consuming and often not come to fruition,” he says.

Thinktank also supports and educates brokers in commercial lending, led by its relationship managers: from deal struc-turing and workshopping, to client visits, to assisting with the entire journey of the loan.

“With low rates, the affordability of owning or upgrading commercial property has never been more attractive for borrowers and more advantageous for brokers. For self-employed and SME clients, now is an excel-lent time for those renting to consider buying,” Vala says.

Many ways to grow a business

Despite recent growth to a record high in the number of mortgage brokers also writing commercial loans, Mohnacheff says commercial lending remains largely over-looked. Brokers hold the majority of the residential mortgage market share, and he warns that it is a highly competitive climate for those looking to scale up.

“One of the great things about this industry is the endless ways to grow your business and increase your customer base – and diversifying into commercial lending is an ideal place to start,” he says.

While Mohnacheff agrees that loans for commercial properties can be very similar to residential loans, he warns that there are a few differences.

“While many lenders will fund up to 90% of a residential property’s purchase price, most are more conservative when it comes to commercial property – and some may only agree to fund 60%,” he explains.

He adds that Liberty has a flexible approach to commercial loans, and with its range of options and competitive LVRs, it can offer tailored solutions.

“Although purchasing a commercial property will generally require a larger deposit, it’s worth keeping in mind that lease periods are typically much longer than for a residential property,” Mohnacheff says.

“This means that a commercial property like office space or a warehouse can potentially be a more stable long-term investment and can also require a lot less legwork for the owner.”

As shown by the figures in the MFAA’s 11th Industry Intelligence Service report, growing numbers of mortgage brokers are diversifying into commercial lending.

Pepper Money is seeing more mortgage brokers take up its commercial real estate offering, and Withers says one of the key reasons for this is the fact that its application process uses the same ApplyOnline functionality that brokers already use to lodge mortgage applications.

“Keeping the process as simple as possible was vital to us when designing this product, as it makes it even easier for brokers to work with credit and find the right solution for their customer,” he says.

The non-bank is actively helping brokers diversify into commercial by offering them regular training. Two thirds of the training focuses on helping the broker feel comfort-able by teaching them the tools they need to identify an opportunity and how to have a quality conversation with their customer.

The other third covers training on Pepper’s products and policies, assessing customers’ incomes and servicing. “Having access to Pepper’s commercial property loan products means mortgage brokers can potentially help more of their clients,” Withers adds.

“Whether it’s a client looking to buy a commercial property for owner-occupier or investment use, or a client wanting to consolidate debt and access cashout, then Pepper Money has options to offer them.”