CEO 'disappointed' by rejection of proposal

ANZ says it disagrees with the ACCC’s decision to deny its bid to acquire Suncorp Bank and plans to seek an independent review of the competition regulator’s call.

The major bank was reacting to the Australian Competition and Consumer Commission’s announcement on Friday not to grant authorisation for ANZ’s proposed $4.9 billion acquisition of Suncorp Bank from Suncorp Group.

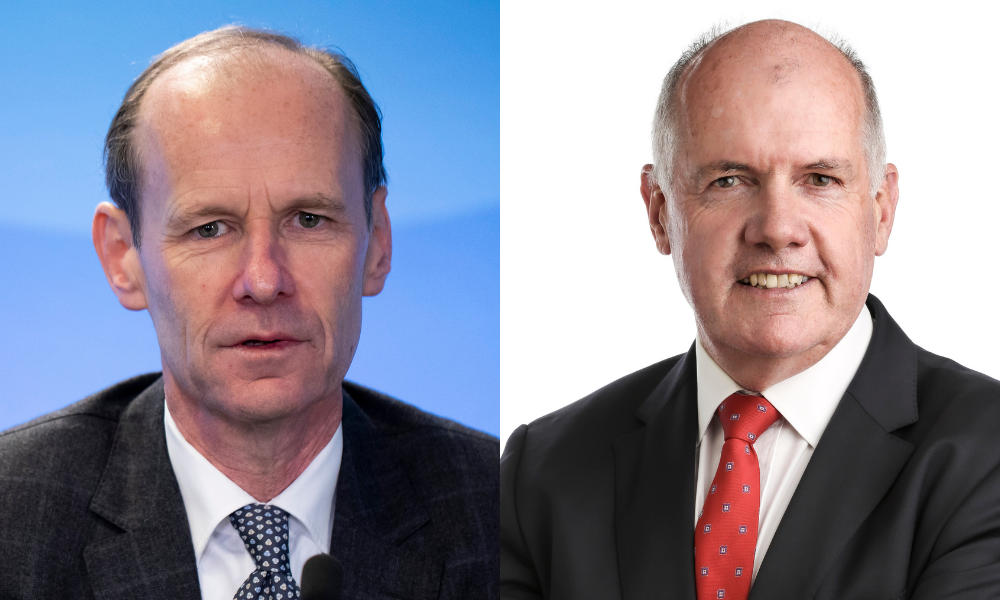

“We are naturally disappointed and disagree with the ACCC’s decision,” said ANZ CEO Shayne Elliott (pictured above left). “We are closely reviewing the determination and will seek an independent decision through the avenues of review available to us.”

Elliott, in a statement on ANZ’s website shortly after the ACCC announced its decision, said ANZ believed the acquisition would improve competition, and benefit Australian consumers, particularly in Queensland.

“All of the relevant markets are intensely competitive and will continue to be intensely competitive after the acquisition,” Elliott said. “Indeed, the acquisition will create a combined bank which is better equipped to respond to competitive pressures, and deliver significant public benefits, particularly in Queensland.”

When announcing the agreement to buy Suncorp Bank in July 2022, Elliott said the acquisition would be a “cornerstone investment” for ANZ, and was a vote of confidence in the future of Queensland.

Under Australian competition law, a decision by the ACCC to not grant authorisation can be reviewed by the independent Australian Competition Tribunal.

The acquisition also remains subject to additional conditions including approval from the Federal Treasurer and Queensland legislative amendments.

“While the acquisition remains subject to these conditions, ANZ continues its preparations for the integration of Suncorp Bank into ANZ,” Elliott said.

Competition concerns drove ACCC’s decision

Under the statutory test for acquisitions, the ACCC can’t grant authorisation unless it is satisfied in all the circumstances that the proposed acquisition would not be likely to substantially lessen competition, or that the likely public benefits would outweigh the likely public detriments.

Explaining the ACCC’s decision and an executive summary of its reasons, ACCC deputy chair Mick Keogh (pictured above right) said it was “not satisfied that the acquisition is not likely to substantially lessen competition in the supply of home loans nationally, small to medium enterprise banking in Queensland, and agribusiness banking in Queensland”.

“These banking markets are critical for many homeowners and for Queensland businesses and farmers in particular,” Keogh said. “Competition being lessened in these markets will lead to customers getting a worse deal.”

He went on to say second-tier banks such as Suncorp Bank were important competitors against the major banks, especially because barriers to new entry at scale into banking were very high. Evidence the ACCC had obtained “strongly indicates that the major banks consider the second-tier banks to be a competitive threat”.

“The proposed acquisition of Suncorp Bank by ANZ would further entrench an oligopoly market structure that is concentrated, with the four major banks dominating,” Keogh said. “It also limits the options for second-tier banks to combine and strengthen in a way that would create a greater competitive threat to the major banks.”

Big bank coordination in the home loans market

Keogh said the ACCC was not satisfied that the acquisition was not likely to substantially lessen competition in the supply of home loans to Australian consumers.

“We consider there is an increased likelihood of coordination between the four major banks in the supply of home loans should Suncorp Bank become part of ANZ. Coordinated market outcomes mean competition is muted at best, to the detriment of customers.”

Less competition would have major flow-on impacts to Australians with a mortgage, Keogh said. “More than a third of Australian households have a mortgage, with loans totalling around two trillion dollars, illustrating how critical it is that competition in this market is not substantially lessened.”

“The proposed acquisition increases the likelihood that the major banks adopt a ‘live and let live’ approach to each other, aimed at maintaining or protecting their existing market shares. This is instead of competing strongly on price, innovation and the quality of their service and products to win customers.”

The ACCC considered that the Australian home loans market was already at risk of coordination between the major banks for a number of reasons. These included the banks’ ability to price signal, the similarities of the major banks in terms of size and structure, the stability of the existing market structure and high barriers to entry.

“While there is evidence of increased competition in the home loans market recently, including in the form of cash-back offers to consumers, we are not persuaded that this level of competition will continue,” Keogh said.

“We note recent commentary by bank chief executives that they are stepping back from aggressive promotions. If this market was truly competitive, we would not expect to see banks publicly flagging plans to reduce the competitiveness of their offerings."

The ACCC said the acquisition of Suncorp Bank would boost ANZ’s home loans market share beyond that of NAB, and closer to CBA and Westpac. “Increased symmetry between competitors can increase the likelihood of coordination, as there is less incentive to upset the status quo and try to win market share by aggressively competing for customers,” Keogh said.

“If ANZ doesn’t acquire Suncorp Bank it will remain the smallest of the major banks, giving it a stronger incentive to disrupt any coordination in the market.

“The acquisition by ANZ would also remove the potential for a Bendigo and Adelaide Bank deal with Suncorp Bank. That potential combination would likely strengthen and diversify the competitive power of second-tier banks, reducing the likelihood of coordination.”

Queensland SME banking

The ACCC’s assessment found that the supply of SME banking services in Queensland was already concentrated and the acquisition would significantly increase ANZ’s market share.

“We are not satisfied there would not be a likely substantial lessening of competition in small to medium-sized business banking in Queensland,” Keogh said.

“Suncorp Bank is an important competitor for business customers in Queensland. It offers a differentiated product with a strong focus on customer relationships and smaller businesses. That differentiated offer, and the competitive benefits it brings for Queensland businesses, will not be available if ANZ acquires Suncorp Bank.”

Possible merger between Suncorp Bank and Bendigo and Adelaide Bank

The ACCC said to assess the competitive impact of a proposed acquisition, it also had to consider the likely future state of competition with and without the proposed acquisition.

“In considering the likely outcomes if ANZ does not acquire Suncorp Bank, the ACCC considers there are two commercially realistic potential scenarios; that Suncorp Bank largely continues as it is now or that it merges with or is acquired by a second-tier bank, specifically Bendigo and Adelaide Bank,” Keogh said.

“Suncorp Group’s own documents show that these were the two options that it considered as alternatives to the proposed sale of its banking arm to ANZ.”

The ACCC’s assessment found that whether or not Suncorp Bank would combine with Bendigo and Adelaide Bank if the ANZ transaction does not go ahead was keenly contested by a range of stakeholders.

The competition regular “assessed the issue of a potential Suncorp Bank deal with Bendigo and Adelaide Bank very closely, and considered many witness statements, expert reports and internal emails and documents and questioned bank executives under oath”.

“After undertaking this intensive assessment, the ACCC considers that there is a realistic prospect of a Suncorp Bank transaction with Bendigo and Adelaide Bank,” Keogh said. “We know Suncorp has extensively considered the option of a transaction with Bendigo and Adelaide in particular.”

“While we are not saying such a merger between Suncorp Bank and Bendigo and Adelaide Bank will definitely occur if the ANZ deal does not proceed, we consider it is sufficiently likely that it is necessary to consider this scenario as part of the ACCC’s assessment.”

Agribusiness banking in Queensland

The ACCC was not satisfied there would not be a likely substantial lessening of competition in agribusiness banking in Queensland.

Keogh said the ACCC’s assessment found agribusiness banking to have a strong local focus, with bankers typically visiting farmers and developing a detailed understanding of their requirements.

“We found agribusiness customers value specialised banking services with local knowledge and industry expertise.

“Suncorp Bank is a vigorous agribusiness banking competitor in many local areas of Queensland, and in particular competes strongly and directly against ANZ in areas such as Ayr, Bundaberg, Cairns, Dalby, Emerald, Mackay, Rockhampton, Roma, Goondiwindi, Townsville, and Toowoomba.”

Keogh said agribusiness banking services in Queensland were already concentrated. “Removing Suncorp Bank’s independent presence will likely lead to worse offerings being made to Queensland farmers,” Mr Keogh said.

Public benefits

The ACCC said ANZ would benefit from cost savings from the proposed acquisition and that Suncorp Group would also benefit from being able to focus on its insurance business. There may also be prudential benefits from the transaction.

“However, the ACCC considers that those benefits do not outweigh the likely detriments, particularly competitive detriments likely to result from the proposed acquisition.”

The competition watchdog also responded to ANZ’s claims about the benefits to Queensland’s economy that would be achieved by setting up a Brisbane tech hub and through increased lending to businesses in Queensland, including lending to support renewable energy targets and new energy projects.

“Based on a recent determination from the Australian Competition Tribunal, it may not be appropriate for us to take the claimed Queensland benefits into account,” Keogh said. “However, even when taken into account they are insufficient to offset the competitive harm.”

“After taking into account all of the claimed benefits we are not satisfied they are enough to outweigh the likely significant detriments to competition in banking markets that have the potential to impact many Australian households and businesses."

The ACCC will release its full reasons for rejecting ANZ’s acquisition proposal on Monday, August 7, following confidentiality checks with relevant parties.