The time and cost-saving benefits of technology - and the threat from cyber crime - cannot be ignored. MPA speaks to those at the cutting edge

.jpg)

The time and cost-saving benefits of technology - and the threat from cyber crime - cannot be ignored. MPA speaks to those at the cutting edge

Brokers can be forgiven for not prioritising technology. At present, smartphone apps cannot beat a human being explaining a client’s best options, despite the banks’ best efforts. And the promised gains in turnaround times still seem as fanciful to most brokers as John Maynard Keynes’ predicted 15-hour working week.

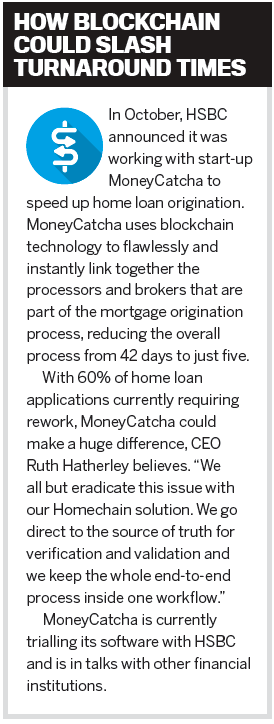

This year, however, investing in technology has taken on a higher priority. Not because of new inventions – for all the hype around blockchain and cryptocurrency they still have little relevance to brokers – but because of new regulations. The government, APRA and ASIC are demanding more detail on borrowers than ever before, stretching brokers’ resources. With an increasing amount of confidential documentation required and stored, the threat of cyber attacks looms.

This article brings together leading technology providers and aggregators, including Connective, CoreLogic, Finsure, MSA National and NextGen.Net, to explain which apps, software and systems should be top priority for your business over the next 12 months.

Comprehensive credit reporting

A “slow-burn” development, as Connective director Glenn Lees puts it, comprehensive credit reporting (CCR) will finally become a reality in 2018. This is because the government has finally lost patience with the banks and ordered that, by July, 50% of customer data will be shared.

Treasurer Scott Morrison claims that “for borrowers, this regime should lead to one thing – a better deal on your mortgage, your personal loan or business loan”. For brokers, CCR, otherwise known as open banking, “gets down to a whole new granular way of assessing a deal that you can’t do now”, says Lees.

More data allows better profiling of customers and, eventually, customised interest rates. The change may not be difficult to notice at first, Mortgage Choice CEO John Flavell tells MPA: “Some [customers] will definitely notice a difference and others may not. It all depends on their unique financial situation.” The Consumer Action Law Centre has warned that some already-disadvantaged customers could become more disadvantaged by higher interest rates.

“Brokers who fail to invest in anything that will bring business efficiencies may find that the cost through lost business is much more significant” - John Kolenda, Finsure

One likely effect of CCR will be confusion. “My premium will be different to your premium, even if we live next to each other, because my house and the characteristics of my risk are slightly different to yours,” Suncorp’s banking and wealth CEO, David Carter, explains to MPA. Mortgage Choice’s Flavell expects this confusion to further enhance the broker proposition.

Tony Carn, director of sales at NextGen. Net, says, “What CCR might bring is a moving forward of credit checking to the point of sale”, directly involving brokers. For now, “there’s no immediate action or immediate development, but we are in consultation with credit reporting bureaus”, he says.

NextGen.Net is already heavily involved in credit reporting, but Carn warns that “there are a number of hurdles, from a participation perspective, that make it a very important thing on the horizon, but not immediately”.

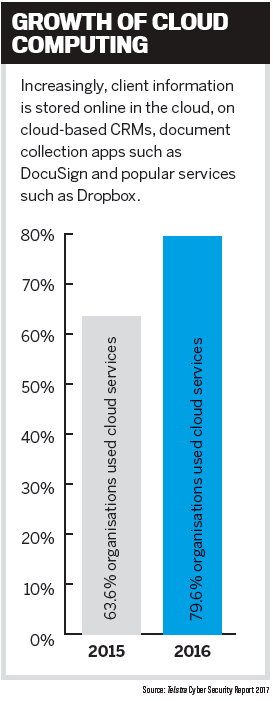

Cloud-based working

Perhaps the biggest change to a broker’s day-to-day routine this year will come from relatively simple software.

John Kolenda, managing director of Finsure, says “companies like ZipID, Proviso, Breezedocs and DocuSign are allowing regular mortgage brokers to minimise the time spent on administrative processes and spend more time focused on enhancing the customer experience”.

This year will see technology providers take on two pain points in particular: client identification and document collection.

ZipID and MSA National now provide smartphone apps that allow brokers to verify a client in person. MSA National’s app IDyou also enables clients to verify themselves without being in the same place as the broker.

“Open APIs are like the pipes and cabling below a city; the city that grows on top of them can be as wild as the imagination” - Glenn Lees, Connective

Document collection will soon change as brokers use the capabilities of DocuSign and electronic signatures to smooth the application process. MSA National’s New Generation Digital Documents service sends documents electronically to customers for signing and then guides them through the process. “The moment the customer hits ‘completed’, verification is instant,” explains Makhoul. “The broker and lender get an email, we get an email, and the customer gets an email with a copy of the documents.”

Furthermore, Makhoul claims that digital documents are less prone to errors and missed signatures, as the documents won’t send until completed and are less vulnerable to fraud given that they are sent directly to the borrower. Lenders therefore have a huge incentive to push this software out to brokers. “The difference between the lenders who are using this and those who are not live on digital is significant,” Makhoul says.

Brokers will also see changes from CoreLogic, which is building a platform to power broker workflows. The benefit, says chief technology officer Greg Dickason, is that “we [will] understand that how you will use our data, how you will target new leads and convert existing prospects, will change. This means we are constantly refining our mobile, desktop and direct API offerings to make your job easier”.

Dickason also suggests brokers look at the Val Status look-up tool on the RP Data Pro mobile app, and encourages interested brokers to take part in earlier adopted schemes to improve valuation.

Even onboarding will change: Finsure has developed a system that tracks new brokers through qualification to document verification and accreditation with lenders. By ensuring the right documentation is collected, “the system takes away a lot of the manual work and enhances the onboarding process for both our internal team and the brokers”, Kolenda explains.

Open API systems

The recent explosion in software and apps cannot be entirely credited to established technology providers; an increasing number of new players and even brokers themselves are building innovative tools. The reason is open APIs.

Put simply, open APIs allow you to connect two pieces of software. To take one example: Connective’s Mercury CRM system can now be paired with popular email tool MailChimp, with advantages for brokers, says CEO Lees. “Rather than us trying to build a marketing tool that might be perfect for one day and then it’s out of date, if MailChimp uses the best marketing tools, we’ll let you connect it up to MailChimp.”

It’s not necessary to understand the technology behind open APIs, Lees explains. “Open APIs are like the pipes and cabling below a city; the city that grows on top of them can be as wild as the imagination.” Connective brokers use a program called Zapier to connect more than 1,000 apps together, vastly reducing the amount of time they spend re-entering client details, for instance, or synchronising folders.

“There is a strong push to get ARNECC to actually approve remote verification, to recognise there are technologies out there” - Sam Makhoul, MSA National

Most excitingly, open APIs allow brokers to build software too. Connective broker George Samios of Madd Home Loans developed a program that left automated voice messages on potential clients’ phones, which is now integrated into Mercury.

NextGen.Net has been using open APIs for years within the business; it is now rolling out this technology to brokers. It now has an API for brokers to validate certain data such as address and title details, ABNs and ACNs, and serviceability calculations, Carn explains. “Rather than reverse engineering lenders’ Excel spreadsheets and building their own serviceability calculations, it’s far easier and far more accurate and reliable to use an API for those services.”

Carn adds that NextGen.Net is “currently in the pilot stage of doing a product API in the broker community”. He expects this product API to be rolled out by the end of 2018.

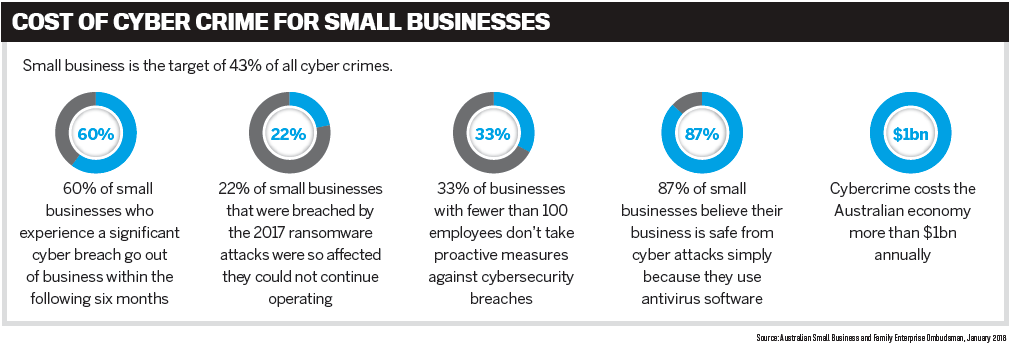

The threat from cyber crime is not new, nor is it necessarily exciting, Carn reflects. “It’s a lurking issue; it doesn’t become an issue until someone suffers.” Yet awareness of cybersecurity has been gathering momentum in the broker community, and 2018 will see the topic dominate industry conversations.

The catastrophic cyber attacks of 2017 were generally associated with big businesses and governments, but small businesses also suffered. In January this year, Small Business Ombudsman Kate Carnell warned that “cyber criminals are becoming more sophisticated and small businesses are particularly vulnerable”.

Nine out of 10 small businesses rely on antivirus software alone, which Carnell warned would not be sufficient. “Online threats are just as real as physical threats. Cybersecurity needs to be taken seriously, like having locks on your doors and a burglar alarm."

Brokers have good reason to be concerned, given the number of confidential documents they deal with. MSA National’s Makhoul recalls a roadshow promoting the IDyou app. “For the brokers who were reluctant and aren’t using it, I asked: ‘What are you currently doing?’ They said, ‘Ah, I’m really clever; I take a photo of it, convert it to a PDF and send it to the lender’. They had hundreds of people’s identities on their photo stream.”

“I’m still flabbergasted by the amount of email traffic that flows with personal details in it” - Tony Carn, NextGen.Net

Carn warns that sending documents electronically can also be risky. “I’m still flabbergasted by the amount of email traffic that flows with personal details in it: credit card numbers, financials, tax returns; ‘I’ll email you my payslips’. That’s incredibly valuable personal information when it gets into the wrong hands, and we still see people utilise email, which is bad security, unless of course it’s encrypted.”

The technology providers listed in this article all have secure data storage, with 24/7 professional monitoring and tools for brokers available. “That’s how we help brokers,” says Connective’s Lees. “We give them security they couldn’t buy themselves.” However, Lees warns that “most security breaches and lapses aren’t technology based; it’s not some incredibly clever guy in a room somewhere hacking into something – it’s when you do something dumb personally”.

The government’s Cyber Security Best Practice Guide lists simple tips such as limiting access to administrator accounts and patching and backing up data regularly. Brokers should also note their obligations to securely store data under the NCCP Act. Aggregators can help: Connective will run a cybersecurity training program for brokers early this year.

The cost of technology

For all the potential benefi ts of the smartphone apps, open APIs and cybersecurity programs out there, brokers as business owners have one major concern: cost.

Yet according to the aggregators and technology providers MPA spoke to, brokers need not be concerned.

“Modern technology platforms are designed to be scalable, which in turn allows them to be quite cost-effective,” explains Finsure’s Kolenda. “Furthermore, platforms that allow for monthly subscriptions are perfect for brokers who are looking to employ the latest technology, without blowing their budget or cash flow.

The Office 365 suite of products, for example, costs the equivalent of two co ees a month, Lees points out. “To buy the capability is trivial these days; it’s commodity-level price. The real and substantial investment is the human investment,” he says. This means not only training but the discipline to regularly use all the capabilities technology provides.

Nevertheless, the time taken training, as MSA National's Makhoul points out, is more than made up for by the time saved using the technology.

There is also a risk in not investing in technology, Kolenda warns. “Remember that brokers who fail to invest in anything that will bring business e ciencies may fi nd that the cost through lost business is much more signifi cant than any initial investment. This is an extremely competitive industry that we work in, and it’s vital to stay ahead.”

Making the most out of technology isn’t about investment at all, CoreLogic’s Dickason believes. “It requires curiosity,” he says. “Reading and listening to what’s happening and then intelligently choosing what to work with. Technology is getting cheaper, with the cloud providers making it easier to build, and host solutions. Keep curious! In the end technology won’t replace the relationship with your customers but will enhance it – so always ask, ‘How will this help my customers?"