Help your landlords to make their cash work harder

This article was created in partnership with Family Building Society

The main benefit of an offset mortgage, where savings are linked to a mortgage account, is either greater cash flow via reduced monthly payments or a shorter length of time that they’ve got the mortgage secured against the property as more of the payment goes to capital reduction rather than interest. Either way, those funds are put to better use than sitting in a low-rate current account, or a savings account where interest is potentially subject to income tax and, importantly, still available to use whenever needed. And while it’s valuable for many people — including parents or grandparents who want to help their children or grandchildren in the housing market without outright gifting a large sum — the offset option can be a particularly great fit for those customers who have a buy-to-let portfolio.

“It’s ideally suited for landlords with a few different properties who want to make the money that’s coming in work as best as they possibly can,” said Nathan Waller (pictured left), business development manager at Family Building Society. “They can use funds strategically to help finance their next project, to renovate, to flip, to develop, to save money on property or income tax. Flexibility is key with this product — the options of what customers can do with an offset are wide ranging.”

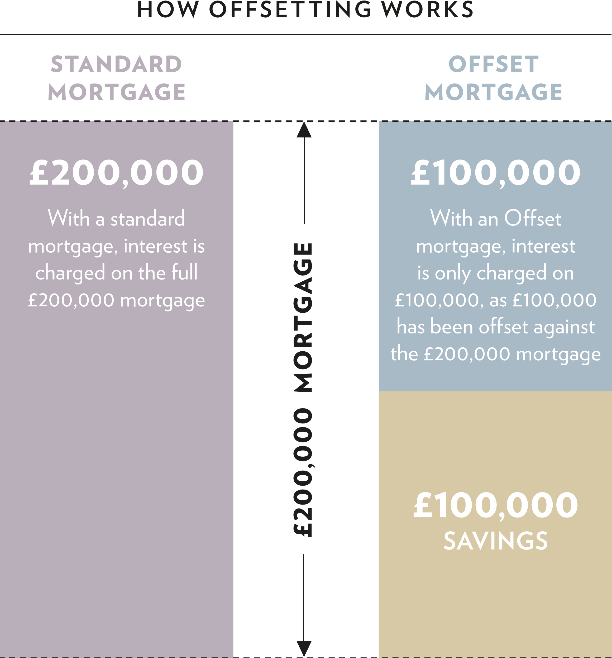

How offsetting works

With an offset mortgage, a client can deposit their savings into an offset savings account linked to their mortgage. There are two options to choose from: balance reduction or payment reduction. With balance reduction the client pays the full mortgage payment each month but the benefit from offsetting their savings goes towards reducing the capital, reducing the balance faster. With payment reduction, the offset savings are used to lower monthly payments, which can improve cashflow. Either way, the mortgage can be fully offset.

An increasingly attractive option

There has been a rise in popularity of the product that Darren Deacon (pictured right), head of intermediary sales at Family Building Society, traces back to the 2022 budget where fixed rates began to spike and “we moved into a variable rate world — with the one upshot being we saw more interest in our discounted variable product.”

Deacon calls landlords a robust group, adding they’ve specifically been impacted by recent events, legislation and tax changes, and are eager to utilise income in the most financially savvy way. Customers are increasingly interested in different ways of funding as historical go-to options like second charges, bridging, or development financing became more expensive, especially in light of the higher cost and delay of materials. By setting up an offset in this scenario, the benefit to the customer is that the interest is only applied on the amount they have drawn upon so they can “dip in and out of that money when and as they need it rather than pay interest on the full amount to start with,” Waller noted.

“They can also use the product to create a tiered and tapered approach, with the ability to fund new properties without chasing more funding,” he added. “It’s for landlords looking to put their eggs in different baskets by not just utilising one type of funding but leveraging multiple products.”

To illustrate the point, if someone had five buy-to-let properties each netting £500 a month, that’s £2.5k every month they could add to an offset account giving them £30k annually to lower the interest due on their properties. When their tax bill comes at the end of the year or when it’s time to complete a renovation or repair, they can easily access the funds — but in the meantime, it’s benefitting them.

Other options could be putting their money into a high interest savings account but, depending on their tax position, with that scenario they could potentially be liable for up to 45% income tax gain which makes the high interest rate they’re getting less attractive. Though they could save that interest by using an ISA, there’s a contribution limit and, if they do take it out, they can’t necessarily put it straight back in again.

“With an offset account, they are saving interest rather than gaining it in income, so it’s saving them money and a potential tax liability moving forward,” Waller said. “They’re making their investments work harder, saving themselves money and keeping it accessible should they need it later on.”

Boosting broker education

Though mortgage advisors like the sound of the product and brokers have a limited awareness of it, they need to make themselves more aware of its benefits to serve the landlord customer most effectively, including learning the ins-and-outs of an offset mortgage and what it can achieve.

“Brokers are looking at the product with more of a keen eye, but they need to take a closer look at the benefits — they’ll certainly have clients to talk to about it,” said Deacon. “Overall, our flexible buy-to-let criteria helps bring our offerings to the fore — for example, we don’t stress test a portfolio, which makes us attractive to portfolio landlords in particular, and we don’t have a restriction on the number of properties they hold in the background either. These are obstacles they may run into with other lenders.”

Family Building Society offers tailored, holistic underwriting and the ability to talk to one of the nine local BDMs who are dedicated to their own specific area. The BDMs are fantastic at working with the brokers to get a case placed with the underwriters, with whom they can have conversations if there’s something that needs to be figured out.

“We add value to that broker’s business by suggesting a different outcome that perhaps the broker didn’t think was available or was unaware of,” Deacon said. “That’s how we fit in that marketplace.”

“An offset will suit anybody who has extra cash but wants to keep some money behind them for a rainy day,” Waller summed up, adding that Family Building Society is committed to communication and stresses that their knowledgeable BDMs are always available to assist.

“The nice thing about us is we work closely with introducers and brokers to help with these cases, or any others. Call and have a chat.”