Maybe not, or maybe not this year…

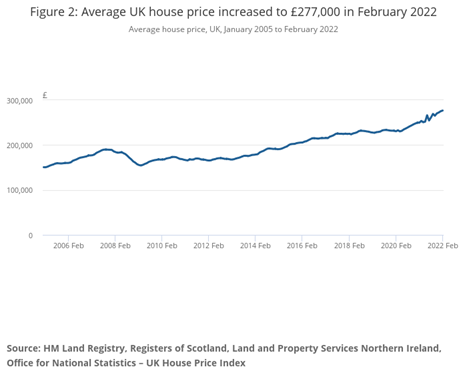

Home prices are red hot. You don’t need us to tell you that. Estate agents are still scrambling for stock. The Halifax’s latest figures put house price appreciation at nearly 11% for the year to February – surely it will all end in tears?

Property booms are widely believed to be cyclical – 18 years is the number according to the economist Fred Harrison, on average 14 years of growth, followed by four years of stagnation or prices falling.

The cycle starts, according to Harrison, with a recovery phase. Prices from the wreckage of the previous boom have fallen enough to attract new investors, mortgages are tough to get and ‘amateur’ investors are absent in the market.

The next phase is as the recovery starts to accelerate – pension funds and private equity are starting to enter the market, and more regular buyers are starting to enter the market.

The third phase may even spark headlines about property price appreciation and see a lot more investors/buyers in the market as FOMO motivates purchasers to offer over asking prices, and gazumping becomes more active. Lenders start rolling up their sleeves to gain market share, and are much happier extending home loans.

And the fourth phase? That’s when the fat lady is clearing her throat, ready to come on stage. Usually around 1-2 years long, Harrison called this the “winner’s curse” phase. Win the house? You’re cursed with the fact it may soon be worth less than you paid.

Phase five, of course, is when we get to clear up the mess after the bubble bursts. Property sales slow to a standstill, all those agent-owned flashy BMWs and Mercedes get handed back, and houses start to get affordable again.

| The house price boom | |

| Over the 12months to Feb (ONS data) | |

| Average house | 10.9% |

| New build | 19.3% |

| Detached | 14.4% |

| Flats | 8.1% |

So which phase are we currently in?

The quick answer is that’s it’s hard to tell if we’re in number four, but it certainly smells like it. Usually, we can’t see that everything is about to blow up – we just suddenly see that all of a sudden that NOW there are lots of houses to buy, and you know what? You can haggle too.

At the peak of the 2008 boom, houses were at an 8x price to earnings ratio. 2022? That number, according to Halifax, is 8.4x and you know what? We’re almost exactly 14 years since the last peak, which means recession next, right?

Well, ‘yes’ and maybe ‘no’. That 18 years (14 up, four down) is an average, not a rigid number, so let’s not get too caught up on that (although it IS worth remembering).