Slowdown could be attributed to the combined pressure of restrictive government policies

Investor activity in Vancouver’s rental apartments remains subdued amid uncertainty in the market and the economy, according to data from CBRE.

From January to June, apartment sales in the Vancouver region had a total of just over $400 million, far below last year’s pace that saw an overall 2018 total of $1.4 billion.

“Based on a few deals that have sold since June, and what I believe is currently in play, I estimate that total sales for year-end 2019 could be in the $850-million range,” CBRE executive vice president Lance Coulson said, as quoted by the Vancouver Sun.

A significant contributor to the slowdown since late last year was the pressure from strict government policies. In particular, the Residential Tenancy Act, the brunt of which is endured by investors and apartment owners.

Other factors were provincial and municipal measures that have pulled down the rate of renovictions.

“It was just easier [for many investors] to do nothing,” Coulson stated. “There were a lot of things going on in the market that created some uncertainty. A number of investors were on the sidelines … wanting to see what 2019 was going to bring.”

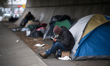

Extremely tight supply in the affordable housing segment remained a feature of the Vancouver market, with rental vacancy hovering around a mere 1% by the end of last year.

The recent edition of IPA’s Midyear Canadian Multifamily Investment Forecast Report stated that Vancouver is by far still the most expensive housing destination in the country. The benchmark price for single detached homes currently exceeds $1.4 million, and the median mortgage payment is around $4,000 greater than the market’s average rental rate.