The results reflect the market cycle and the business in transformation, CEO says

Bank of Queensland has had a challenging FY23, with an 8% fall in cash earnings, changes in leadership, and identified operational risk failings that led to two court enforceable undertakings.

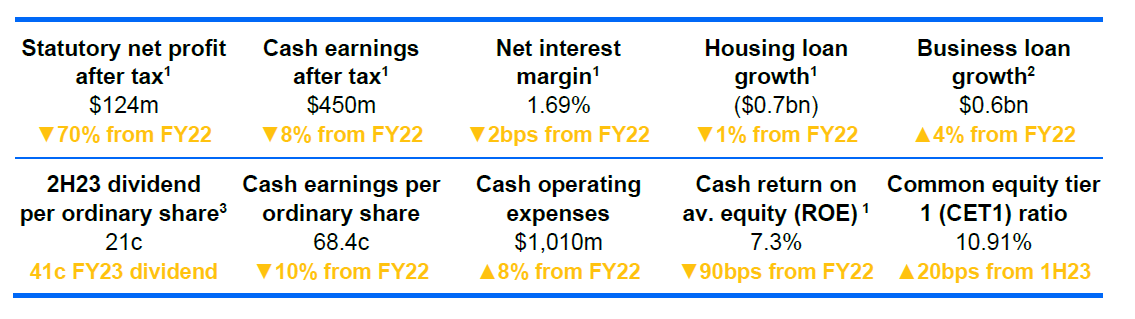

For the full year ended Aug. 31, the bank delivered a statutory net profit after tax of $124 million, a 70% plunge on its FY22 result, impacted by large one-off items, including an impairment of goodwill, ME integration costs, provision for the group’s remedial action plans, and restructuring costs as part of the group’s simplification program.

The group’s cash earning for FY23 was $450m, an 8% drop on the previous year, driven by higher operating costs and a return to a more normalised level of loan impairment expense.

FY23 saw BOQ reducing its mortgage lending portfolio, in response to persistent pressures in the mortgage market. The group achieved a $3.1bn growth in retail deposits, providing it with a lower cost and more diversified funding source. As capital deployment was focused on growth in lending to SMEs, BOQ saw its business banking total income increase by 14% in FY23, a 450bps decline in the business bank cost-to-income ratio.

In an ASX release, BOQ also reported that its portfolio quality remained “well secured and sound with prudent provisioning and forward-looking overlays considering the uncertain economic climate.”

The board has determined to pay a final fully franked dividend of 21 cents per share, representing 71% of reported 2H23 cash earnings.

“Our results reflect the market cycle and the business in transformation,” said Patrick Allaway (pictured above), managing director and CEO.

“We continue to invest through the cycle and traded some performance in FY23 for medium- and long-term benefits. We have high conviction in our strategy and a clear roadmap in place to deliver a stronger, simpler, and digitally enabled, low-cost bank with exceptional customer experience.”

Allaway said the bank is “committed to addressing our challenges head on” and “is managing what it can control in current market conditions, positioning BOQ for recovery and growth when the economic cycle turns.”

Click here to the BOQ’s Annual Report 2023.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.