Upsizing to a four-bedroom house still challenging

New Zealanders still find it tough financially to move to a larger property in most parts of the country.

According to CoreLogic data, the gap in median values between three- and four-bedroom dwelling is more than $200,000, in Auckland, Hamilton, Tauranga, Wellington City, and Christchurch.

But almost everywhere else, that “trade-up premium,” or the amount of extra equity and/or debt a household needs to upsize, has declined in the past year, said Kelvin Davidson (pictured above), CoreLogic NZ chief economist.

Each year, CoreLogic takes a look at the trade-up premium, using the gap in median values between three-bedroom and four-bedroom properties across the country as proxy.

“The 2023 refresh of the data reveals some pretty interesting patterns,” Davidson said. “Most notably, the continued downturn in property values over the past year has seen the trade-up premium shrink in most parts of NZ, or in other words, things have shifted a bit more in favour of those looking to get that extra space. The largest percentage drops in the premium have been in Upper Hutt (24%), Lower Hutt (16%), and Wellington City and Tauranga (both 15%).”

Davidson explained that although the median values for each property type in each area have fallen by pretty similar amounts in percentage terms, given that four-bedroom properties start at a higher level in dollar terms, any given percentage drop also translates into bigger falls in dollar terms, shrinking the premium.

He also noted that the trade-up premiums were still quite large even after the recent value falls.

“They range from around $150,000 in Upper Hutt and Dunedin, to between $200,000-$250,000 in areas such as Franklin, Tauranga, Wellington City, Waitakere, Hamilton, Christchurch, and Papakura,” Davidson said.

“Meanwhile, the premium still exceeds $300,000 in Auckland’s North Shore and Manukau areas, and is about $530,000 in the city (the old central council area).

“Outside those Auckland sub-markets, the only other parts of the country with trade-up premiums in excess of $300,000 are Queenstown ($345,000), Waipa ($314,000), and Hastings ($306,000).”

At the other end of the spectrum, trading up will only cost $35,000 in Kawerau, $64,000 in Otorohanga, and $74,000 in Clutha, and below $100,000 in seven other parts of NZ, CoreLogic data showed.

In Auckland City, trade-up premium was not only haigher than in any part of NZ, it even slightly increased over the past year.

“With an annual drop in median value of 11% for three-bedders in this market, versus a lesser fall of 8% for larger-sized homes, the trade-up premium has increased by $11,000 since the middle of 2022 – and by $148,000 since the middle of 2020 (from $383,000),” Davidson said.

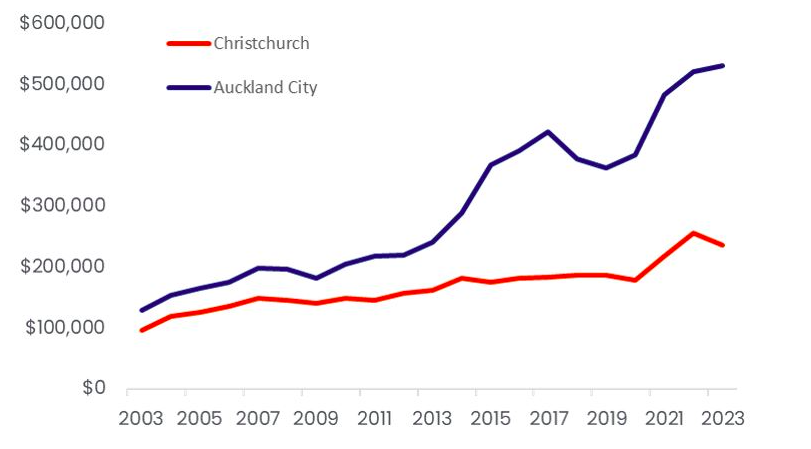

“It’s quite a stark contrast between Auckland City and, say, Christchurch, where those looking to trade up are probably having an easier time doing so (see second chart). Of course, the concentration of ‘super-prime’ suburbs in the Auckland City area, such as Herne Bay, makes it relatively easy to explain why it costs a lot to take each step up the ladder.”

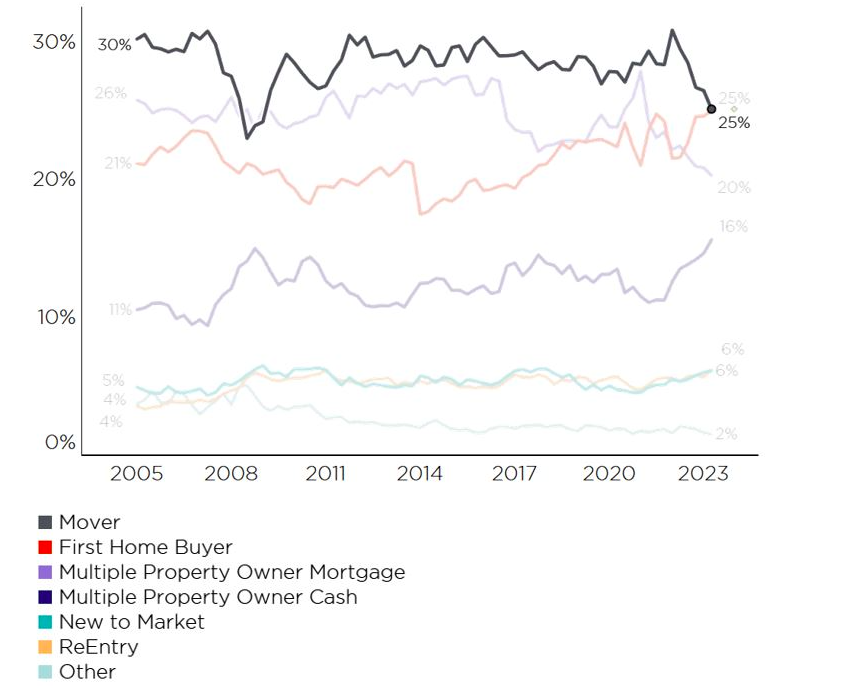

The CoreLogic economist said there’s no doubt that “movers,” or relocating owner-occupiers, have been fairly quiet lately (see third chart), probably due to uncertainty about the length of time a sale would take, what price would be achieved, and the hurdle of trying to sell before they buy.

Another drawback is all that extra cost required to trade up onto a bigger mortgage, with the higher cost of debt.

That said, Davidson noted that a downturn – and subsequent period of broad stability that we now expect for property values – can also be a good time to trade.

“After all, if your property has lost value, there’s every chance that the next one will have dropped too, and that can lead to ‘profitable’ relocations – either in terms of saving a bit of money or getting a better house for the same price,” he said.

CoreLogic plans to keep an eye on investors in the next six to nine months, as this group potentially looks to benefit from reinstated interest deductibility, that is, if National wins the election, and possibly also try to buy before debt-to-income limits kick off.

Movers are another group to watch out for.

“With trade-up premiums having fallen, and a degree of confidence now slowly returning to the property market (as job security stays high and mortgage rates peak, for example), it wouldn’t be a surprise to see some pent-up demand from households keen to relocate starting to emerge in the rest of 2023,” Davidson said.

Use the comment section below to tell us how you felt about this.