MPA hears from challenger aggregators on why it’s time for you, the broker, to look beyond the major players

The business world is obsessed with the mega and the micro; the typical examples being Apple and whatever happens to be the latest hot fintech.

What tends to get ignored are the challengers – established companies that need to fight for new customers, through innovation and competitive offers, while satisfying their existing customer base. This is the situation that Australia’s challenger aggregators face, and this article is about how they’re responding.

The past 12 months have seen challenger aggregators – a term that includes boutique operators – be far more vocal within the industry. Indeed, challenger aggregators have started important debates about the value of mentoring, while overturning established thinking in areas like white label and technology. Challenger aggregators also disagree with each other on these issues; you can read their differing opinions over the next few pages.

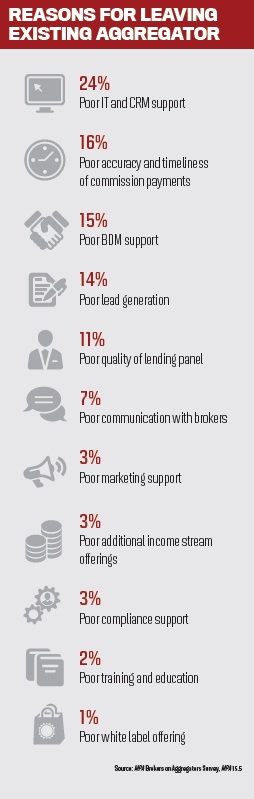

Words only go so far; brokers will be looking for examples of concrete investments in support and infrastructure before they consider leaving the major players in the sector. Nevertheless, the overall challenger aggregator proposition has arguably been improved by the very diverse approaches adopted by different aggregators. The traditional challenger aggregator proposition – emphasising individual service – is still valid of course, but with diversification and technology becoming ever more pressing concerns for brokers, individual service alone is not enough.

The way challenger aggregators are addressing these concerns, by delivering diversification opportunities through powerful software platforms, is one of the most interesting developments in the sector in recent years. Whether it’s eChoice’s FLeaTS, nMB Pro, or Liberty Network Service’s Spark

platform, brokers are being empowered to diversify their businesses by using intelligent software that reduces their workload and actually assists them in identifying new business opportunities.

Bigger, established aggregators can afford this technology too, of course, so challenger aggregators can’t afford to rest on their laurels. As smaller organisations, challenger aggregators have the advantage of being able to respond faster to changes, and will be expected to do so as regulation and changing market conditions begin to bite. They need to show brokers how they can take their brokerages to the next level.

What does your typical broker look like?

What does your typical broker look like?

Liberty Network Services

Liberty Network Services (LNS) doesn’t have brokers; it has advisers. This distinction is important when answering this question because our network allows our advisers to sell so much more than just mortgages, including SMSF, motor and commercial loans. Using the term ‘broker’ just doesn’t suffice.

So we’re looking for operators who recognise the value of a growing brand, want to work smarter through better technology and diversify beyond mortgage lending, need comprehensive marketing support, and embrace business coaching.

eChoice

eChoice broker partners are a diverse group of individuals who as a collective share the common goal of developing not only a successful but sustainable business. Our programs are designed to complement and develop skills at every stage of the broking business cycle, which is why we are attracting high numbers of new partners.

Typically our brokers have a background in a finance-related trade, such as financial planning, banking or accounting, and more recently we have seen many younger candidates coming on board as they choose broking for their preferred career path. Our brokers embrace our technological edge and are attracted to our ability to innovate and deliver customised tools and service platforms.

Outsource Financial

Outsource’s typical broker is often a financial planner or accountant who wants to diversify their business by adding lending. This type of member has the advantage of a financial background and an existing database. Our models attract these professionals as they can mix and match the loan writer and referrer models to suit the level of business in their existing practice at any one time. That is, if their practice is particularly busy with planning or accountancy at a specific time of year, then they can refer lending to a dedicated Outsource lending manager during that time and then write loans again when it suits.

nMB

A typical broker with nMB is one who is professional, focused, independent, and has a strong interest in providing a great client experience. We do not believe there is a ‘typical broker’ in a sense of gender, background, experience and/or business model. Our most successful brokers operate under a range of different business models, varying from retail to corporate office or home office, and can be sole operators to being part of larger teams.

What are you doing to help your members diversify their businesses?

What are you doing to help your members diversify their businesses?

eChoice

Innovation and diversification are at the very core of our forward strategy, and given our industry moves in line with property and interest rate cycles, challenges will always be present.

Our goal of providing a ‘complete’ and progressive borrower solution is very clear and real to us, so as we continue to develop and add to our suite of products and services, we not only support income diversification but also ensure our broker businesses are fortified for the long term and can sustain any inevitable market changes. In addition, our white-labelled outbound call program and customised marketing toolkit also assists brokers in identifying new opportunities, which is particularly valuable when the market is slow.

nMB

Our first approach on diversification is to broaden our brokers’ range of lending products. Many brokers do tend to specialise in only one segment of the market, and miss out on many opportunities that are available through specialist lenders, commercial or business lending, and asset finance.

Many of our brokers use nMB to introduce a broader financial services offering to their existing accounting, financial planning or other financial services business.

This is a focus for us in 2016. Firstly, to widen our supplier panel in a few of these areas and then run single-topic training sessions in conjunction with our suppliers to broaden skills and opportunities.

Outsource Financial

Since inception, Outsource has promoted diversification and a holistic approach to lending. There are many examples, but one would be that Outsource provides its members with an uncomplicated motor vehicle and equipment finance platform. Members are given access to 10 funders without the need to hold individual accreditations, and an online quoting and application system.

A second example is the provision of a unique property platform which is designed to offer an investment property solution for the clients of financial planners, accountants and other groups in a professional and easy-to-use offering of listings that match their clients’ requirements. What is different is the member does not need to be a property expert; there are no middlemen involved and it is FOFA compliant in terms of vertical integration.

Liberty Network Services

The cornerstone of the LNS offer has always been diversification. This is why we have advisers, not mortgage brokers. Our network distributes motor, business, SMSF, personal and small business loans, not to mention insurance.

Given Liberty’s strength in specialty lending, LNS advisers can also help customers who can no longer be serviced by the banks due to their unpredictable rules. Brokers who are smart wouldn’t have waited for the market to turn before diversifying their portfolio; they’d already be selling new products.

Our mobile platform, Spark, has been cleverly designed to bring all of our residential, motor, SMSF and insurance solutions together in the same place, making the process of engaging with customers about different products more natural.

Should mentoring of new brokers be free?

Should mentoring of new brokers be free?

Outsource Financial

Outsource does not believe in charging members for mentoring. Many aggregators are charging for the service and additionally require members to operate under another group’s tutelage until the mentoring is complete. This does not suit our membership as we attract a large portion of accountants and financial planners who obviously have a finance background and often already run busy practices, making it impractical for them to work out of someone else’s office. We feel we are attracting the right people to the industry and there is no way we would charge them for mentoring when we see these entrants as a positive to the industry. Instead, Outsource has a new-entrant program that allows participants to maintain their operational independence and does not charge for the service.

nMB

Where mentoring is being provided by a dedicated specialist then logically a fee should be paid for that service. However, the best form of mentoring is where a new broker can join an existing business which supplies an environment where the new broker can learn and build their knowledge and experience on a daily basis in an active broker business. The ‘cost’ to the broker is such an environment should then be reflected through a lower commission sharing arrangement until such time as they can operate totally independently from the support mechanisms provided.

Liberty Network Services

Anyone who is new to an industry needs as much training, mentoring and support as they can get – it’s the only way they will compete with established brokers. It is unfortunate that many in the industry have taken advantage of this and charged ridiculous fees for the privilege. LNS has a comprehensive, high-touch onboarding process that invests the time and resources needed to ensure success. And we charge a fraction of the price

– in the first 12 months it’s just $100 a month

– so our training is accessible and affordable.

eChoice

There is a great deal of discussion around the cost of mentoring right now; however, the emphasis should be placed on the quality of mentoring and the ‘value for money’ this provides to the new entrant.

Internally developed, managed and maintained aggregator programs provide greater value to new brokers, as the control element not only encourages broad-based learning, it allows the teaching to incorporate specific technology, process and procedural elements.

Mentoring is not just about deal submission and funder idiosyncrasies; it’s about a holistic approach to building a career on sound coaching and instruction – and our Broker Academy is a fine example of this approach.

BEATING THE COMPETITION: BRENDAN O’DONNELL, MANAGING DIRECTOR, LIBERTY NETWORK

Liberty Network Services is going from strength to strength, and we’re well on our way to having a big 2016. This is a signifi cant year for us, particularly as the Liberty brand increases its profile amongst consumers. More advisers are joining LNS to get upwardly mobile and to sleep more soundly at night. We keep our advisers’ businesses powered up through:

Economics: Our unique hybrid model offers exceptionally competitive commissions, alternate income opportunities, and a market-leading premium club program.

Technology: Award-winning technology platform Spark improves adviser productivity up to 30%, helping advisers meet the technology demands of tomorrow.

Diversification: Our adviser network is provided all the support to offer customers motor, business, SMSF, insurance and small business loans.

Marketing: Liberty’s new brand positioning and identity is growing, with signifi cant national and local marketing initiatives. Our dedicated team of marketing professionals provide bespoke campaigns.

Strategic referral partnerships: Our successful strategic referral partner programs continue to grow and provide additional business across a range of asset classes to our adviser network.

additional business across a range of asset classes to our adviser network.

High-touch support: Our national team and local network sales managers are

passionate about what they do and are skilled in lending, coaching and helping advisers execute integrated advertising and marketing strategies.

Do you have a white label product, and if not, why not?

nMB

Our ‘white label’ product is currently on hold. It has never been a big part of our business model and only comes into play where we think there is a gap in current suppliers. In the current climate our suppliers are able to meet the vast demands of our brokers. When we did run with our ‘nMB Direct’ product line we felt it was of paramount importance to treat it as any other supplier on our panel in both the manner in which we promote it and the transparency of the remuneration model.

eChoice

As our name suggests, the eChoice brand is all about ‘Choice’ for the consumer. Part of our broader business platform includes a white label funding arm, but this is not available to our broker partners. We are funder agnostic – our technology platforms allow our brokers to connect and deliver the right product for the customer based on their individual needs, without proprietary incentive or motivation. This can only benefi t the consumer and enhances our position as a brand of ‘Choice’.

Outsource Financial

No, we do not have a white label. Outsource is one of the few aggregators that is not owned or partially owned by a bank, and as such we are not promoting any particular lender or white label. Our members have access to a huge panel of lenders already, and simply provide the best comparisons to suit the client’s needs. If we were ever to add a white label it would have to be in line with other lenders (especially in regard to commissions) and would have to exist on its benefi ts to the clients, not on any incentives offered.

Liberty Network Services

LNS is unique because it doesn’t offer any white label products. That’s because our portfolio of products is so broad we don’t have to. In addition to our 18-strong lender panel, we have a broad and deep range of Liberty products available to our advisers, which provides excellent flexibility to diversify.

BEATING THE COMPETITION: TANYA SALE, CEO, OUTSOURCE FINANCIAL

As we position ourselves on being the preferred aggregator for the professional sector we don’t feel the need to compete with larger aggregators. Our models are different to most and cater for financial planners, accountants, quality loan writers and other professional groups. We rarely advertise as our reputation and credibility within the professional services sector drives our recruitment, which is evidenced by the number of professionals within our database.

Outsource also prides itself on providing the tools and resources to ensure education and training is at the forefront of our members’ interaction with their clients. There is a need to educate clients, and with our education and training we intend to change the way lending is done in Australia.

forefront of our members’ interaction with their clients. There is a need to educate clients, and with our education and training we intend to change the way lending is done in Australia.

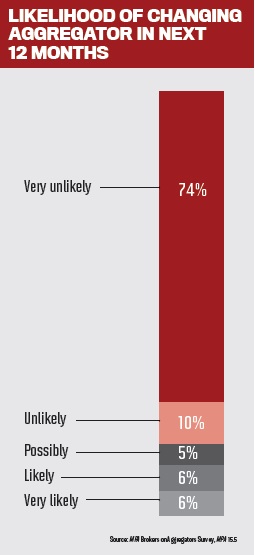

Because of the support mechanisms that we provide, in addition to the relationship that is created, our retention is extremely high. Our success is attested to by the number of members referring their industry colleagues to Outsource.

What have you done over the past 12 months to invest in IT and CRM support?

eChoice

We’ve recently released a new version of our CRM platform FLeaTS. This state-of-the-art system is one of the most dynamic and broker-intuitive in Australia. Available across all devices, it’s been designed by our dedicated tech team to allow brokers to be mobile and responsive to the immediate and ongoing needs of customers. We’ve recently integrated insurance programs, free property reporting, and an interactive ‘Ask eChoice’ forum.

Conveyancing solutions, along with building and pest reporting, are next on the list, as well as a new credit repair service. Our newly developed ‘smart reporting’ program will also be added, identifying risks and clients that could potentially refinance or sell.

Outsource Financial

In the past 12 months we have invested in IT and CRM support for various areas of the business. In 2015 we built a new, updated version of our Referrer Online Tracking Software, which provides referrers with the ability to track the status of their referrals. Features include the ability for referrers to submit a lead via the web at any time or place; updates and status changes in real time; even more comprehensive reports; and records can be reviewed by our audit team.

Other investments in 2015 included updating our website with an even more interactive members’ area, and an update of our commissions system.

Liberty Network Services

Our mobile technology platform Spark continues to innovate, and provides a service to our advisers that they couldn’t get elsewhere. Liberty is an established player in the fintech space, so we have a signifi cant technology team that marries our 19 years of experience and data with the latest technological tools and capabilities.

Spark has won awards for its innovation and continues to evolve without the legacy constraints experienced by so many other aggregators. Having made the initial leap to condense an adviser’s office into an iPad, Spark’s feature enhancements are really just business as usual at LNS.

nMB

nMB has invested heavily over the past year to deliver a new and innovative point of sale platform (nMB Pro). We believe a customised IT solution should encompass relevant tools and features which simplify, through automation, key client transactions and interactions. It should have fl exibility to follow a broker’s daily activity and accurately reflect individual workflows and practices. Above all, it should enhance both broker and client interactions through a number of tools designed to deliver ease of use and efficiencies. nMB Pro delivers on all these fronts, and perfectly complements our existing Mortgage Broker Suite and our unique Affiliate Marketing Software.

BEATING THE COMPETITION: BLAKE BUCHANAN, NATIONAL SALES MANAGER, ECHOICE

Part of our genuine competitive edge is that we don’t compete with the larger aggregator businesses in the marketplace. We are setting new industry standards and benchmarks in relation to lead generation, IT and CRM support, business sustainability and digital solutions. Our size allows us to be nimble to the changing needs of the market and deliver an intuitive and adaptive platform for the modern digital broker.

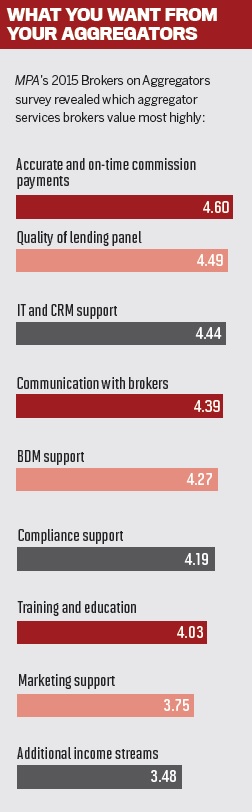

Our success to date is evidenced by the results of the MPA magazine 2015

Brokers on Aggregators survey, in which eChoice ranked number one in the IT and CRM support category (relative to importance) with a performance score of 4.63 out of a possible 5.

It’s not enough any more for an aggregator to just simply connect with their broker partners, as the combined success of both parties should rely on a profound base of mutuality. The size of our business complements our ability to deliver to this brief – with real people, dedicated resources and bespoke programs at the core.

rely on a profound base of mutuality. The size of our business complements our ability to deliver to this brief – with real people, dedicated resources and bespoke programs at the core.

We consider ourselves a whole business enabler, investing in individuals and businesses to deliver what we believe is the best-value proposition for new and experienced brokers on offer today.

How will you respond to new, technologically driven aggregators competing for brokers?

nMB

Having an accurate, user-friendly and relevant platform is now a ‘ticket to the dance’ for all aggregators. It is not the key decider in a broker joining or moving between aggregators, just part of an overall package to be considered. Systems, along with competitive commission models and, most importantly, business support in marketing, recruitment and licensing, are all key elements for brokers to consider when deciding on their aggregator partner. All aggregators need to maintain an eye on advancements in technology to ensure their business platforms remain relevant, however can’t get caught up thinking systems will be the only point of difference.

Liberty Network Services

Technology has always been at the heart of our offering, and we have decades of experience refining our tools – so we’re not concerned about fresh new competitors. Our advisers run their entire businesses through Spark and can process any loan end-to-end, which is unique in the industry. For aggregators to remain relevant and competitive they need to continuously update their technology platforms. We’ve been doing this for years and have led the way in this space, particularly when it comes to streamlining and future-proofing our technology.

Outsource Financial

Whilst we keep at the forefront of technology we will always be an aggregator that concentrates on building strong relationships with our members, and to us that means personal contact. I meet all new members prior to them signing with Outsource, and will always continue to do so. All members also know that they can contact me personally if they need to. This attitude flows down through the staff and even to how a member treats their client. We not only become our member’s partner in lending but play a strong role in assisting them to grow a multifaceted business, which is required in this current environment to ensure longevity and success.

eChoice

The eChoice aggregation business has led, and will continue to lead, the industry in relation to technology and innovation – and as such we welcome new competitors to the space. Part of our core philosophy is our commitment to building and delivering the cutting-edge tools of today and tomorrow to our broker network, leading the industry in lead generation, intuitive customer management systems and digital marketing programs.

The future of broker is exciting, dynamic, technology-driven, and to some extent elegant. The future is digital. At eChoice, we have a saying: we don’t just participate in aggregation, we are defining its future.

How will you respond to new, technologically driven aggregators competing for brokers?

nMB

Having an accurate, user-friendly and relevant platform is now a ‘ticket to the dance’ for all aggregators. It is not the key decider in a broker joining or moving between aggregators, just part of an overall package to be considered. Systems, along with competitive commission models and, most importantly, business support in marketing, recruitment and licensing, are all key elements for brokers to consider when deciding on their aggregator partner. All aggregators need to maintain an eye on advancements in technology to ensure their business platforms remain relevant, however can’t get caught up thinking systems will be the only point of difference.

Liberty Network Services

Technology has always been at the heart of our offering, and we have decades of experience refi ning our tools – so we’re not concerned about fresh new competitors. Our advisers run their entire businesses through Spark and can process any loan end-to-end, which is unique in the industry. For aggregators to remain relevant and competitive they need to continuously update their technology platforms. We’ve been doing this for years and have led the way in this space, particularly when it comes to streamlining and future-proofi ng our technology.

Outsource Financial

Whilst we keep at the forefront of technology we will always be an aggregator that concentrates on building strong relationships with our members, and to us that means personal contact. I meet all new members prior to them signing with Outsource, and will always continue to do so. All members also know that they can contact me personally if they need to. This attitude fl ows down through the staff and even to how a member treats their client. We not only become our member’s partner in lending but play a strong role in assisting them to grow a multifaceted business, which is required in this current environment to ensure longevity and success.

eChoice

The eChoice aggregation business has led, and will continue to lead, the industry in relation to technology and innovation – and as such we welcome new competitors to the space. Part of our core philosophy is our commitment to building and delivering the cutting-edge tools of today and tomorrow to our broker network, leading the industry in lead generation, intuitive customer management systems and digital marketing programs.

The future of broker is exciting, dynamic, technology-driven, and to some extent elegant. The future is digital. At eChoice, we have a saying: we don’t just participate in aggregation, we are defi ning its future.

BEATING THE COMPETITION: GERALD FOLEY, MANAGING DIRECTOR, NMB

The strategy for smaller aggregators when competing with the bigger players is to play to your strengths.

Operating at a much lower BDM to broker headcount, business support is paramount. It is important to create a culture across the whole staff that we are here to support our broker business partners. Each broker is important to the overall success of the business, whereas in the larger groups often brokers are lost in the crowd or treated as just another number.

We often get feedback from brokers who move to nMB from larger aggregators that there is a real sense of camaraderie among the group. That is something we value as a business and that is core to our company culture. We’re fortunate at nMB that we can provide a sort of ‘boutique’ service with the benefit that comes with strong corporate ownership through the Aussie/CBA relationship.

Our approach of working with business owners through the ‘ Broker to Broker Business’ model puts a greater emphasis on improving broker profitability through better use of resources and understanding business dynamics than purely a revenue play.

Broker to Broker Business’ model puts a greater emphasis on improving broker profitability through better use of resources and understanding business dynamics than purely a revenue play.

At the end of the day it is all about understanding, then working with our brokers to maximise their business objectives and profitability..

What tends to get ignored are the challengers – established companies that need to fight for new customers, through innovation and competitive offers, while satisfying their existing customer base. This is the situation that Australia’s challenger aggregators face, and this article is about how they’re responding.

The past 12 months have seen challenger aggregators – a term that includes boutique operators – be far more vocal within the industry. Indeed, challenger aggregators have started important debates about the value of mentoring, while overturning established thinking in areas like white label and technology. Challenger aggregators also disagree with each other on these issues; you can read their differing opinions over the next few pages.

Words only go so far; brokers will be looking for examples of concrete investments in support and infrastructure before they consider leaving the major players in the sector. Nevertheless, the overall challenger aggregator proposition has arguably been improved by the very diverse approaches adopted by different aggregators. The traditional challenger aggregator proposition – emphasising individual service – is still valid of course, but with diversification and technology becoming ever more pressing concerns for brokers, individual service alone is not enough.

The way challenger aggregators are addressing these concerns, by delivering diversification opportunities through powerful software platforms, is one of the most interesting developments in the sector in recent years. Whether it’s eChoice’s FLeaTS, nMB Pro, or Liberty Network Service’s Spark

platform, brokers are being empowered to diversify their businesses by using intelligent software that reduces their workload and actually assists them in identifying new business opportunities.

Bigger, established aggregators can afford this technology too, of course, so challenger aggregators can’t afford to rest on their laurels. As smaller organisations, challenger aggregators have the advantage of being able to respond faster to changes, and will be expected to do so as regulation and changing market conditions begin to bite. They need to show brokers how they can take their brokerages to the next level.

What does your typical broker look like?

What does your typical broker look like?Liberty Network Services

Liberty Network Services (LNS) doesn’t have brokers; it has advisers. This distinction is important when answering this question because our network allows our advisers to sell so much more than just mortgages, including SMSF, motor and commercial loans. Using the term ‘broker’ just doesn’t suffice.

So we’re looking for operators who recognise the value of a growing brand, want to work smarter through better technology and diversify beyond mortgage lending, need comprehensive marketing support, and embrace business coaching.

eChoice

eChoice broker partners are a diverse group of individuals who as a collective share the common goal of developing not only a successful but sustainable business. Our programs are designed to complement and develop skills at every stage of the broking business cycle, which is why we are attracting high numbers of new partners.

Typically our brokers have a background in a finance-related trade, such as financial planning, banking or accounting, and more recently we have seen many younger candidates coming on board as they choose broking for their preferred career path. Our brokers embrace our technological edge and are attracted to our ability to innovate and deliver customised tools and service platforms.

Outsource Financial

Outsource’s typical broker is often a financial planner or accountant who wants to diversify their business by adding lending. This type of member has the advantage of a financial background and an existing database. Our models attract these professionals as they can mix and match the loan writer and referrer models to suit the level of business in their existing practice at any one time. That is, if their practice is particularly busy with planning or accountancy at a specific time of year, then they can refer lending to a dedicated Outsource lending manager during that time and then write loans again when it suits.

nMB

A typical broker with nMB is one who is professional, focused, independent, and has a strong interest in providing a great client experience. We do not believe there is a ‘typical broker’ in a sense of gender, background, experience and/or business model. Our most successful brokers operate under a range of different business models, varying from retail to corporate office or home office, and can be sole operators to being part of larger teams.

What are you doing to help your members diversify their businesses?

What are you doing to help your members diversify their businesses?eChoice

Innovation and diversification are at the very core of our forward strategy, and given our industry moves in line with property and interest rate cycles, challenges will always be present.

Our goal of providing a ‘complete’ and progressive borrower solution is very clear and real to us, so as we continue to develop and add to our suite of products and services, we not only support income diversification but also ensure our broker businesses are fortified for the long term and can sustain any inevitable market changes. In addition, our white-labelled outbound call program and customised marketing toolkit also assists brokers in identifying new opportunities, which is particularly valuable when the market is slow.

nMB

Our first approach on diversification is to broaden our brokers’ range of lending products. Many brokers do tend to specialise in only one segment of the market, and miss out on many opportunities that are available through specialist lenders, commercial or business lending, and asset finance.

Many of our brokers use nMB to introduce a broader financial services offering to their existing accounting, financial planning or other financial services business.

This is a focus for us in 2016. Firstly, to widen our supplier panel in a few of these areas and then run single-topic training sessions in conjunction with our suppliers to broaden skills and opportunities.

Outsource Financial

Since inception, Outsource has promoted diversification and a holistic approach to lending. There are many examples, but one would be that Outsource provides its members with an uncomplicated motor vehicle and equipment finance platform. Members are given access to 10 funders without the need to hold individual accreditations, and an online quoting and application system.

A second example is the provision of a unique property platform which is designed to offer an investment property solution for the clients of financial planners, accountants and other groups in a professional and easy-to-use offering of listings that match their clients’ requirements. What is different is the member does not need to be a property expert; there are no middlemen involved and it is FOFA compliant in terms of vertical integration.

Liberty Network Services

The cornerstone of the LNS offer has always been diversification. This is why we have advisers, not mortgage brokers. Our network distributes motor, business, SMSF, personal and small business loans, not to mention insurance.

Given Liberty’s strength in specialty lending, LNS advisers can also help customers who can no longer be serviced by the banks due to their unpredictable rules. Brokers who are smart wouldn’t have waited for the market to turn before diversifying their portfolio; they’d already be selling new products.

Our mobile platform, Spark, has been cleverly designed to bring all of our residential, motor, SMSF and insurance solutions together in the same place, making the process of engaging with customers about different products more natural.

Should mentoring of new brokers be free?

Should mentoring of new brokers be free?Outsource Financial

Outsource does not believe in charging members for mentoring. Many aggregators are charging for the service and additionally require members to operate under another group’s tutelage until the mentoring is complete. This does not suit our membership as we attract a large portion of accountants and financial planners who obviously have a finance background and often already run busy practices, making it impractical for them to work out of someone else’s office. We feel we are attracting the right people to the industry and there is no way we would charge them for mentoring when we see these entrants as a positive to the industry. Instead, Outsource has a new-entrant program that allows participants to maintain their operational independence and does not charge for the service.

nMB

Where mentoring is being provided by a dedicated specialist then logically a fee should be paid for that service. However, the best form of mentoring is where a new broker can join an existing business which supplies an environment where the new broker can learn and build their knowledge and experience on a daily basis in an active broker business. The ‘cost’ to the broker is such an environment should then be reflected through a lower commission sharing arrangement until such time as they can operate totally independently from the support mechanisms provided.

Liberty Network Services

Anyone who is new to an industry needs as much training, mentoring and support as they can get – it’s the only way they will compete with established brokers. It is unfortunate that many in the industry have taken advantage of this and charged ridiculous fees for the privilege. LNS has a comprehensive, high-touch onboarding process that invests the time and resources needed to ensure success. And we charge a fraction of the price

– in the first 12 months it’s just $100 a month

– so our training is accessible and affordable.

eChoice

There is a great deal of discussion around the cost of mentoring right now; however, the emphasis should be placed on the quality of mentoring and the ‘value for money’ this provides to the new entrant.

Internally developed, managed and maintained aggregator programs provide greater value to new brokers, as the control element not only encourages broad-based learning, it allows the teaching to incorporate specific technology, process and procedural elements.

Mentoring is not just about deal submission and funder idiosyncrasies; it’s about a holistic approach to building a career on sound coaching and instruction – and our Broker Academy is a fine example of this approach.

BEATING THE COMPETITION: BRENDAN O’DONNELL, MANAGING DIRECTOR, LIBERTY NETWORK

Liberty Network Services is going from strength to strength, and we’re well on our way to having a big 2016. This is a signifi cant year for us, particularly as the Liberty brand increases its profile amongst consumers. More advisers are joining LNS to get upwardly mobile and to sleep more soundly at night. We keep our advisers’ businesses powered up through:

Economics: Our unique hybrid model offers exceptionally competitive commissions, alternate income opportunities, and a market-leading premium club program.

Technology: Award-winning technology platform Spark improves adviser productivity up to 30%, helping advisers meet the technology demands of tomorrow.

Diversification: Our adviser network is provided all the support to offer customers motor, business, SMSF, insurance and small business loans.

Marketing: Liberty’s new brand positioning and identity is growing, with signifi cant national and local marketing initiatives. Our dedicated team of marketing professionals provide bespoke campaigns.

Strategic referral partnerships: Our successful strategic referral partner programs continue to grow and provide

additional business across a range of asset classes to our adviser network.

additional business across a range of asset classes to our adviser network.High-touch support: Our national team and local network sales managers are

passionate about what they do and are skilled in lending, coaching and helping advisers execute integrated advertising and marketing strategies.

Do you have a white label product, and if not, why not?

nMB

Our ‘white label’ product is currently on hold. It has never been a big part of our business model and only comes into play where we think there is a gap in current suppliers. In the current climate our suppliers are able to meet the vast demands of our brokers. When we did run with our ‘nMB Direct’ product line we felt it was of paramount importance to treat it as any other supplier on our panel in both the manner in which we promote it and the transparency of the remuneration model.

eChoice

As our name suggests, the eChoice brand is all about ‘Choice’ for the consumer. Part of our broader business platform includes a white label funding arm, but this is not available to our broker partners. We are funder agnostic – our technology platforms allow our brokers to connect and deliver the right product for the customer based on their individual needs, without proprietary incentive or motivation. This can only benefi t the consumer and enhances our position as a brand of ‘Choice’.

Outsource Financial

No, we do not have a white label. Outsource is one of the few aggregators that is not owned or partially owned by a bank, and as such we are not promoting any particular lender or white label. Our members have access to a huge panel of lenders already, and simply provide the best comparisons to suit the client’s needs. If we were ever to add a white label it would have to be in line with other lenders (especially in regard to commissions) and would have to exist on its benefi ts to the clients, not on any incentives offered.

Liberty Network Services

LNS is unique because it doesn’t offer any white label products. That’s because our portfolio of products is so broad we don’t have to. In addition to our 18-strong lender panel, we have a broad and deep range of Liberty products available to our advisers, which provides excellent flexibility to diversify.

BEATING THE COMPETITION: TANYA SALE, CEO, OUTSOURCE FINANCIAL

As we position ourselves on being the preferred aggregator for the professional sector we don’t feel the need to compete with larger aggregators. Our models are different to most and cater for financial planners, accountants, quality loan writers and other professional groups. We rarely advertise as our reputation and credibility within the professional services sector drives our recruitment, which is evidenced by the number of professionals within our database.

Outsource also prides itself on providing the tools and resources to ensure education and training is at the

forefront of our members’ interaction with their clients. There is a need to educate clients, and with our education and training we intend to change the way lending is done in Australia.

forefront of our members’ interaction with their clients. There is a need to educate clients, and with our education and training we intend to change the way lending is done in Australia.Because of the support mechanisms that we provide, in addition to the relationship that is created, our retention is extremely high. Our success is attested to by the number of members referring their industry colleagues to Outsource.

What have you done over the past 12 months to invest in IT and CRM support?

eChoice

We’ve recently released a new version of our CRM platform FLeaTS. This state-of-the-art system is one of the most dynamic and broker-intuitive in Australia. Available across all devices, it’s been designed by our dedicated tech team to allow brokers to be mobile and responsive to the immediate and ongoing needs of customers. We’ve recently integrated insurance programs, free property reporting, and an interactive ‘Ask eChoice’ forum.

Conveyancing solutions, along with building and pest reporting, are next on the list, as well as a new credit repair service. Our newly developed ‘smart reporting’ program will also be added, identifying risks and clients that could potentially refinance or sell.

Outsource Financial

In the past 12 months we have invested in IT and CRM support for various areas of the business. In 2015 we built a new, updated version of our Referrer Online Tracking Software, which provides referrers with the ability to track the status of their referrals. Features include the ability for referrers to submit a lead via the web at any time or place; updates and status changes in real time; even more comprehensive reports; and records can be reviewed by our audit team.

Other investments in 2015 included updating our website with an even more interactive members’ area, and an update of our commissions system.

Liberty Network Services

Our mobile technology platform Spark continues to innovate, and provides a service to our advisers that they couldn’t get elsewhere. Liberty is an established player in the fintech space, so we have a signifi cant technology team that marries our 19 years of experience and data with the latest technological tools and capabilities.

Spark has won awards for its innovation and continues to evolve without the legacy constraints experienced by so many other aggregators. Having made the initial leap to condense an adviser’s office into an iPad, Spark’s feature enhancements are really just business as usual at LNS.

nMB

nMB has invested heavily over the past year to deliver a new and innovative point of sale platform (nMB Pro). We believe a customised IT solution should encompass relevant tools and features which simplify, through automation, key client transactions and interactions. It should have fl exibility to follow a broker’s daily activity and accurately reflect individual workflows and practices. Above all, it should enhance both broker and client interactions through a number of tools designed to deliver ease of use and efficiencies. nMB Pro delivers on all these fronts, and perfectly complements our existing Mortgage Broker Suite and our unique Affiliate Marketing Software.

BEATING THE COMPETITION: BLAKE BUCHANAN, NATIONAL SALES MANAGER, ECHOICE

Part of our genuine competitive edge is that we don’t compete with the larger aggregator businesses in the marketplace. We are setting new industry standards and benchmarks in relation to lead generation, IT and CRM support, business sustainability and digital solutions. Our size allows us to be nimble to the changing needs of the market and deliver an intuitive and adaptive platform for the modern digital broker.

Our success to date is evidenced by the results of the MPA magazine 2015

Brokers on Aggregators survey, in which eChoice ranked number one in the IT and CRM support category (relative to importance) with a performance score of 4.63 out of a possible 5.

It’s not enough any more for an aggregator to just simply connect with their broker partners, as the combined success of both parties should

rely on a profound base of mutuality. The size of our business complements our ability to deliver to this brief – with real people, dedicated resources and bespoke programs at the core.

rely on a profound base of mutuality. The size of our business complements our ability to deliver to this brief – with real people, dedicated resources and bespoke programs at the core.We consider ourselves a whole business enabler, investing in individuals and businesses to deliver what we believe is the best-value proposition for new and experienced brokers on offer today.

How will you respond to new, technologically driven aggregators competing for brokers?

nMB

Having an accurate, user-friendly and relevant platform is now a ‘ticket to the dance’ for all aggregators. It is not the key decider in a broker joining or moving between aggregators, just part of an overall package to be considered. Systems, along with competitive commission models and, most importantly, business support in marketing, recruitment and licensing, are all key elements for brokers to consider when deciding on their aggregator partner. All aggregators need to maintain an eye on advancements in technology to ensure their business platforms remain relevant, however can’t get caught up thinking systems will be the only point of difference.

Liberty Network Services

Technology has always been at the heart of our offering, and we have decades of experience refining our tools – so we’re not concerned about fresh new competitors. Our advisers run their entire businesses through Spark and can process any loan end-to-end, which is unique in the industry. For aggregators to remain relevant and competitive they need to continuously update their technology platforms. We’ve been doing this for years and have led the way in this space, particularly when it comes to streamlining and future-proofing our technology.

Outsource Financial

Whilst we keep at the forefront of technology we will always be an aggregator that concentrates on building strong relationships with our members, and to us that means personal contact. I meet all new members prior to them signing with Outsource, and will always continue to do so. All members also know that they can contact me personally if they need to. This attitude flows down through the staff and even to how a member treats their client. We not only become our member’s partner in lending but play a strong role in assisting them to grow a multifaceted business, which is required in this current environment to ensure longevity and success.

eChoice

The eChoice aggregation business has led, and will continue to lead, the industry in relation to technology and innovation – and as such we welcome new competitors to the space. Part of our core philosophy is our commitment to building and delivering the cutting-edge tools of today and tomorrow to our broker network, leading the industry in lead generation, intuitive customer management systems and digital marketing programs.

The future of broker is exciting, dynamic, technology-driven, and to some extent elegant. The future is digital. At eChoice, we have a saying: we don’t just participate in aggregation, we are defining its future.

How will you respond to new, technologically driven aggregators competing for brokers?

nMB

Having an accurate, user-friendly and relevant platform is now a ‘ticket to the dance’ for all aggregators. It is not the key decider in a broker joining or moving between aggregators, just part of an overall package to be considered. Systems, along with competitive commission models and, most importantly, business support in marketing, recruitment and licensing, are all key elements for brokers to consider when deciding on their aggregator partner. All aggregators need to maintain an eye on advancements in technology to ensure their business platforms remain relevant, however can’t get caught up thinking systems will be the only point of difference.

Liberty Network Services

Technology has always been at the heart of our offering, and we have decades of experience refi ning our tools – so we’re not concerned about fresh new competitors. Our advisers run their entire businesses through Spark and can process any loan end-to-end, which is unique in the industry. For aggregators to remain relevant and competitive they need to continuously update their technology platforms. We’ve been doing this for years and have led the way in this space, particularly when it comes to streamlining and future-proofi ng our technology.

Outsource Financial

Whilst we keep at the forefront of technology we will always be an aggregator that concentrates on building strong relationships with our members, and to us that means personal contact. I meet all new members prior to them signing with Outsource, and will always continue to do so. All members also know that they can contact me personally if they need to. This attitude fl ows down through the staff and even to how a member treats their client. We not only become our member’s partner in lending but play a strong role in assisting them to grow a multifaceted business, which is required in this current environment to ensure longevity and success.

eChoice

The eChoice aggregation business has led, and will continue to lead, the industry in relation to technology and innovation – and as such we welcome new competitors to the space. Part of our core philosophy is our commitment to building and delivering the cutting-edge tools of today and tomorrow to our broker network, leading the industry in lead generation, intuitive customer management systems and digital marketing programs.

The future of broker is exciting, dynamic, technology-driven, and to some extent elegant. The future is digital. At eChoice, we have a saying: we don’t just participate in aggregation, we are defi ning its future.

BEATING THE COMPETITION: GERALD FOLEY, MANAGING DIRECTOR, NMB

The strategy for smaller aggregators when competing with the bigger players is to play to your strengths.

Operating at a much lower BDM to broker headcount, business support is paramount. It is important to create a culture across the whole staff that we are here to support our broker business partners. Each broker is important to the overall success of the business, whereas in the larger groups often brokers are lost in the crowd or treated as just another number.

We often get feedback from brokers who move to nMB from larger aggregators that there is a real sense of camaraderie among the group. That is something we value as a business and that is core to our company culture. We’re fortunate at nMB that we can provide a sort of ‘boutique’ service with the benefit that comes with strong corporate ownership through the Aussie/CBA relationship.

Our approach of working with business owners through the ‘

Broker to Broker Business’ model puts a greater emphasis on improving broker profitability through better use of resources and understanding business dynamics than purely a revenue play.

Broker to Broker Business’ model puts a greater emphasis on improving broker profitability through better use of resources and understanding business dynamics than purely a revenue play.At the end of the day it is all about understanding, then working with our brokers to maximise their business objectives and profitability..