Which regions are most at risk of payment defaults?

The CreditorWatch Business Risk Index for January 2023 shows an increasingly challenging landscape for Australian businesses, with the index’s key trade indicator at its lowest point since 2015.

Other indicators also continue to decline after a “subdued end to 2022”, the credit reporting agency said.

CreditorWatch’s key trade indicator is the average value of invoices – called “trade receivables” – which in turn reveals general business-to-business cash flow activity in Australia.

In January 2023, the business risk index showed trade receivables at their lowest point since CreditorWatch began collecting data in January 2015. Trade receivables also experienced a 39% month-on-month decrease and a 17% year-on-year decrease, the latest in a trend of declines that has persisted since July 2022, only two months after the RBA began increasing interest rates in order to dampen inflation.

B2B trade payment defaults

B2B trade payment defaults were down by 8% from December 2022, but were still up by almost 40% year-on-year. Credit enquiries shot up by 129% year-on-year and followed an uptick CreditorWatch observed had begun in October. It attributed this uptick to the Optus and Medibank data breaches announced at the time.

The BRI also compared the probability of trade payment default across industries and regions. It found that the food and beverage service industry was most likely (7.26%) to see B2B trade payment defaults “by a considerable margin”.

CreditorWatch said this may have been informed by the challenges the industry continued to grapple with, including labour shortage, price hikes, and low consumer demand. Rounding the top three industries with the highest probability of trade payment default were transport, postal, and warehousing (4.64%) and arts and recreation services (4.63%).

Healthcare and social assistance was the least at risk of default (3.26%).

Regions and states most at risk of defaults

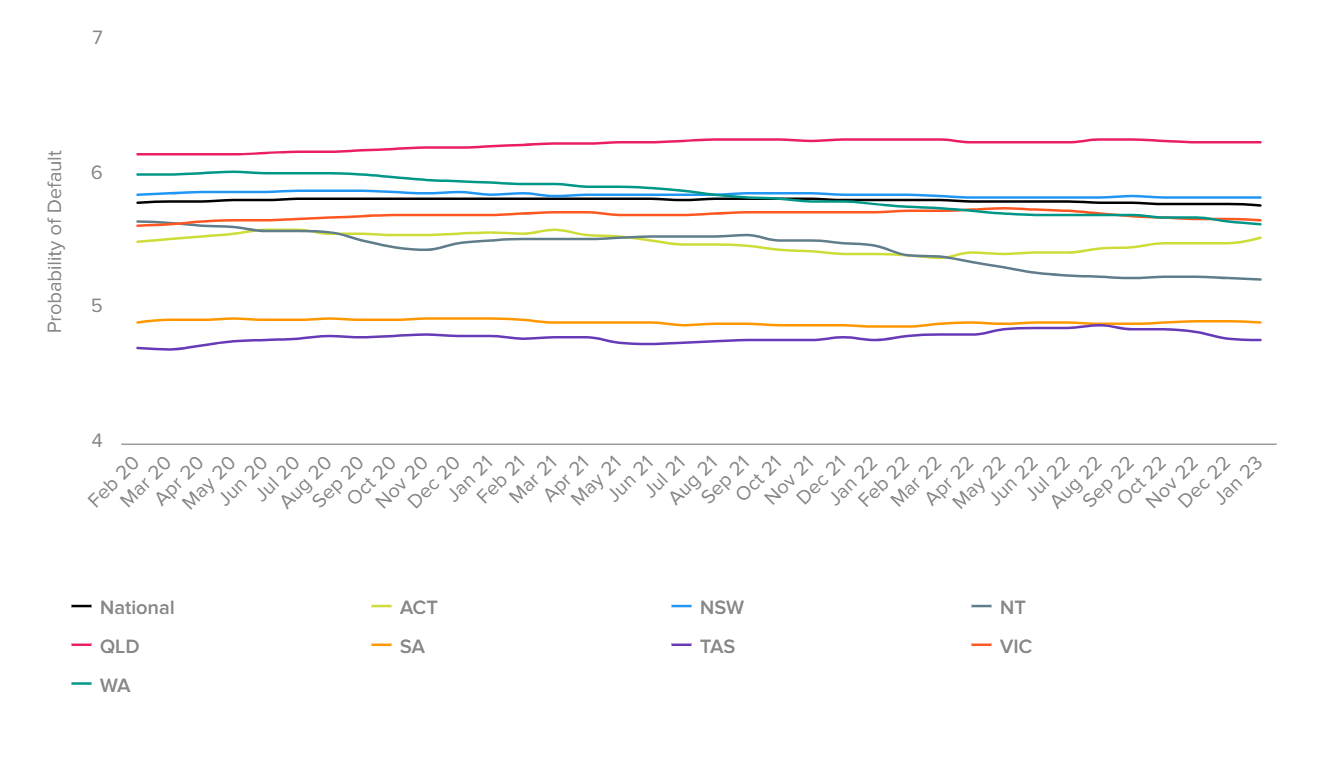

Among the states, Queensland was the most likely (6.24%) to see trade payment defaults, while Tasmania was the least at risk (4.77%).

The areas with the highest number of households with residential mortgages tended to be the most likely to see experience defaults, a fact CreditorWatch chalked up to many small businesses’ finances in those areas depending closely on individual or household finances.

CreditorWatch also listed the five regions with more than 5,000 registered businesses most at risk of default over the next 12 months. These were:

- Gold Coast Hinterland (Qld): 7.02%

- Melton – Bacchus Marsh (Vic): 7.04%

- Kogarah – Rockdale (NSW): 7.09%

- Southport (Qld): 7.27%

- Bankstown (NSW): 7.30%

Regions least at risk of default were:

- Yarra Ranges (Vic): 4.80%

- Cottesloe-Claremont (WA): 4.87%

- Adelaide City (SA): 4.89%

- Cairns – South (Qld): 4.96%

- Chatswood – Lane Cove (NSW): 5.02%

Court actions were at their highest point since September 2022, up by 36% year-on-year, the report showed. While external administrations underwent a seasonal drop in January, CreditorWatch expected the February BRI to reveal a resumption of its upward trend.

Rising trade payment defaults a concern

“The upward trend in trade payment defaults, in particular, should definitely be of concern to business owners,” said CreditorWatch CEO Patrick Coghlan (pictured above, left), who said the January 2023 results indicated a tough year ahead for Australian businesses.

“The RBA’s tightening of monetary policy is beginning to bite, on top of other challenges like labour shortages and supply chain disruptions. We will hopefully see inflation peaking soon, followed by an improvement in business and consumer confidence. It is important to remember that the Australian economy is still in a much better position than most.”

CreditorWatch chief economist Anneke Thompson (pictured above, right) said trade receivables and trade default data were particularly strong indications that Australia was well past its prime in terms of business conditions.

“This is in line with NAB’s latest business conditions survey, which also shows business conditions and confidence falling,” she said. “While 2023 will certainly be a tougher trading environment for businesses than 2022, we are coming off a period where many businesses were operating at or close to capacity, and the RBA is looking for a slowdown in activity to cool inflation.”

Thompson projected unemployment to rise with the slowing of business activity, and wage growth to decrease.

“Again, employment conditions have been extremely tight, so any rise in the unemployment rate will likely still see the rate at very low levels in overall terms,” Thompson said. “[The slowing of business activity] will also dampen wage growth, something the RBA is very keen to keep at moderate levels so as not to induce a wage-price spiral.”

What are your thoughts on the latest business risk index results? Let us know in the comments below.