Commercial property outlook improving, say non-banks

The current state of the commercial property finance sector is like looking out of the window – there’s a few grey clouds but clear blue skies are on the horizon.

Commercial property has suffered a variety of problems, including higher interest rates and inflation, rising building supply costs, and labour shortages.

This has made it difficult for businesses to “make the numbers work” and secure finance, but there are positive signs this is turning around.

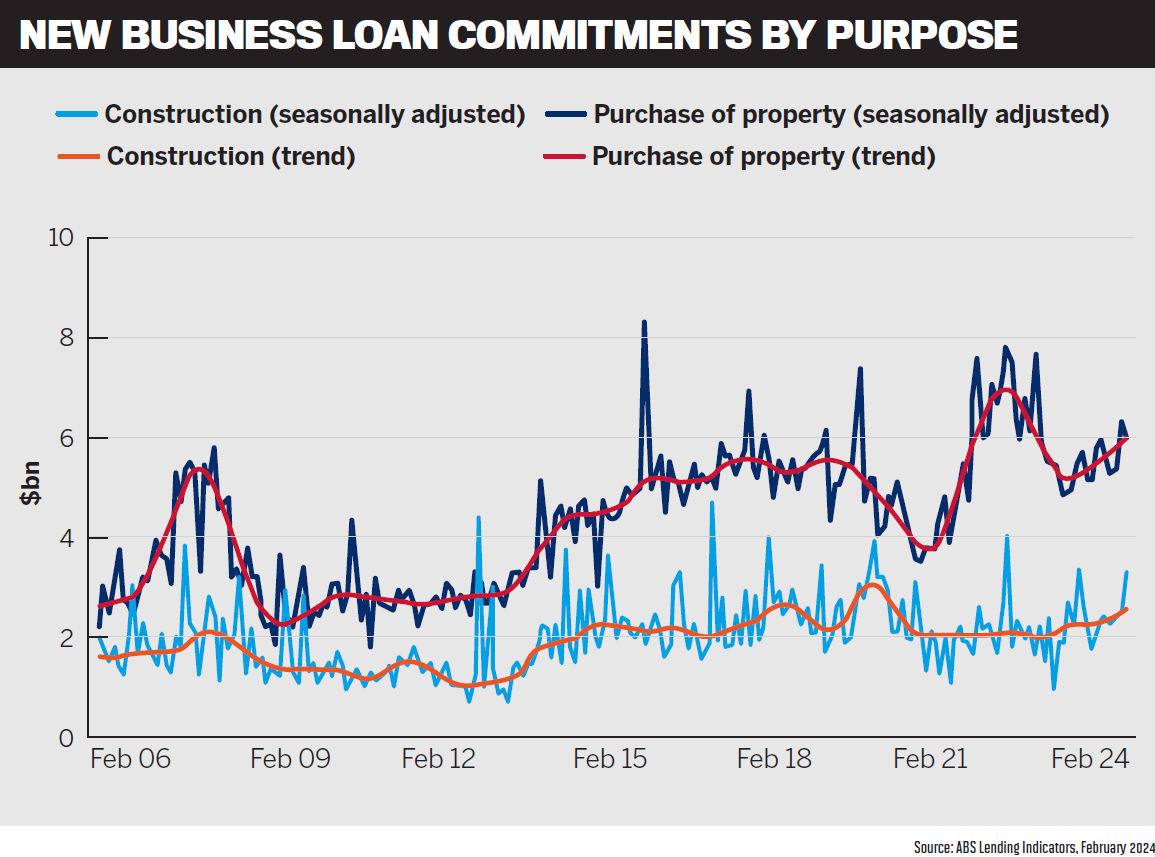

The latest ABS business finance figures for February 2024 show loan commitments for construction finance rose 31.4%, after a rise of 5.9% in January.

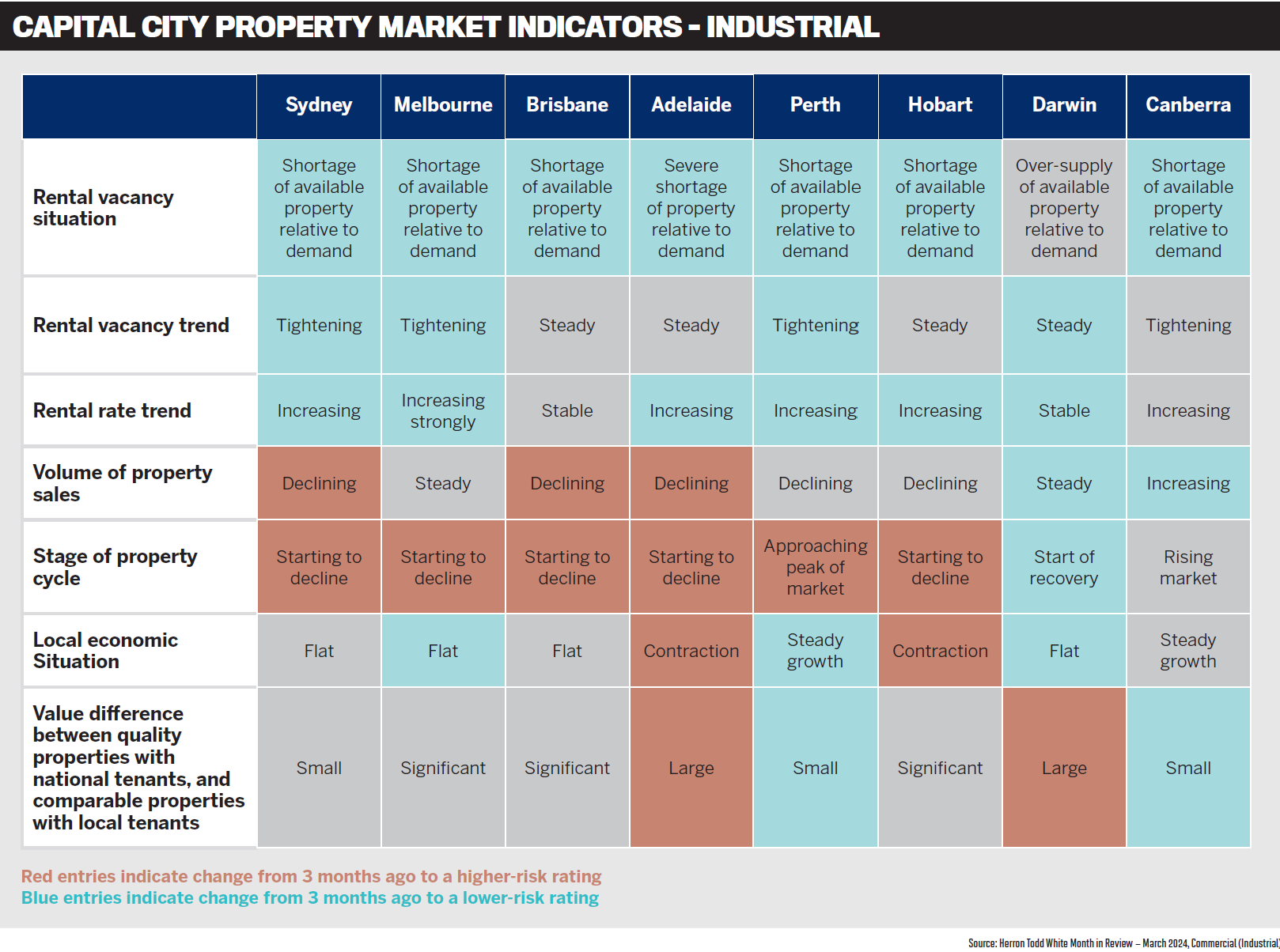

Herron Todd White’s Month in Review March property report predicted another robust year for industrial property, a sector preferred by many investors.

To gain some insights into the sector and the opportunities for brokers and their clients, MPA spoke to Zeb Drummond (pictured above left), chief operating officer at Gateway Bank, David Smith (pictured above second from right), chief distribution officer at Liberty, Michelle Whateley (pictured above second from left), NAB’s specialised business bank executive commercial real estate, and Belinda Wright (pictured above right), head of partnerships and distribution at Thinktank.

Commercial property market trends

Whateley says the commercial property market continues to go through a period of adjustment.

“We are still seeing good activity across the sector, but it is off its peak,” Whateley says. “There remains good demand for industrial property. Development activity is continuing and still seeing some rental growth, which has also resulted in owner-occupiers moving to purchase their premises.”

Whateley says activity in the retail property market has improved after a period of reset.

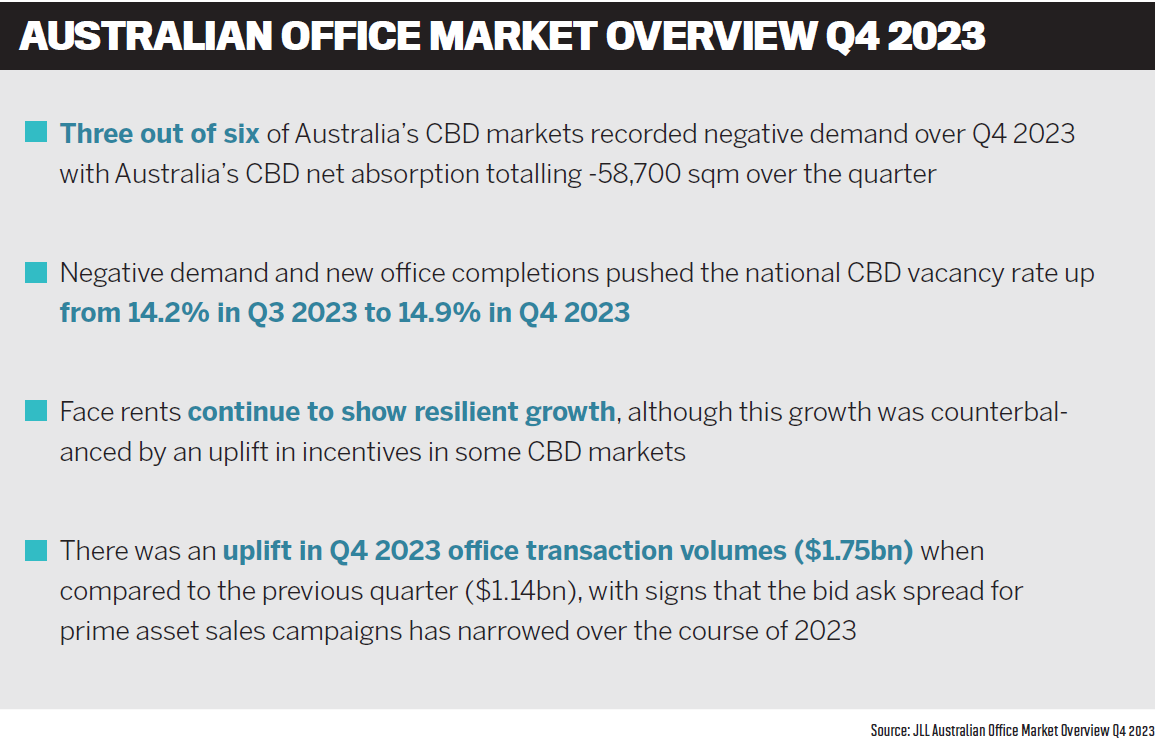

“Office is still in a period of readjustment. We see a flight to quality assets. There is leasing activity, but incentives are high.”

NAB has also seen a softening of yields across valuations for all sectors.

“Residential development activity has significantly decreased, with pressure on feasibilities and builder uncertainty. Sales have been impacted by interest rates and confidence in the delivery of projects.”

Smith says as inflation stabilises and the interest rate environment settles, Liberty expects business confidence to improve.

“SMEs are well positioned to adapt quickly, creating more opportunities for brokers to provide support,” says Smith.

“At Liberty, we’re seeing both SMEs and investors looking for larger, modern spaces to help meet demand and allow for business growth. These commercial borrowers need trusted guidance, which presents an ideal occasion for brokers to expand their offering and their network.”

Drummond says given the ongoing interest rate environment, Gateway Bank is continuing to see strong demand and enquiry from borrowers looking for more favourable terms.

“Most often this is purely a simple rate decision, but we’re increasingly seeing enquiry from borrowers looking at our longer – up to 30-year – loan terms, which are helping ease financial burden and freeing up working capital for other areas,” he says.

“Our portfolio is targeted at the smaller end of the market and we’re continuing to see enquiry related to industrial units and retail properties.”

Wright says the past year has been challenging due to inflation, rising interest rates and a changing economic environment, all of which have affected consumer sentiment and the business sector.

“However, despite these generally negative influences, we have continued to see solid commercial property lending activity across different property asset classes.”

Thinktank remains conscious of numerous challenges facing the commercial office market and of the significant revaluations being revealed. Wright says Thinktank’s latest Monthly Market Focus report focuses on the industrial property space.

“Our view is that this sector remains strong, primarily driven by structurally supported demand leading to exceptionally low vacancy rates. While the prospect of lower interest rates may exert pressure on commercial property yields, industrial properties have largely offset this through positive rental dynamics.”

Wright says vacancy rates have consistently fallen across all Australian states, with average net face rents experiencing quarterly increases in Q4 2023.

“The underlying supply-demand disparity, coupled with the ongoing demand for modern warehouse spaces, continues to support upward pressure on rents for the more sought after properties and areas.”

Diversification opportunities

Drummond says it is pleasing to see increased demand from residential brokers wanting to become accredited to offer Gateway’s commercial products.

“We definitely see our commercial property lending offering being a fairly natural diversification option for brokers.”

Drummond says it opens up a new segment of the market for brokers with business owners, commercial property investors, be it individuals, companies or trusts. Often the client’s residential mortgage tends to come with the commercial [loan], offering brokers opportunities in both segments.

“We’ve had brokers provide feedback that they’ve avoided commercial because it can be too complex. While there can be more complexity than a vanilla home loan, on the whole once you’ve been through the process brokers tend to find that the basics of a commercial deal are very similar to that of a home loan.”

Drummond says an experienced commercial banker at Gateway can support brokers through the process step by step.

Gateway Bank, in keeping with its Pocket & Planet purpose, offers a discounted green commercial property loan and a suite of fixed, variable, P&I and IO commercial property loans, up to $10 million for business owners and investors for purchase and refinance with limited cashout.

Wright says brokers who offer a wide range of solutions to their client base will cultivate stronger and deeper relationships while creating new advocates.

“Expanding into commercial loans, and SMSF loans which support a growing proportion of commercial property purchases, also unlocks potential new revenue streams.”

Thinktank was originally established nearly 20 years ago as a specialist commercial lender, and so it has deep commercial experience, says Wright. It offers education sessions designed to empower brokers to successfully diversify into commercial.

The property lending specialist’s product range is available exclusively through mortgage brokers. It includes full, mid and quick doc, SMSF and lease doc options with loan amounts up to $8 million, maximum LVR at 80% and loan terms up to 30 years with no annual reviews or regular covenant compliance requirements.

“We can provide finance solutions for investors, owner occupiers, PAYG, self-employed and SMSFs using retail, industrial, office space and professional suites along with specialised securities such as boarding houses… our loan terms and serviceability requirements are not restricted by a WAULT or WALE,” says Wright.

Whateley says there has never been a better opportunity for brokers to help business customers with their banking needs.

“Higher interest rates and a slowing economy presents both opportunities and challenges for SME owners,” she says. “Because of this they are increasingly choosing the broker channel as their pathway to a lender.”

This provides brokers with a huge opportunity to lend the assistance and advice that SME owners seek. However, Whateley says this comes with responsibility and brokers choosing to work with business customers must have the skills required.

“Mortgage brokers who are considering moving into the business lending space should invest in their own strategy to ensure that their firm has the capability to offer customers the most professional service possible.

“Support for brokers is available from their aggregator and/or industry body, who can provide the necessary guidance.”

Whateley says mortgage brokers should be open-minded about the options on the table, ranging from personally upskilling through to hiring the services of a former business banker.

“Regardless, the customer experience and the matching of the right advice is paramount.”

Smith says having an open mind to try new approaches and tools will prove vital for brokers looking to unlock options for business customers.

“By embracing the solutions offered by commercial lending, brokers can deepen relationships while expanding the range of customers they can serve,” he says.

As a specialist lender, Liberty has a broad range of commercial solutions which are straightforward and complementary for residential mortgage brokers.

Smith says Liberty’s commercial lending products are highly flexible, with prime, non-prime and low doc choices.

It also offers multiple income verification options and a streamlined application process, making it easier to gather the required customer information.

“Even when customers have more complex scenarios, the Liberty has the widest credit capacity to provide creative solutions.”

Partnerships with brokers

Wright says Thinktank’s relationship manager team has extensive industry experience, and each member is available to provide guidance from workshop to settlement.

“We recommend establishing a partnership with your Thinktank relationship manager and reaching out to them in the first instance. Engaging with a trusted partner who can quickly workshop a loan application, then take that all the way through to settlement can make all the difference.”

The Thinktank team also understands the various nuances of structuring required for commercial loans, such as special purpose vehicles (SPVs), trust structures or SMSFs, and can help guide the collection of appropriate information required to support any loan application.

Drummond says Gateway prides itself on its collaborative approach to lending with brokers and maintaining responsive turnaround times.

“This approach is delivered in the commercial space through our broker team and our specialist commercial banker, who works through deals with brokers to help deliver great outcomes for brokers and their clients.”

The bank’s dedicated commercial banker has proved valuable for residential-focused brokers looking to diversify into commercial or those with a commercial opportunity coming across their desk for the first time.

“We’re able to assist with initial assessments and support brokers in delivering for their clients as they gain exposure and experience in the category,” says Drummond.

Gateway has also enabled commercial lending through Apply Online, giving brokers easy and convenient digital lodgement.

Smith says Liberty prides itself on working closely with brokers to quickly understand the needs of customers and any critical timelines.

“Recognising there is often more to a customer’s story than what is found in their credit file, we assess each application on a case-by-case basis,” Smith notes.

“This ensures we are in a great position to support brokers to achieve better outcomes as the application progresses. Encouraging direct communication with our credit assessors and supported by our experienced sales team, this focus provides real comfort for our business partners.”

NAB is one of the largest commercial property lenders in the market, says Whateley.

“Our large team of BDMs are well versed in our appetite. We have the greatest number of business bankers and spread across all parts of the nation.

“Our bankers hold their own delegated lending authorities and are supported by an experienced specialised credit team who are available to workshop the larger transactions in a responsive manner.”

Whateley says that whether the project involves industrial land, an office complex or a medium-size multi-residential unit development, NAB is a staunch supporter of the broker channel and has appetite for lending to commercial property customers.

Predictions for the next 12 months

Smith says he’s confident more brokers will help more commercial customers than ever before in the coming year.

Brokers have continued building networks and referral channels into the business sector and it is up to lenders to “make sure we can support them with this positive momentum”.

“Liberty’s free-thinking approach and consistent performance positions us well to meet borrowers’ changing needs and work with businesses throughout their growth cycles,” says Smith.

Whateley says ESG considerations will become more prevalent, particularly the carbon emissions of commercial real estate.

“This will be a focus for tenants, purchasers, investors, financiers and will impact valuations,” she says.

Given the housing shortage in Australia, and the recent Housing Australia Future Fund applications, affordable and social housing will also be an active sector.

Looking ahead, Whateley says confidence is expected to rebound when there is more certainty around interest rates, which will create further uplift in activity across the property sector.

Wright says Thinktank maintains the view that interest rates have reached the top of the cycle and momentum is positive for the cash rate to fall in the next 12 months.

“We expect to see stable to good performance in key sectors including industrial, and well supported segments such as childcare and student accommodation,” she says.

“However, due to the flow-on effects of tighter monetary policy, we anticipate some weakness in pockets of retail and strata office.”

Drummond says if the “last few years have taught us anything, it’s making predictions can be a thankless task”.

“That said, much will depend on the interest rate environment, if and when the RBA feels in a position to cut rates and how lenders respond to the predicted cuts will be key.”

If there are, as predicted, two to three cuts in the next 18 months, Drummond says optimism will rise among investors and owners.

“Lenders willing to pass on any rate cuts may be able to win share in this increasingly competitive space.

“If the current trend of growing commercial accreditation continues, more brokers will be able and willing to offer commercial lending to their client base, which will only support growth of the sector.”

What opportunities are you seeing in commercial property? Comment below